This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

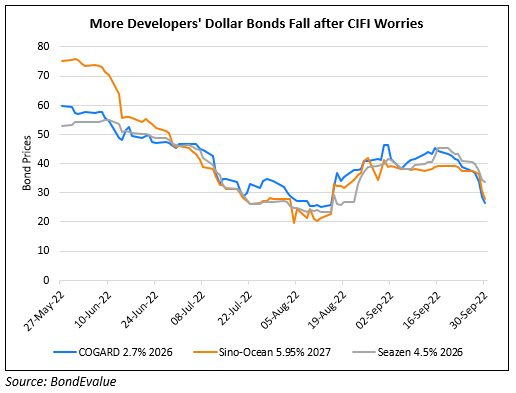

Sino-Ocean Downgraded to CCC+ by Fitch

June 27, 2023

Sino-Ocean was downgraded to CCC+ from B- by Fitch. Additionally, its subordinated perpetual notes were downgraded to CCC- from CCC. Some of the primary reasons cited were its significant debt maturities, reliance on asset disposals and underwhelming sales figures. Over the next 12 months, Sino-Ocean will face debt maturities of about RMB 14.6bn ($2bn) which it may face challenges meeting due to low cash balances of RMB 4.6bn ($640mn) at end-2022. Moreover, its reliance on asset sales to repay its debt leads to execution risk and uncertainty over the timing of receiving cash from the sales. Sino-Ocean’s sales underperformed the market by falling 2% in May 2023, a sharp contrast to the market average of an 8% increase. Sales for 2023 are forecasted to fall by 5% YoY due to base effects. Moreover, such sales and cash flow forecasts may be negatively affected by the company’s worsening liquidity situation as well as a prevailing market preference for state-owned developers over most private developers. This downgrade comes just days after Sino-Ocean launched a second consent solicitation to make amendments to its $497mn 6.25% 2023s that was due on June 22 after the first round failed to forma quorum.

Sino-Ocean’s dollar bonds continue to trade at deeply distressed levels. Its downgraded 6.946% Perp currently trades at 13.5 cents on the dollar.

Go back to Latest bond Market News

Related Posts: