This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

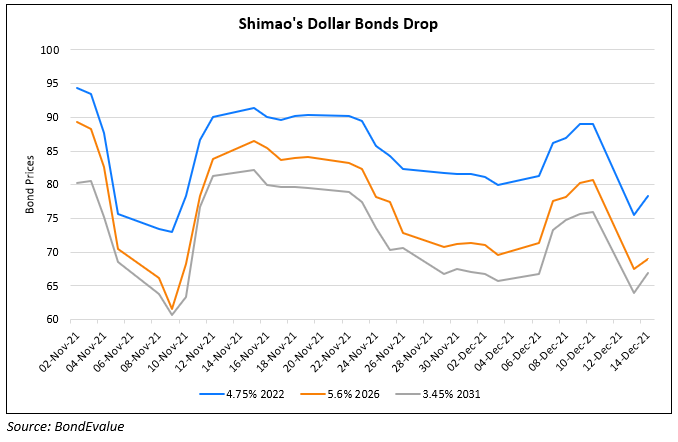

Shimao’s Dollar Bonds Tumble Over 13%

December 14, 2021

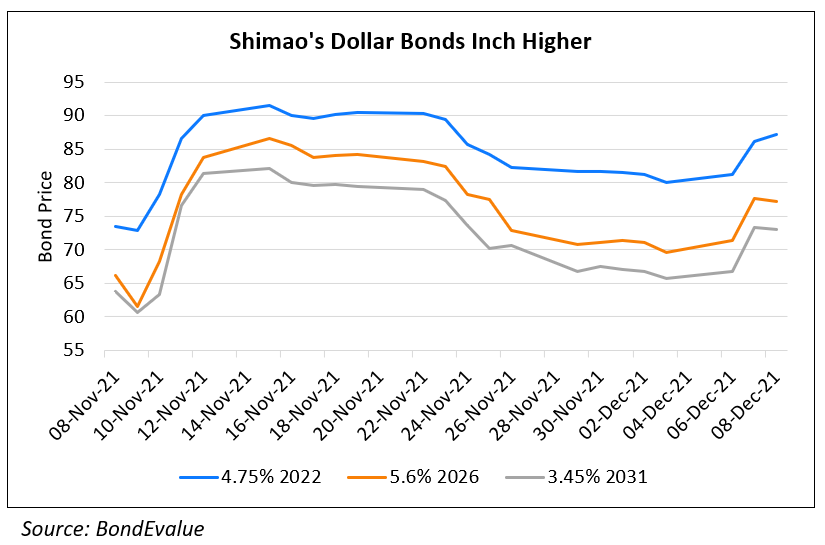

Dollar bonds of Chinese property developer Shimao tumbled 13-15% on Monday. Moreover, its local 3.25% 2025 Yuan-denominated bond dropped 54% on Monday, from near par to trade at 45. While the exact reason for the fall is unclear, the move highlights the frailty in the property sector despite the company being higher rated firm. Shimao said it is looking into market rumors, which it blamed for causing Monday’s selloff. Shimao, the 13th biggest Chinese developer by contracted sales recently became a fallen angel after a downgrade by S&P and is currently rated Ba1/BB+/BBB- (Moody’s/S&P/Fitch), holding its IG-rating by Fitch. Bloomberg notes that liquidity concerns about the company have persisted, even after a share issuance earlier a week ago and the firm’s pledge of its Shanghai headquarters for financing. Shimao and its subsidiaries have bond repayments worth $2.5bn in 2022. Shimao’s dollar bonds across the curve have recovered ~3% on Tuesday after the prior day’s fall.

For the full story, click here

Go back to Latest bond Market News

Related Posts: