This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sino-Ocean Launches Second Consent Solicitation on 6.25% 2023s

June 26, 2023

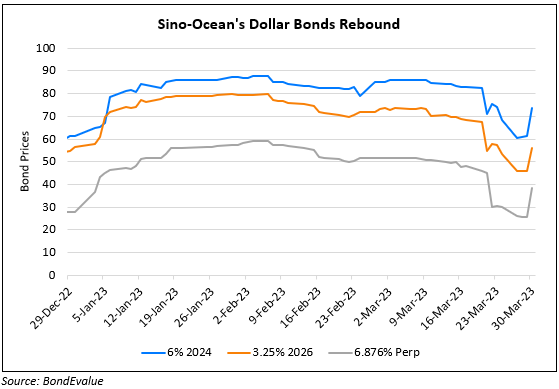

Following a failed attempt, Sino-Ocean has launched a second consent solicitation to extend the maturity of and to amend certain terms to its $497mn 6.25% note that was due on June 22. Its first consent solicitation was launched on May 26 and expired on June 16, with the subsequent bondholder meeting on June 21 dissolved due to the absence of a quorum being formed. The amendments proposed are the same as those in the first consent solicitation, which are to extend the maturity of the note by 6 years to 2029 and to lower the interest rate to 5% with a payment in kind option at an interest rate of 6%. The interest rate frequency will also be changed to annual from semi-annual. Moreover, the company will have to redeem at least 5% of the principal amount two years before maturity and 15% of it, a year before maturity. The new consent solicitation was launched last Friday and is set to expire on July 12.

Sino-Ocean’s dollar bonds are currently trading at deeply distressed levels of 22-25 cents on the dollar.

Go back to Latest bond Market News

Related Posts:

Sino-Ocean Downgraded to BB by Fitch; CIFI Cut to B1

September 16, 2022