This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sichuan Languang’s Bonds Plummet Further on Liquidity Concerns

June 7, 2021

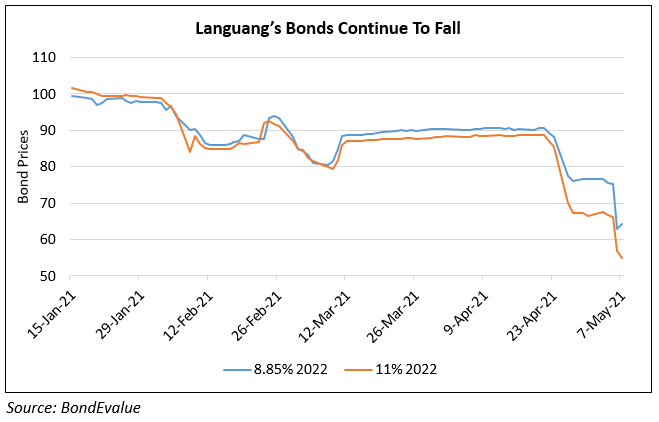

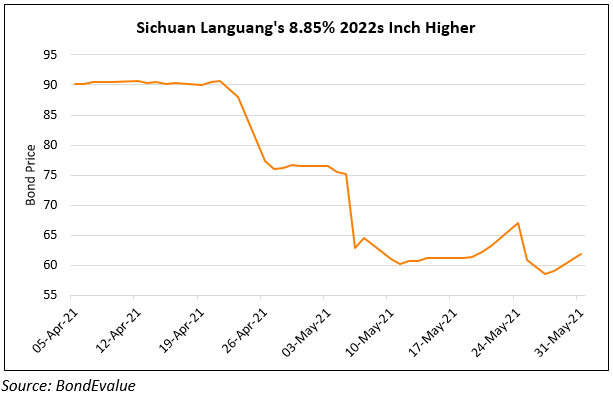

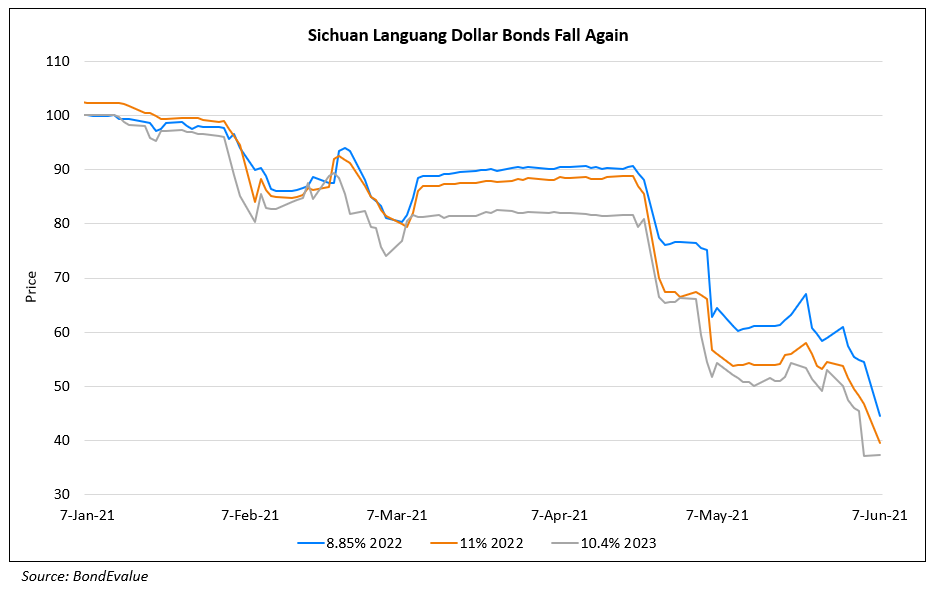

Chinese real estate developer Sichuan Languang Development Co. saw its dollar bonds, issued by Hejun Shunze Investment, plummet 7-10 points on Friday as investor concerns continue to build up over the company’s liquidity position. It’s 8.85% bonds due January 2022 and 11% bonds due June 2022 have fallen from ~90 levels in late April to 44.5 and 39.6 cents on the dollar currently. The company was downgraded by Moody’s and S&P to B3 and B- respectively last week citing weakening liquidity and funding access. The latest fall in its dollar bonds comes as the company names Yang Wuzheng, in his mid-20s, as its Chairman as per Bloomberg.

Go back to Latest bond Market News

Related Posts: