This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sri Lanka’s Depleting Forex Reserves Causes Concerns

June 30, 2021

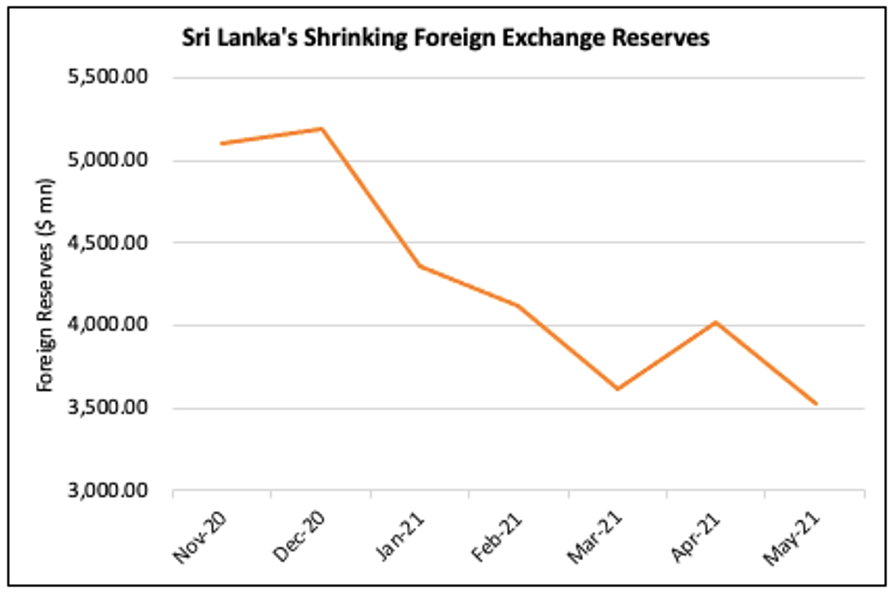

Sri Lanka’s Foreign Exchange Reserves fell to $3.5bn in May 2021 as per CEIC data vs. $4bn a month ago and are sufficient to cover only ~2 months of imports, leading to concerns among investors especially in the face of the upcoming debt maturities. The country has to repay dollar debt worth $1bn at the end of next month and $2.4bn by the end of this year. To allay the fears of the public at large and investors in particular, the central bank governor released a statement on Foreign Currency Liquidity in the Domestic Market on Monday where he revealed that the Gross Official Reserves stood at $4bn without considering the standby Swap agreement of ~$1.5bn with People’s Bank of China. He emphasized that despite short term fluctuations in the foreign reserves, Sri Lanka is focusing on managing its debt obligations and has adequate financing strategies in place, which include the following

- Special Swap facility of $1bn being negotiated with the Indian counterpart.

- Receipt of ~ $800mn under the IMF SDR allocation expected in August 2021

- Swap facility of $250mn from the Bangladesh Bank expected in July 2021

- SAARCFinance Swap facility from the Reserve Bank of India of $400mn expected in August 2021

- Central Bank purchases of export proceeds and worker remittances from the market worth ~$700mn annually

- Efforts to negotiate with the resident holders of maturing Sri Lanka International Sovereign Bonds (ISB) to repatriate maturity proceeds.

The Governor said, “As a result of the measures taken by the Government and the Central Bank in the past 1 ½ years, the Government has been able to substantially reduce its foreign debt to GDP ratio to about 40% and the face value of foreign debt from $34.1bn at end 2019 to $32.2bn by end March 2021, while successfully meeting its maturing debt service obligations.”

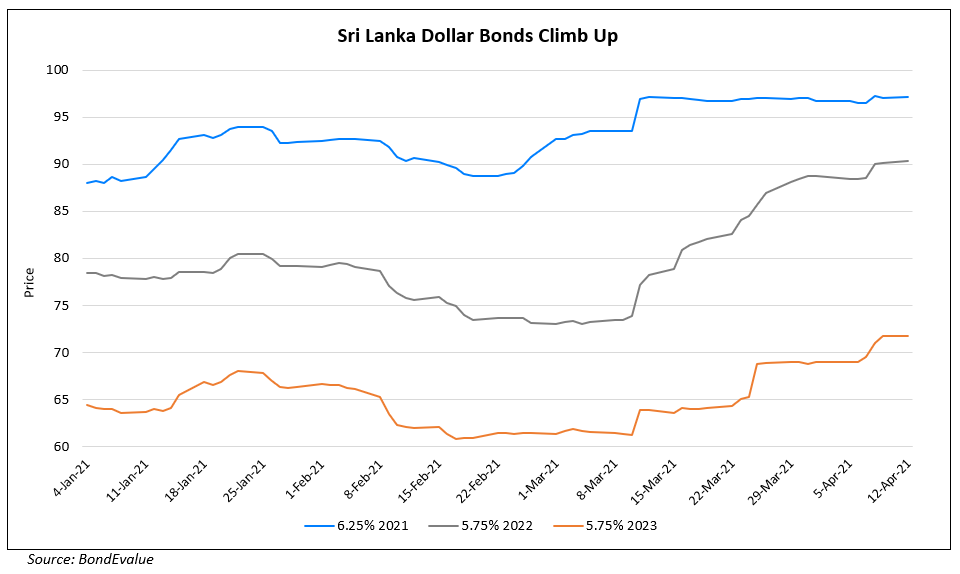

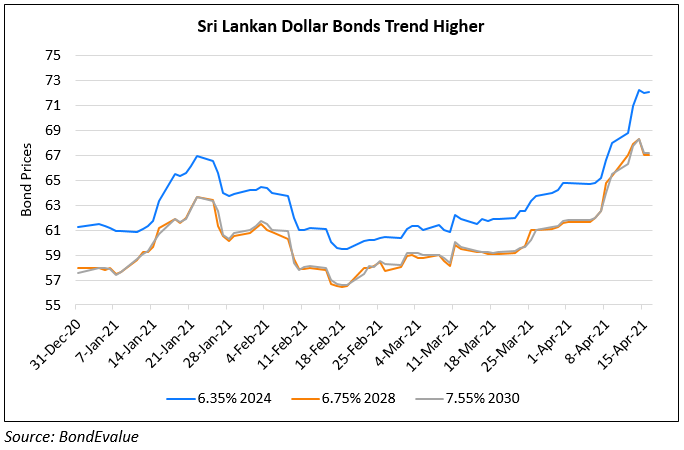

Sri Lanka’s bonds were largely stable. It’s 6.25% 2021s maturing in July are trading at 98.5. Its 9.45% 2021s and 11.2% 2023s were trading above par at 101.21 and 110.09. However, its longer dated maturities are trading much below par. It’s 6.825% 2026s and 7.85% 2029s were trading at 65.5 and 64.5 respectively.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Sri Lanka’s Bonds Trend Higher

April 12, 2021

Sri Lanka’s Dollar Bonds Trend Up 10-15% Over a Month

April 16, 2021