This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sichuan Languang Bonds Plummet Post Downgrade

May 7, 2021

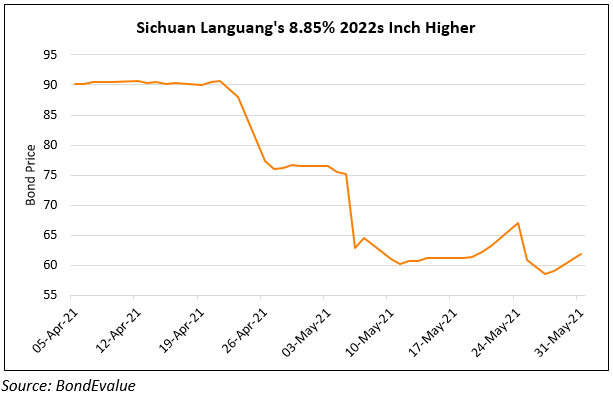

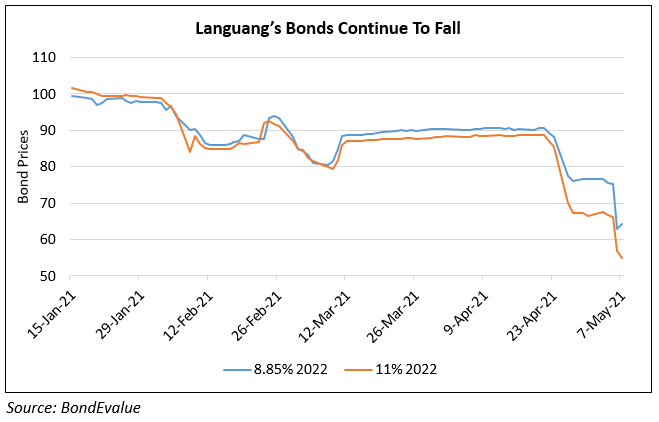

Bonds of Chinese property developer Sichuan Languang dropped further after Moody’s downgraded it to B2 citing a low liquidity buffer, especially as the company has large upcoming debt maturities in the next 12-18 months. The 11% 2022s issued by subsidiary Hejun Shenze dropped 14% on Thursday after the rating action. Bonds of the company first fell during the last week of April on liquidity concerns with Bloomberg reporting that the company has about $1bn of offshore bonds and $2bn of onshore debt outstanding and they were mulling a sale of a stake in the company and/or in some of its property projects.

Go back to Latest bond Market News

Related Posts: