This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was (18 – 24 Sep, 2023)

September 25, 2023

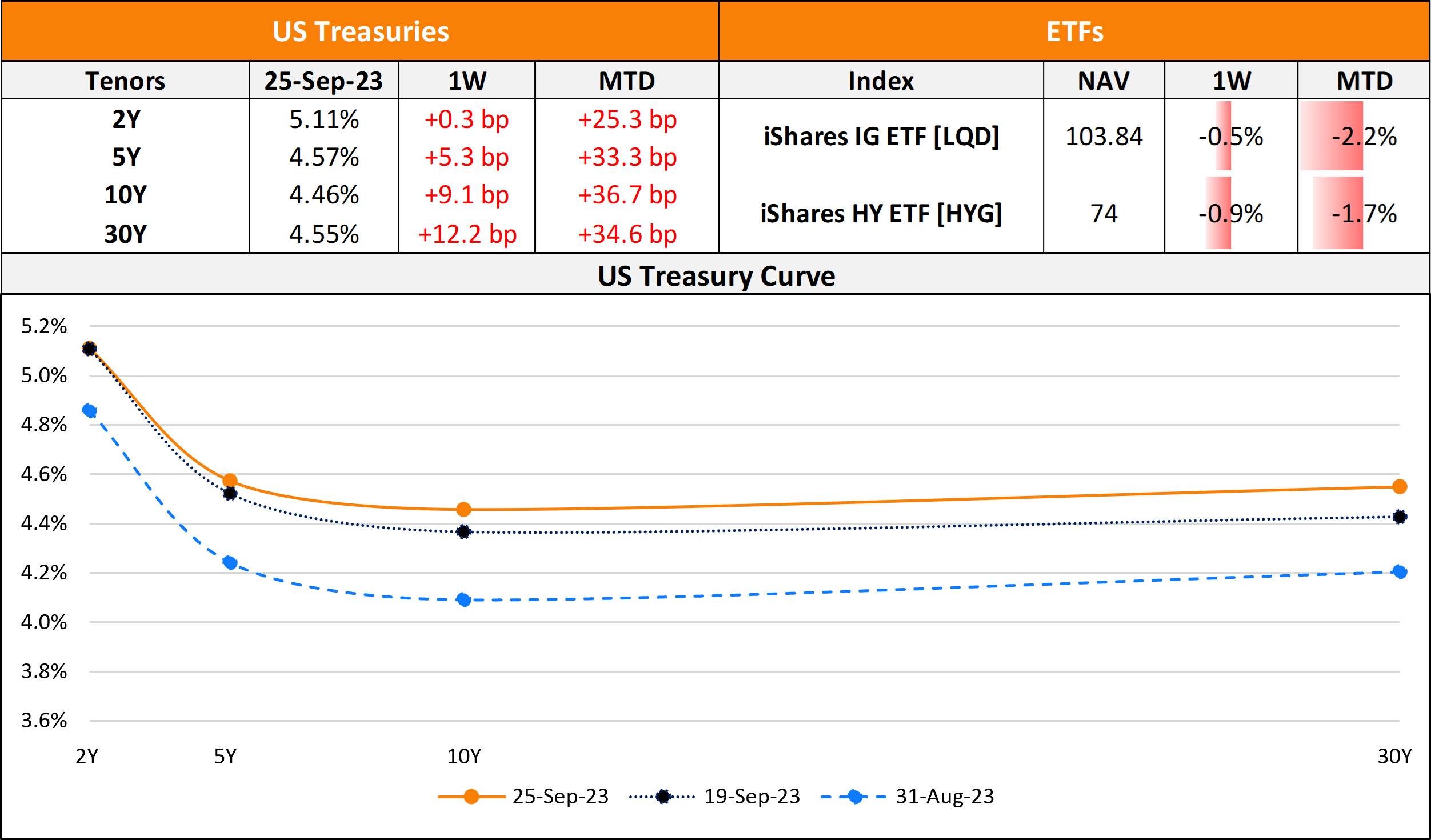

US primary market new deals dropped last week to $12.3bn vs. $38.8bn a week prior. Among this, IG deals stood at $5.6bn, led by GTCR’s $2.17bn deal and Hyundai Capital’s $3bn three-trancher. HY deals last week stood at $7.1bn led by Forward Air’s $1.5bn and NCE Atleos’ $1.35bn deals. In North America, there were a total of 34 upgrades and 36 downgrades across the three major rating agencies last week. US IG bond funds saw inflows of $2.06bn, adding to the inflows of $223mn seen during the prior week. For the same period, HY funds saw outflows of $416mn, reversing the inflows $80.5mn seen in the week prior. Separately, the S&P and Nasdaq registered their largest weekly losses since March.

EU Corporate G3 issuances more than doubled to $44.4bn vs. $21.5bn a week prior. Issuance volumes were led by big banks with UBS’s $4.5bn three-trancher, ING Groep’s €2.5bn deal, SocGen and BNP’s €1.5bn issuances each. The region saw 71 upgrades and 30 downgrades across the three major rating agencies. The GCC dollar primary bond market saw $1.5bn in new deals after $1.75bn in deals a week prior with UAE being the sole issuer. Across the Middle East/Africa region, there was 1 upgrade and 1 downgrade across the major rating agencies. LatAm saw no new deals after $565mn in deals a week ago. The South American region saw 3 upgrades and downgrades each across the rating agencies.

G3 issuance volumes from APAC ex-Japan were at $4.4bn vs. $6.4bn a week prior to it led by Korean issuers including Korea Housing Finance’s €1bn deal, followed by LG Energy’s $1bn two-trancher and IBK’s $600mn issuance. In the APAC region, there were 5 upgrades and 22 downgrades each across the three rating agencies last week.

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Fed Survey Results Supportive of Funds Flow into Bonds

September 10, 2017