This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sri Lanka Signs $1.5bn Currency Swap with China; Bonds Inch Up

March 24, 2021

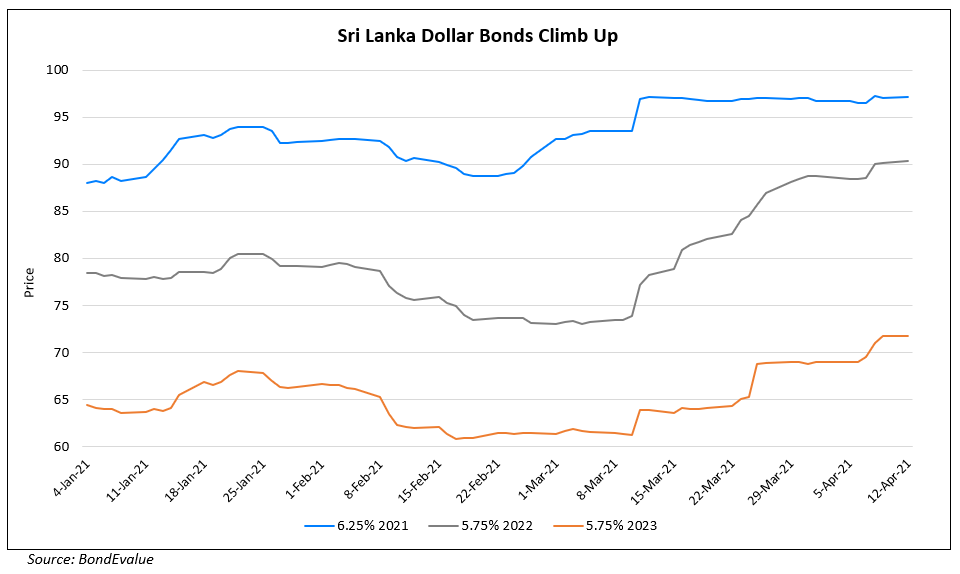

Sri Lanka’s central bank announced on Tuesday that the country has signed a $1.5bn currency swap deal with China. This comes after months of negotiation with China, its largest import partner as Sri Lanka has been struggling with shrinking foreign exchange reserves and upcoming debt payments. The central bank said that the swap has a tenor of 3Y and a total amount of CNY 10bn ($1.5bn) with the People’s Bank of China “with a view to promoting bilateral trade and direct investment for economic development of the two countries”. As per officials, a $750mn funding from China Development Bank is also in talks. The island nation’s foreign reserves stood at $4.5bn as of last month, down from $8bn a year ago. Sri Lanka’s 5.875% bonds due 2022 inched up by 2.1 points to 74.75 yielding 30.3% while its 5.75% bonds 2023 rose by 1 point to 65.25 yielding 29.4%.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

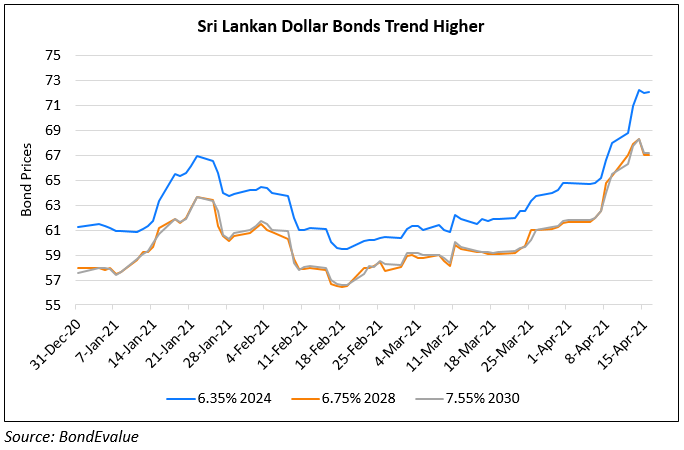

Sri Lanka’s Bonds Trend Higher

April 12, 2021

Sri Lanka’s Dollar Bonds Trend Up 10-15% Over a Month

April 16, 2021