This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

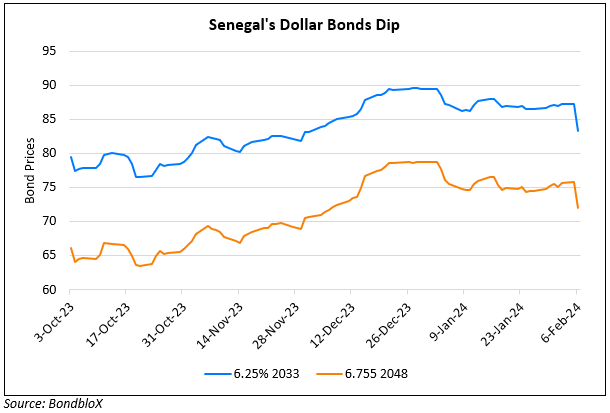

Senegal Bonds Drop on Fiscal Deficit Concerns

September 17, 2024

Senegal’s dollar bonds were lower across the curve after the IMF said that nation’s fiscal position was expected to deteriorate. According to the statement of the IMF, Senegal’s economy slowed in early 2024 with its fiscal deficit widening due to reduced revenues and rising energy subsidies. The IMF highlighted the urgent need for reforms, including cutting untargeted subsidies and streamlining tax exemptions to stabilize public finances and reduce debt. Last year, the IMF had reached a staff-level agreement with Senegal for a $1.5bn facility to support a program of economic reforms. Senegal’s bonds have been volatile since President Bassirou Diomaye Faye signaled plans to dissolve the opposition-controlled parliament last month. Elections for new representatives are scheduled to be held on November 17, according to the statement by the President.

Its 6.75% 2048s dropped by 0.4 points to 72.7 to yield 9.76%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal’s Dollar Bonds Trend Higher on Political Developments

September 11, 2024