This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

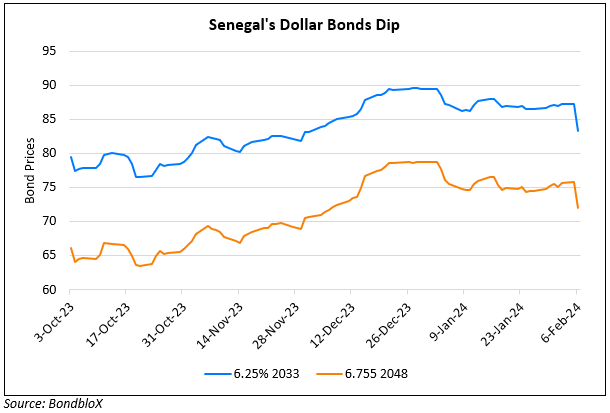

Senegal Bonds Tumble After Audit Unveils Larger Deficit

September 30, 2024

Senegal’s bonds dropped by 1-2 points across the curve after the current government’ audit revealed larger debt and deficit figures than the previous administration had reported. The audit revealed a deficit exceeding 10% at the end of 2023, in contrast to approximately 5% reported by the previous administration, economy minister Abdourahmane Sarr disclosed on Thursday. Public debt surged to an average of 76.3% of GDP, significantly higher than the previously reported 65.9%. Sarr highlighted that these alarming figures, coupled with the fear of breaching IMF regulations, prevented the previous government from requesting IMF funds that could have been released in July. The IMF said the government had shared the initial audit findings and that it was working with them to determine appropriate next steps.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal’s Dollar Bonds Trend Higher on Political Developments

September 11, 2024