This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

TD Prices S$ Perp at 5.7%; Ulker, SMFG Price $ Bonds

July 3, 2024

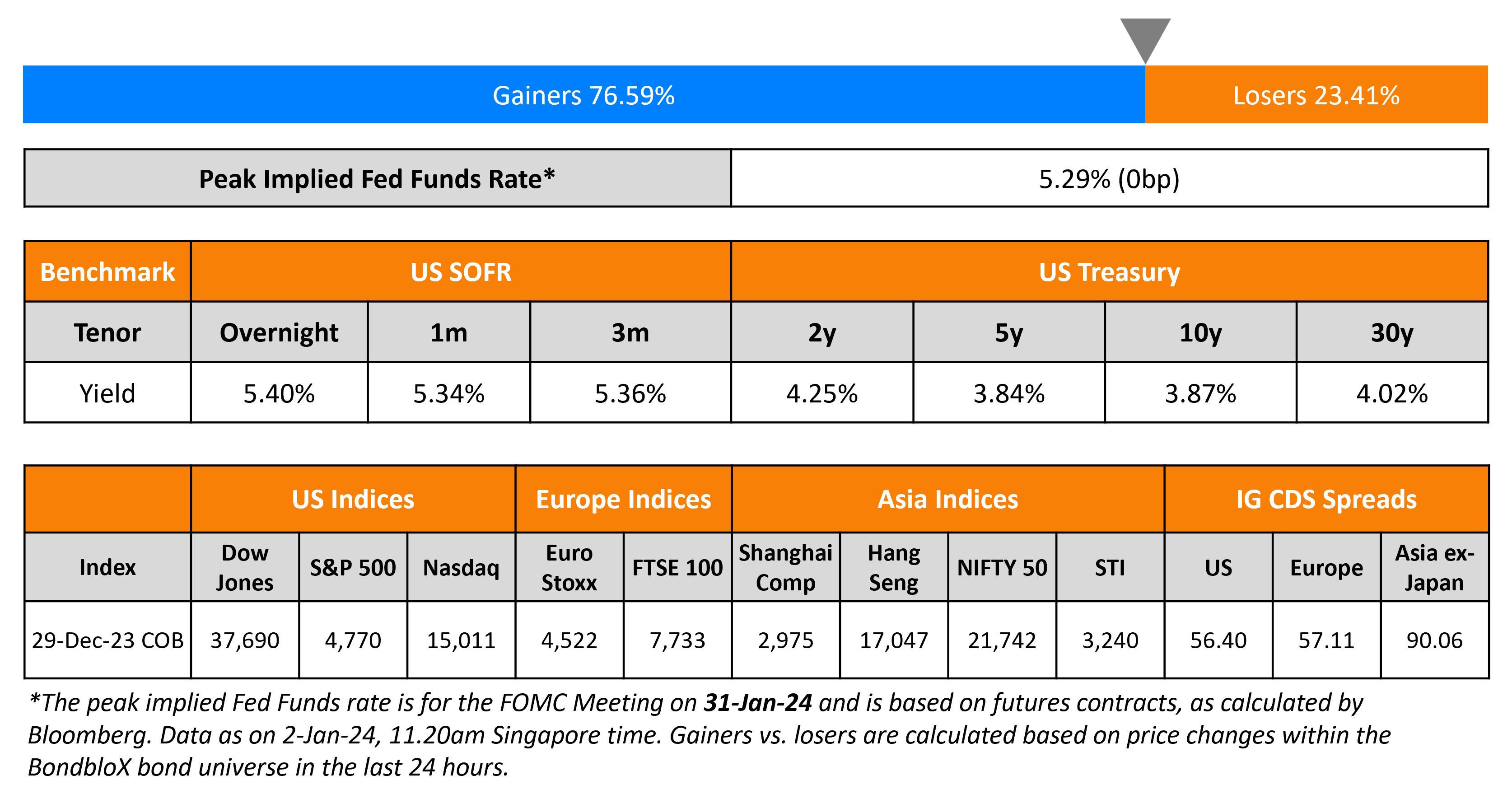

US Treasury yields pulled back slightly, having moved higher after the 2s10s curve bear steepened over the past two days. Fed Chairman Jerome Powell said that the last two inflation reports suggested that the economy was “getting back on the disinflationary path”. He further added that the Fed wants to “be more confident that inflation is moving sustainably down towards 2%” before starting a “loosening policy”. Separately, Chicago Fed President Austan Goolsbee said that they should cut rates, noting that he sees inflation trending downwards. He indicated that holding rates at current levels while inflation comes down, implies tightening. There were no major economic data releases yesterday from the US. Looking at equity markets, S&P and Nasdaq were up 0.6% and 0.8%, respectively. US IG spreads were 1.7bp tighter and while HY CDS spreads tightened by 5.2bp.

European equity indices ended lower. In credit markets, the iTraxx Main and Crossover spreads were tighter by 0.7bp and 2.7bp respectively. Asian equity indices have opened mixed today morning. Asia ex-Japan CDS spreads were 0.4bp tighter.

New Bond Issues

- Samvardhana Motherson $ 5Y at T+175bp area

- CapitaLand Integrated S$ 10Y Green at 3.85% area

- Deqing Construction & Dev $ 3Y at 6% area

- Taizhou Urban Construction $ 3Y at 5.8% area

TD Bank raised S$250mn via a PerpNC5 AT1 bond at a yield of 5.7%, 10bp inside initial guidance of 5.8% area. The subordinated notes are rated Baa1/BBB/BBB+. If not called by 31 July 2029, the coupon resets to the 5Y SORA OIS plus 265.2bp. Proceeds will be use for general corporate purposes including the redemption of outstanding notes and/or repayment of other outstanding liabilities. The new bonds offer a 27bp yield pick-up to UBS’s recently priced S$ 500mn 5.6% Perp (Baa3/BBB-) that currently yields 5.43%. The new bonds also offer a 42bp yield pick-up to HSBC’s recently priced S$ 1.5bn 5.25% Perp (Baa3/BBB) that currently yields 5.28%.

Sumitomo Mitsui Financial Group (SMFG) raised $4.5bn via a five-tranche issuance. It raised:

All the senior unsecured bonds are rated A1/ A- (Moody’s/S&P) while the 20Y Tier 2 note is rated A2/ BBB+ (Moody’s/S&P). All the notes are intended to be qualified as internal TLAC to SMBC who will use the proceeds for general corporate purposes.

ANZ Bank NZ raised $500mn via a 10NC5 Tier 2 bond at a yield of 5.898%, 30bp inside initial guidance of T+180bp area. The subordinated notes are rated A3/A, as compared to the issuer’s ratings of A1/AA-/A+. Proceeds will be used for general corporate purposes.

Ulker raised $550mn via a 7NC3 sustainability-linked bond at a yield of 7.875%, ~43.75bp inside initial guidance of 8.25-8.375% area. The bonds have a change of control put at 100. Proceeds will be used to repay certain existing debt and for general corporate purposes. SPT1 involves a reduction in Scope 1 and 2 GHG emissions by 42% by 31 December 2030. SPT involves a reduction in absolute Scope 3 GHG emissions by 30% by 31 December 2030. The bonds have a step-up redemption payment of 25bp per SPT not achieved (up to 50bps in total), for the latest Sustainability Performance Testing Period. The bonds include a call protection (Term of the Day, explained below) feature for investors in years 3-4 at 50%, years 4-5 at 25% and year 5-7 at par, with a make-whole call at T+50bp during the non-call period. Some of the key covenants include:

- a negative pledge limitation on indebtedness

- 3.5x consolidated net leverage ratio for twelve months from the issue date, and then to 3.0x

- restricted Payments generally limited at 50% of Consolidated Net Income

- asset sales with a 75% consideration in cash or cash equivalent

New Bonds Pipeline

- Astrea 8 Pte. hires for S$ bond

- Warba Bank hires for $ 5Y Green Sukuk

- NongHyup Bank hires for $ 3Y/5Y bond

- Ho Bee Land hires for S$ 5Y Green bond

Rating Changes

- Fitch Upgrades Hellenic Bank to ‘BBB-‘; Outlook Stable

- Fitch Upgrades Bank of Cyprus to ‘BB+’; Outlook Positive

- Fitch Places Lippo Malls Indonesia Retail Trust’s ‘CCC’ Rating on Rating Watch Negative

Term of the Day

Call Protection

Call protection is a protection given to investors by limiting the conditions under which a bond issuer may choose to redeem bonds prior to their stated maturity date. There are two types of protections – a hard call protection and a soft call protection.

A hard call protection prohibits the bond issuer from calling the bonds until after a stated amount of time has elapsed. For example, a 7NC3 bond that can not be called in the first three years, ensuring the coupon rate is maintained for the first three years.

A soft call protection tends to come alongside a hard call protection where the issuer is required to pay a premium to investors over and above the face value if they redeem the bond before maturity. In Ulker’s recently priced 7NC3 bond, the issuer will pay par plus 50% of the coupon in years 3-4, which then falls to 25% in years 4-5 and then at par from years 5-7. A soft call is sometimes intended to to encourage buying interest.

Talking Heads

On ECB ‘Attentive’ on Yields Amid French Vote – ECC President, Christine Lagarde

“Our mandate is price stability. Price stability is obviously relying on financial stability, and we are attentive… These are the things that we monitor (political situation of member states) — this is part of the job”

On next rate cut an easy decision before choices become hard – ECB’s Wunsch

“If we have no major negative surprises, then based on our forecasts, I would say there is room for a second cut. A small deviation from the projections would not change this view dramatically… To continue with cuts, I would need to have some more comfort that we really are going down (to 2%).”

Top Gainers & Losers- 03-July-24*

Go back to Latest bond Market News

Related Posts:

ADP Payrolls Softer Than Expected

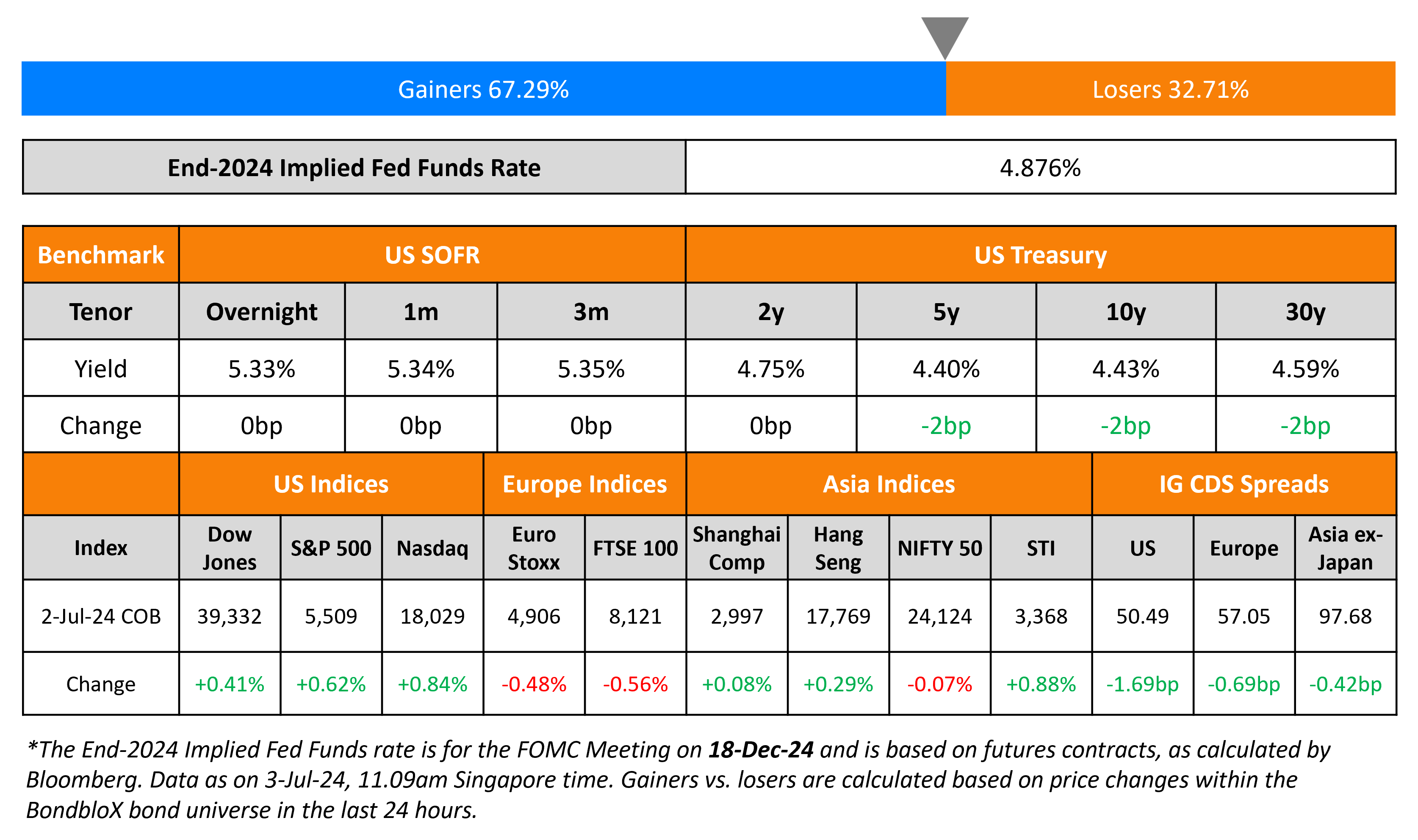

December 7, 2023