This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Senegal’s Debt Misreporting Case to be Reviewed by the IMF; Dollar Bonds Rise

October 3, 2025

The IMF’s executive board will meet today to address Senegal’s debt misreporting case. Earlier, President Bassirou Diomaye Faye’s government revealed that the previous administration had hidden $7bn in borrowing, leading to the suspension of a $1.8bn loan program. The IMF board will review the misreporting before deciding on a waiver for the $700mn already disbursed, and ahead of talks on new funding. IMF spokesperson Julie Kozack emphasized the fund’s commitment to resolving the case and noted that program discussions could begin during the IMF and World Bank annual meetings in October. A new loan is considered vital for restoring investor confidence and stabilizing Senegal’s finances, with Faye’s administration already introducing spending cuts to reduce the fiscal deficit to 7% of GDP in 2025, from 12% in 2024.

Senegal’s dollar bonds rose with its 6.25% 2033s up by 1.2 points to 74.1, yielding 12.05%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

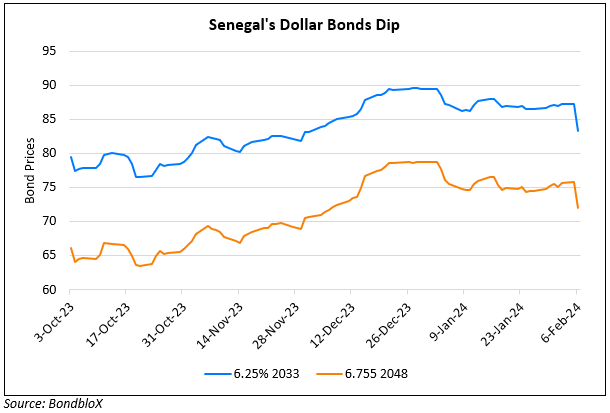

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal’s Dollar Bonds Trend Higher on Political Developments

September 11, 2024