This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was (22 – 28 January, 2024)

January 29, 2024

US primary markets continued to stay active, albeit with lesser new deals at $24.8bn vs. $54.6bn seen a week before this. IG issuers racked up $18.2bn in deals led by Truist Financial’s $3.5bn two-trancher and State Street’s $1.5bn issuance. HY issuers accounted for $6.6bn of the volume with NGL Partners’ $2.2bn two-trancher and Caesar’s Entertainment’s $1.5bn issuance leading the tables. In North America, there were a total of 27 upgrades and 37 downgrades across the three major rating agencies last week. US IG funds saw $1.24bn in inflows for the week ending January 24, adding to the $224mn seen a week before that. HY funds saw only $72mn in inflows during the same period, adding to the $1bn seen a week prior.

EU Corporate G3 issuances recorded $27.2bn in new deals after seeing $35.3bn in issuances for consecutive weeks. The largest deals were led by Rabobank’s €2.5bn two-trancher, Raiffeisen’s and Credit Mutuel Home Loan’s €1.5bn deals. The region saw 11 upgrades and 23 downgrades across the three major rating agencies. The GCC dollar primary bond market saw a jump with $6.2bn in new deals after $3.9bn in deals a week prior to it. This was led by Saudi PIF’s $5bn three-tranche sukuk and ADCB’s $200mn deal. Across the Middle East/Africa region, there was 1 upgrade and 6 downgrades across the major rating agencies. LatAm saw a sharp uptick with $7.1bn in new deals vs. $2.2bn a week ago with two issuances, as Brazil’s $4.5bn and Corp Nacional’s $2bn two-tranchers each lead the tables. The South American region saw 1 upgrade and 8 downgrades across the rating agencies.

G3 issuance volumes from APAC ex-Japan stood at $4.6bn last week vs. $5.3bn a week prior to it, led by KEPCO’s $1.2bn deal, followed by Bank of New Zealand’s $700mn deal and China Orient AMC’s $550mn deal. In the APAC region, there were 10 upgrades and 36 downgrades across the three rating agencies last week. The downgrades were predominantly on account of the rating action on Chinese LGFVs and asset managers.

Go back to Latest bond Market News

Related Posts:

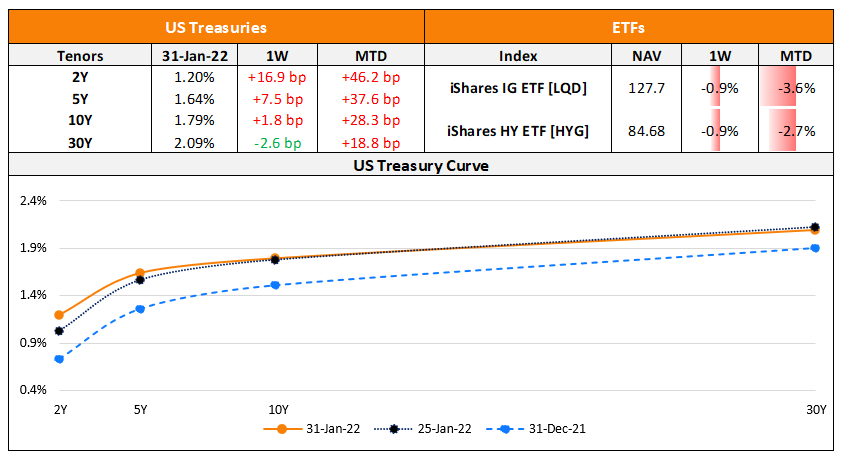

1, 2, 3, 4th Fed Hike!

June 14, 2017

The Week That Was (24 – 30 Jan, 2022)

January 31, 2022