This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

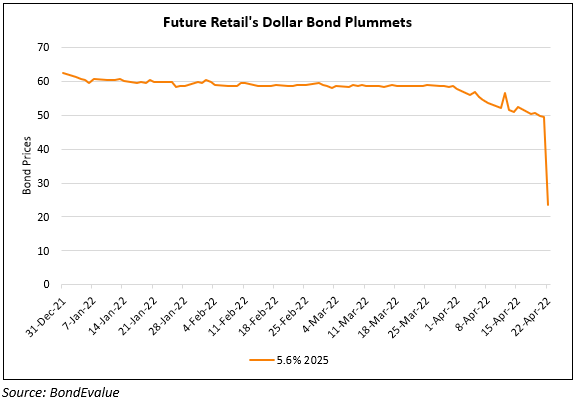

S&P downgrades Future Retail to CC on Default Certainty

April 27, 2022

Future Retail was downgraded to CC from CCC- by S&P with default being a “virtual certainty” following the termination of its proposed asset sale to Reliance Retail Ventures Ltd. (RRVL). Future Retail’s next coupon payment is due on July 22, 2022. The retailer reported an EBITDA loss of about INR 10.5bn ($137bn) over the nine-month period ending December 2021. Operating losses are set to increase further due to store closures. Also, its INR 1bn ($13mn) of cash/cash equivalents as of end-September 2021 is expected to have eroded materially. Future Retail faces the risk of an accelerated repayment of its senior notes. S&P added that under the bonds’ covenants, “principal and unpaid interest on the notes become automatically due and payable if any bankruptcy proceedings initiated against the company remain undismissed for 60 consecutive days, or if the company consents to the liquidation”.

Future Retail’s 5.6% 2025s were flat at distressed levels of 19 cents on the dollar.

Go back to Latest bond Market News

Related Posts: