This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Seazen, Sino-Ocean, Road King Downgraded by Moody’s

September 18, 2023

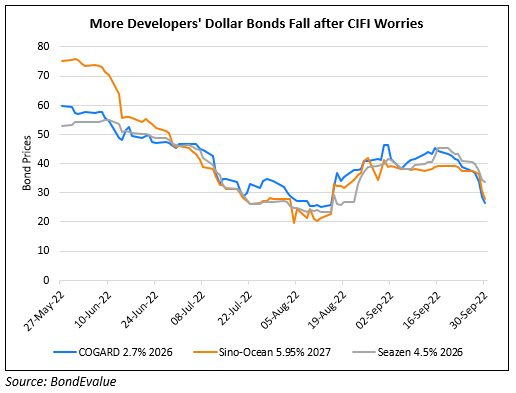

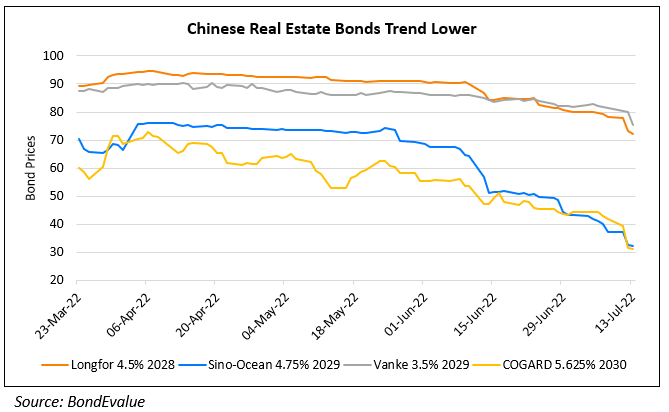

On Friday, Moody’s downgraded multiple Chinese property developers namely Road King Infrastructure (Road King), Sino-Ocean and Seazen Group and revised its outlook to negative. Road King’s and the senior unsecured ratings were downgraded to B2 from B1. Sino-Ocean was downgraded to Ca from Caa2 while the senior unsecured ratings were downgraded to C from Caa3. Senior unsecured bonds guaranteed by Seazen Holdings company (67% owned subsidiary of Seazen) were downgraded to B2 from B1. Moody’s expects contracted sales of these developers to decline, leading their credit metrics to weaken. Liquidity buffers of these developers are expected to deplete over the next year due to continuing challenges in accessing the offshore funding. This comes as China’s property sector is undergoing its worst downturn since the regulations were tightened in 2021 and the default of several developers. Separately, Fitch downgraded Longfor Group to BBB- from BBB, also reflecting weaker than expected sales alongside possible cash and liquidity challenges.

Go back to Latest bond Market News

Related Posts: