This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Senegal Downgraded to B1 by Moody’s

October 7, 2024

Senegal has been downgraded by a notch to B1 from Ba3 by Moody’s. The downgrade follows the preliminary audit findings from the Ministry of Finance indicating significantly higher past government budget deficits and a markedly higher debt burden than previously published. Senegal’s debt burden was estimated at 83.7% of GDP in 2023, around 10% higher than the previously published ratio, according to the preliminary findings. However, the exact scale remains uncertain and is pending validation by Senegal’s Court of Auditors. According to Moody’s, Senegal’s elevated debt burden is a key credit constraint that reduces its shock-absorption capacity, particularly in light of low wealth levels, and leaves the government more susceptible to higher funding costs. The government’s ability to reduce its debt ratio is facing increased challenges, particularly after the recent audit announcement and its 2024 budgetary outcomes have been weighed down by weaker revenue and delayed policy actions. Additionally, Moody’s has placed Senegal’s ratings on review for downgrade to assess the implications of the recent findings for the sovereign’s debt amortization profile and related liquidity risks.

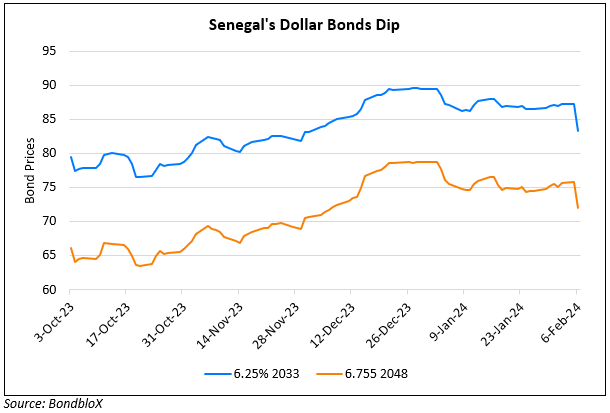

Senegal’s dollar bonds traded weaker across the curve with its 6.75% 2048s at 72.96, yielding 9.74%.

Go back to Latest bond Market News

Related Posts:

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal Bonds Drop on Fiscal Deficit Concerns

September 17, 2024