This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Status Quo at The ECB Meeting; Nissan Raises $8bn via Four Trancher; Tsinghua Unigroup Bonds Fall on Possible US Sanctions

September 11, 2020

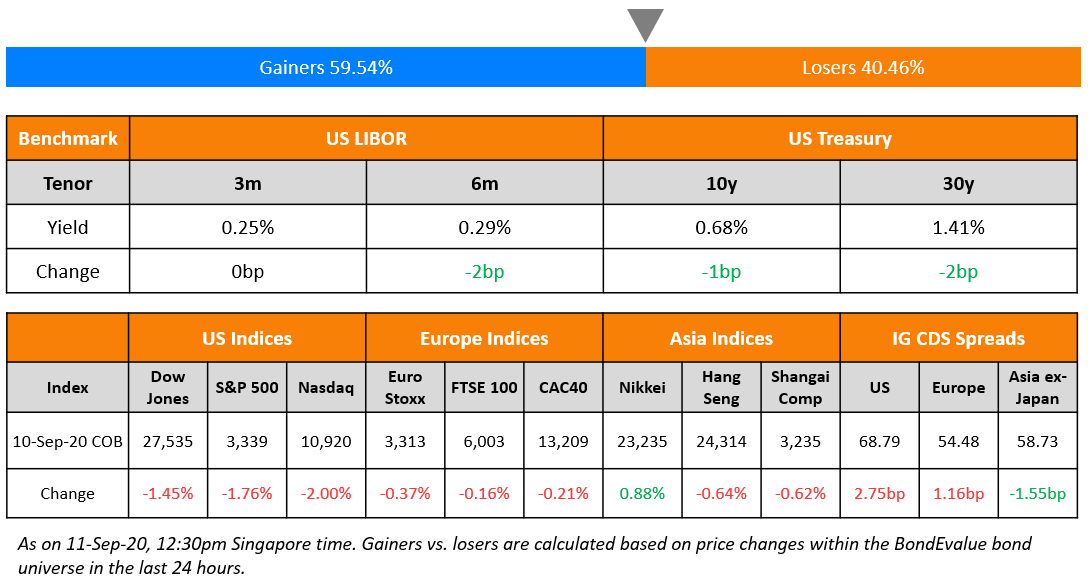

Wall Street dropped on Thursday led by technology stocks as US weekly jobless data showed sluggishness in the pace of the economic recovery. Initial claims came unchanged at 884,000 (above 846,000 expected) and the rejection of the $300bn coronavirus aid package by the US Senate added to the woes. Nasdaq gave up most of the 2.71% rebound on Wednesday with a 2.00% slide led by Apple, Microsoft and Amazon that fell 3.3%, 2.8% and 2.9% respectively. Increase in US crude oil stockpiles also weighed on energy stocks that caused the DJI and S&P to fall around 1.5%. ECB left its rates and monetary stimulus policies unchanged so European shares were only marginally lower. Risk-off benefited long-dated Treasuries that eased 1-3bp. IG CDS spreads widened and Asian dollar credit spreads are set to widen for the week, only the second time since the recovery started a few months ago. Asian markets are having a mixed opening this morning.

New Bond Issues

.png?upscale=true&width=1200&upscale=true&name=New%20Bond%20Issues%2011%20Sep%20(1).png)

Japanese carmaker Nissan Motor raised a total of $8bn via a jumbo four-part bond sale. It raised:

- $1.5bn via 3Y bonds to yield 3.043%, 287.5bp over Treasuries and 37.5bp inside initial guidance of T+325bp area

- $1.5bn via 5Y bonds to yield 3.522%, 325bp over Treasuries and 37.5-50bp inside initial guidance of T+362.5bp–375bp

- $2.5bn via 7Y bonds to yield 4.345%, 387.5bp over Treasuries and 25-37.5bp inside initial guidance of T+412.5bp–425bp

- $2.5bn via 10Y bonds to yield 4.81%, 412.5bp over Treasuries and 25-37.5bp inside initial guidance of T+437.5bp–450bp

The bonds have an expected rating of Baa3/BBB-.

Chinese electric vehicle battery maker Contemporary Amperex Technology (CATL) raised a total of $1.5bn via a dual-tranche bond offering. It raised $1bn via 5Y bonds to yield 1.935%, 165bp over Treasuries and 50bp inside initial guidance of T+215bp area. It also raised $500mn via 10Y bonds to yield 2.72%, 200bp over Treasuries and 55bp inside initial guidance of T+255bp area. The bonds, with expected ratings of Baa1/BBB+, received total orders exceeding $13.5bn, 9x issue size. The bonds will be issued by wholly owned subsidiary Contemporary Ruiding Development and guaranteed by the parent company.

Saudi Electricity raised a total of $1.3bn via a dual-tranche green sukuk offering. It raised $650mn via 5Y sukuk to yield 1.74% 140bp over Mid-swap and 30bp inside initial guidance of MS+170bp area. It also raised $650mn via 10Y sukuk to yield 2.413%, 170bp over Mid-swap and 30bp inside initial guidance of MS+200 area.

Guangzhou Metro Group raised a total of $830mn via a dual-tranche bond offering. It raised $500mn via 5Y bonds to yield 1.507%, 122.5bp over Treasuries and 47.5bp inside initial guidance of T+170bp area. It also raised $330mn via 10Y bonds to yield 2.310%, 160bp over Treasuries and 50bp inside initial guidance of T+210bp area. The bonds, with expected ratings of A+, received combined orders exceeding $7.5bn when final guidance was announced, 9x issue size.

The Temasek-owned property trust Ascendas REIT raised S$300mn ($219.5m) via a Perpetual non-call 5Y green bond (PerpNC5) to yield 3%, 25bp inside initial guidance of 3.25% area. The bonds, expected to be rated Baa2, received orders exceeding S$725mn, 2.42x issue size. This is Singapore’s first ever green non-financial perpetual, priced at the lowest yield for a corporate non-banking perpetual bond in Singapore. The bonds have a reset on September 2025 if not called on the same date, and every five years thereafter to the prevailing Singapore dollar 5Y SOR level, or any alternative reference rate, plus the initial credit spread of 247.7bp with no step-up.

Chinese gas distributor ENN Energy Holdings raised $750mn 10Y green bonds to yield 2.721%, 200bp over Treasuries and 50bp inside initial guidance of T+250bp area. The bonds, with expected ratings of Baa2/BBB/BBB, drew final orders over $2.1bn, 2.8x issue size.

Rating Changes

Fitch Upgrades Argentina to ‘CCC’

Moody’s upgrades Longfor’s ratings to Baa2; outlook stable

Alpek S.A.B. de C.V. Downgraded To ‘BB+’ From ‘BBB-‘ Following Parent’s Downgrade; Outlook Stable

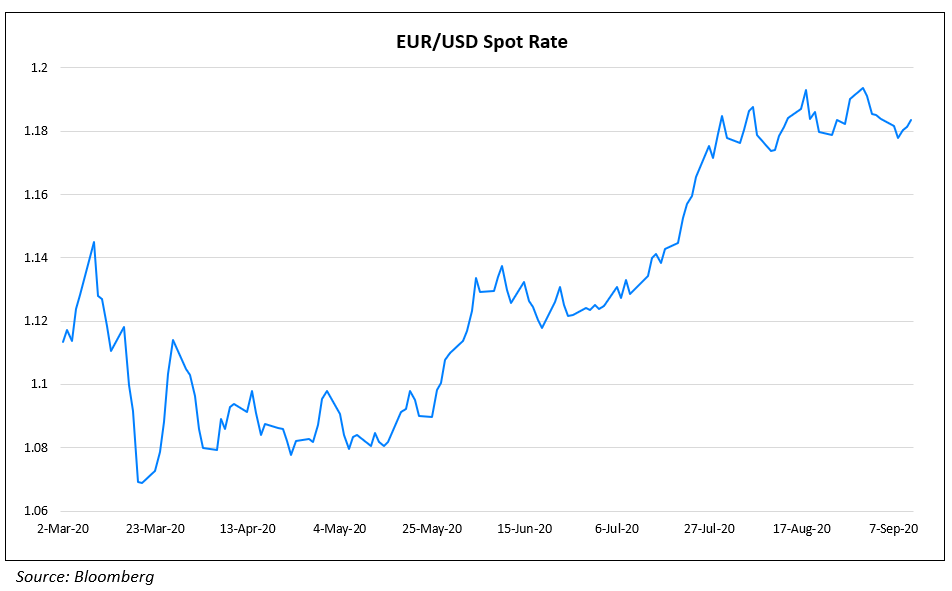

Status Quo With an Eye on the Euro at The ECB’s Monetary Policy Meeting

The Governing Council of the European Central Bank (ECB) concluded its monetary policy meeting on Thursday. In light of the euro rallying against the dollar, ECB Governor Lagarde did not see a need for policy adjustments and suggested that the central bank will only monitor the exchange rate and not target it. The euro has rallied more than 10% against the dollar since March, reaching a high of 1.1936 on August 31, putting pressure on European exports. Lagarde said that the ECB “will carefully examine the information it receives, including exchange rate movements, for its impact on the medium-term inflation outlook”. The highlights of the monetary policy meeting are as follows:

- Interest Rates – The interest rates on main financing operations, marginal lending facilities and deposit facilities will remain unchanged at 0%, 0.25% and -0.50% respectively. These will remain at or below present levels till inflation is at or below ~2%

- Pandemic Emergency Purchase Program (PEPP) – ECB will continue its purchases under the PEPP up to €1,350bn until at least June 2021. The aim of the PEPP is to offset the effects of the pandemic on inflation

- Asset Purchase Program (APP) – ECB will continue to buy at a monthly rate of €20bn under the APP till the end of the year. The purchases will also include the additional €120bn temporary envelope

- Liquidity – Ample liquidity would be provided through financing operations.

Lagarde believed that the existing measures were sufficient and did not suggest any increase in the stimulus. The decision seems to be resonating with the improved economic forecasts published by ECB. According to the latest economic forecast published by ECB, the real GDP is projected to fall by 8%, slightly better than the projection of a fall of 8.7% in June.

For the full story, click here

US High Yield Issuance for August at $53 Billion, Second-Highest on Record

Junk rated issuers “made hay while the sun shone” in August as the issued $52.9bn worth of bonds, the highest ever for August and the second highest for any month on record, as per S&P. The highest on record was in June this year, when issuance reached $59.9bn amid the Fed’s support in buying junk debt. High yield issuance for the year to August stands at $291.9bn, up 71% over last year. Based on estimates from Bank of America Global Research, issuance for the year will stand at $375bn, smashing the annual record of $344.8bn in 2012. Average junk new issue yield for August was 5.3%, 113bp tighter vs July’s average of 6.46% and the lowest level since February before the pandemic spread to the West. August also witnessed the lowest yield on record for a junk issuer with can-maker Ball Corp raising $1.3bn via a 10Y bond at a yield of just 2.875%.

.png?upscale=true&width=1600&upscale=true&name=US%20Corporate%20High%20Yield%20Issuance%20Since%202017%20(1).png)

For S&P’s report on US junk issuance, click here

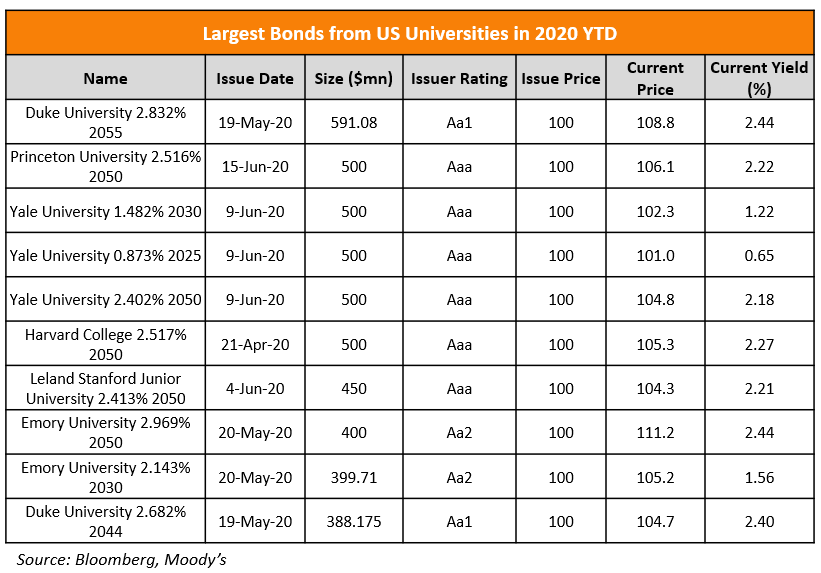

Ivy Leagues Ramp Up Bond Issuance Amid The Low Yield Environment

Capitalizing on the current low yield environment, US universities have tapped the bond market to raise ~$36bn this year thus far, a record since at least 2004 according to Bloomberg. The massive supply has been fueled by demand from international investors from countries such as Japan, South Korea, Singapore and Taiwan. Investors from these countries, many of which have an aging population, find solace in the strong heritage of these universities and their perceived operational and financial strength over the next many decades. In the table below, we have listed the 10 largest deals from US universities, many of them Ivy Leagues, and how they have performed on the secondary markets.

John Augustine, a managing director at Barclays Plc who runs the bank’s higher education group said, “Those types of credits help investors sleep at night,” adding that there has been an increase in interest from Asian investors. Higher rated universities also offer a yield pick-up for investors vs. the benchmark. Harvard’s AAA rated bonds due 2050, for example, priced at a 2.517% yield or 110bp over Treasuries in late April.

For the full story, click here

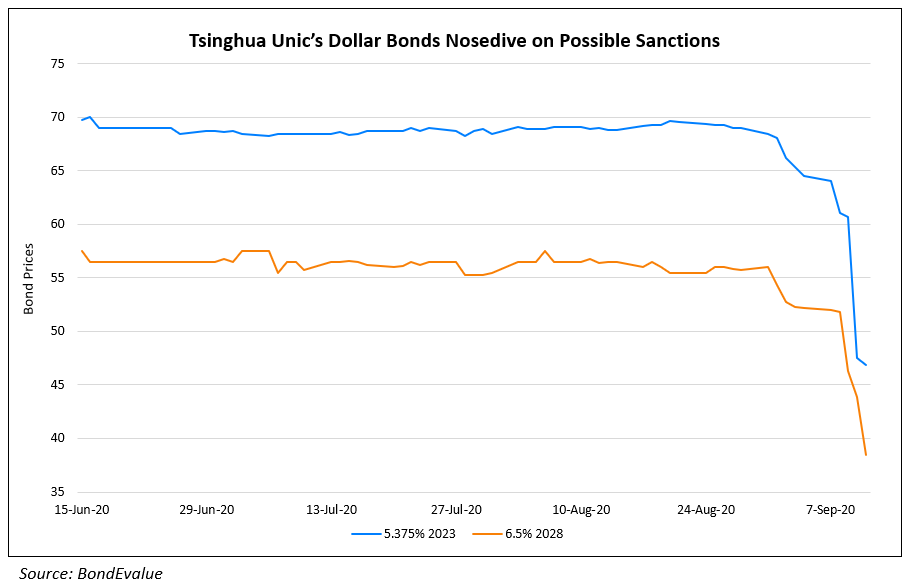

China is Long Way From Dominating Semiconductor Industry – Tsinghua Unigroup Chairman

Tsinghua, the parent company of Yangtze Memory Technologies, China’s top flash memory chipmaker is bracing itself for sanctions on the Chinese semiconductor industry by the Trump administration. Yangtze Memory operates a $22bn facility in Wuhan for chipsets used in smartphones and high-end computing and has acquired RDA Microelectronics and Spreadtrum in its bid to advance its technology. It has also partnered with players like Western Digital to add to its design capabilities. However, despite its efforts, it will be hit hard by US sanctions as it receives over 80% of its equipment from the US and Japan. This equipment includes basic chipmaking equipment as the manufacturing of chipsets has limited exposure to US vendors. Even though China has created a $29bn semiconductor investment fund, its chipset indigenisation efforts have fallen well short. Zhao Weiguo, chairman of Tsinghua Unigroup had said that China has a long way to go before it can even begin to threaten American dominance in the global semiconductor industry. “Long-term investments in innovation and R&D have led to technological advantages” at US and Japanese suppliers, Zheng said and added “This is also the reason why their products are currently in the mainstream and are difficult to replace.”

Tsinghua’s bonds have fallen steeply since the news of possible sanctions. Its 5.375% and 6.5% due 2023 and 2028 traded at 46.8 and 38.5 cents on the dollar respectively down ~30% from September 1.

For the full story, click here

China South City and Modern Land (China) Announce Tender Results

Chinese real estate developers China South City and Modern Land (China) announced results of their respective tender offers for their dollar bonds. Holders of $79.006mn of China South City’s 7.25% bonds due 2021 tendered their bonds at par plus accrued and unpaid interest vs. an offer from the issuer to buyback up to $100mn of the bonds. The bonds are currently trading at $99.625.

Holders of $15.009mn of Modern Land (China)’s 7.95% bonds due 2021 tendered their bonds. This was significantly lower than the offer to buyback up to $100mn of the bonds for a cash price of $100.5 per $100 in principal plus accrued and unpaid interest. The bonds are currently trading at $100.125.

Term of the Day

Bond Auctions

Bond Auctions are public auctions organized by central banks around the world to sell their national debt to investors at the lowest possible financing cost. Typically, the central banks would announce the quantum of new debt, tenor of the proposed bonds, terms and conditions of the offering as well other relevant information, prior to the auction. Market participants such as banks, brokers and other financial institutions can then submit bids for the securities.

Bids are confidential and are typically classified as competitive and non-competitive. Non competitive bidders are guaranteed to receive securities. After all the non-competitive bids are allocated, the remaining securities are awarded by working down the list of competitive bids. After the bidding process, all successful bidders can be allocated securities at a single price – which is the lowest successful competitive bid. This is known as a single price auction and is the method employed for US Treasury auctions. However, other jurisdictions around the world also employ multiple price method, wherein successful bidders are obligated to pay the price they bid at in the auction.

The amount of bids relative to the debt available for auction is an indicator of demand for the bonds and is known as bid-to-cover ratio, a widely watched metric by market participants for bond auctions.

Talking Heads

“Clearly to the extent that the appreciation of the euro puts negative pressure on prices, we have to monitor carefully such a matter, and this was extensively discussed,” Lagarde said. “The strength of the recovery remains surrounded by significant uncertainty as it continues to be highly dependent on the future evolution of the pandemic and the success of containment policies,” she said.

On inflation as a major concern as the US budget deficit grows – Alan Greenspan, former Fed Chair

“We’ve got to resolve the budget deficits that are getting out of hand,” Greenspan said. “My overall view is that the inflation outlook is unfortunately negative and essentially the result of a huge increase in entitlements that are crowding out private investment and productivity growth, which is slowing down to about a 1% annual rate,” he said.

Greenspan added: “All in all my major concern is inflation. It obviously hasn’t emerged in any significant way as yet, but I think that’s the area where our problems lie.”

“They are really dealing with the unknown, we can guess, we can hypothesize … we will learn certain things but not enough to give us real insight into forces which engender stock prices, bond prices, or the like,” Greenspan said. “I think that so far from what I can judge things are going well there,” he said, referring to the current Fed.

On retail investors driving Softbank’s whale-sized trades

Dean Curnutt, the chief executive of Macro Risk Advisors

“My take is that it’s less SoftBank [driving options markets] and more this collective activity of retail, momentum-oriented crowd,” he said. “The data doesn’t have a mark of a whale. It has the mark of lots of little, tiny whales that add up to one big one.”

Ben Onatibia, a strategist at Vanda Research

“Retail doesn’t have the ability to move the market by themselves, but by buying calls they force dealers to hedge themselves, and triggered this parabolic move in tech stocks,” said Onatibia.

Peter van Dooijeweert, an options specialist at Man

“This is mostly a retail phenomenon,” he said. “If a couple of million people get together and all buy a few option contracts, that’s a lot of exposure.”

“I’ve been reducing some of my Chinese quasi-sovereign risk,” said Aggarwal. “It’s very hard to say what names they will sanction. It’s a complete black box.”

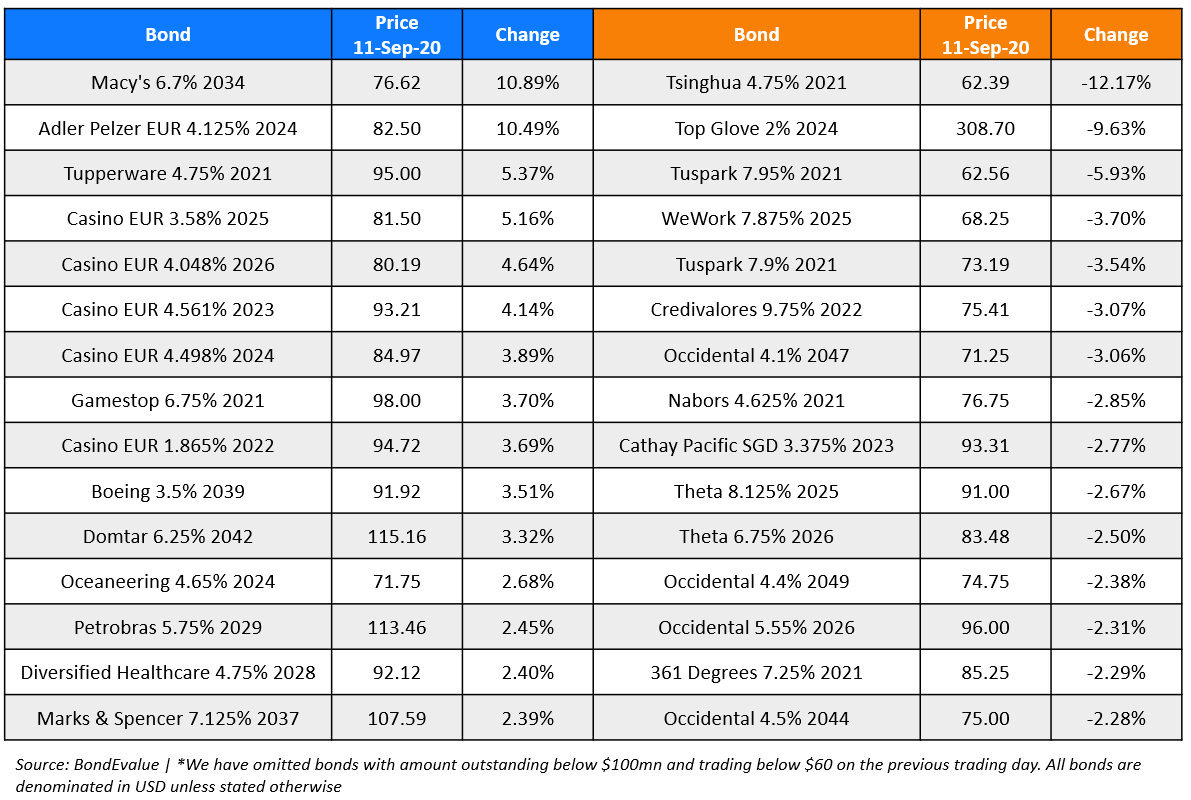

Top Gainers & Losers – 11-Sep-20*

Go back to Latest bond Market News

Related Posts: