This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

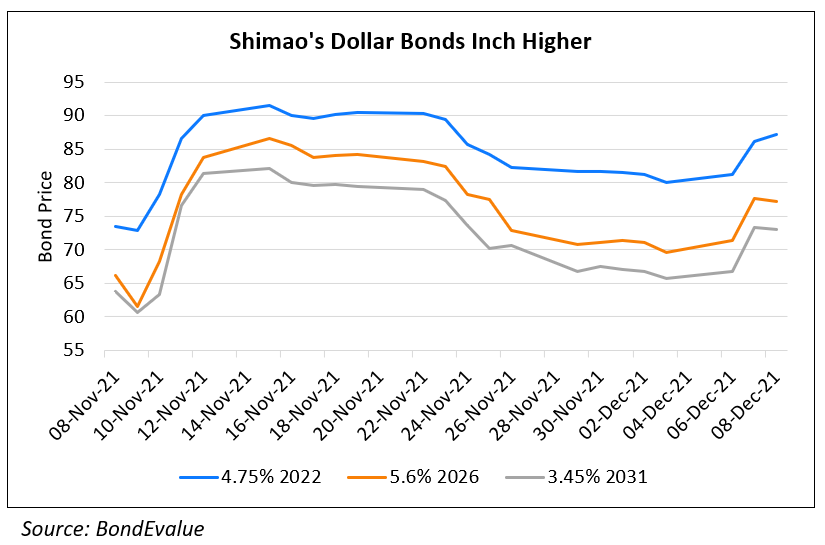

Shimao’s Dollar Bonds Jump ~10% after 150mn Share Issuance

December 8, 2021

Dollar bonds of Shimao jumped up to 10% after it raised HKD1.17bn ($150mn) from the sale of 145mn shares at HKD 8.14/share. The offer price for the share sale was ~8.5% lower than its closing price on December 6 of HKD 8.90. The proceeds will be used for debt repayments and general purposes. Shimao also pledged its Shanghai’s headquarters building as collateral to raise capital. Xu Rongmao, Chairman and Shimao’s largest shareholder will witness a fall in his stake from 66.3% to 63.8% after the sale of shares. Shimao, currently rated Ba1/BB+/BBB-, was placed on review for downgrade by Moody’s after expectation that Shimao’s contracted sales will fall over the next 6-12 months. As per its semi-annual earnings report, Shimao’s revenue rose 13.7% YoY to RMB73.4bn ($11.5bn) in 1H2021 and net profit increased 19.3% YoY to RMB6.3bn ($989mn)

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Sunac’s New $1.1 Billion Dual Trancher Over 6x Covered

January 22, 2021

Evergrande’s EV Unit Raises $3.4 Billion via Share Sale

January 25, 2021