This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

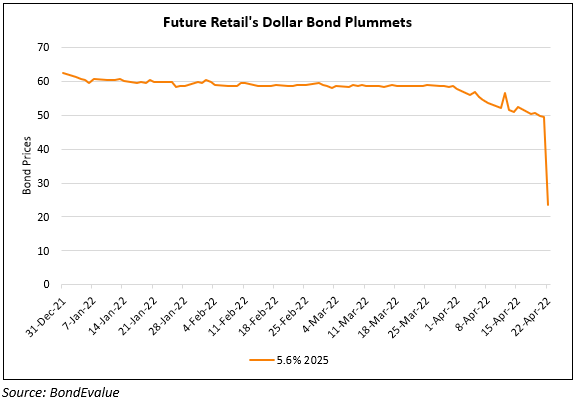

Creditors Reject Future Group Slump Sale to Reliance Retail; Dollar Bonds Collapse

April 22, 2022

Future Retail’s dollar bonds collapsed by over 50% after Future Group lenders rejected a proposal regarding the sale of its wholesale, retail, and logistics assets to Reliance Retail Ventures Ltd. (RRVL). As per Mint, the rejection happened after the deal value was lowered by Reliance Industries from $3.4bn in a surprise move. Lenders pointed out that Reliance Industries not only lowered the valuation of the deal but also came up with new conditions that needed to be met for the deal to be executed at a revised value. Previously in 2020, Reliance had agreed to takeover Future Retail’s assets for $3.4bn. Lenders are not in favor of approving the revised form of the deal as there are some gaps in the way payments to lenders are structured in the new deal. Future Group has a debt burden of more than INR 270bn ($3.54bn) towards its lenders. Future Retail’s shareholders voted on the sale plan on April 20 and creditors cast their votes on April 21 meeting in accordance with an order of the National Company Law Tribunal (NCLT). Reports also suggest that Reliance now wants a cheaper deal and banks are not comfortable with revised valuations. The rejection of the proposal by lenders adds to recent negative news where Bank Of India referred Future Retail to NCLT last week to recover a INR 35bn ($460mn) default on the one-time restructuring scheme.

Go back to Latest bond Market News

Related Posts: