This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Saudi Aramco and Turkiye Price $ Bonds

September 26, 2024

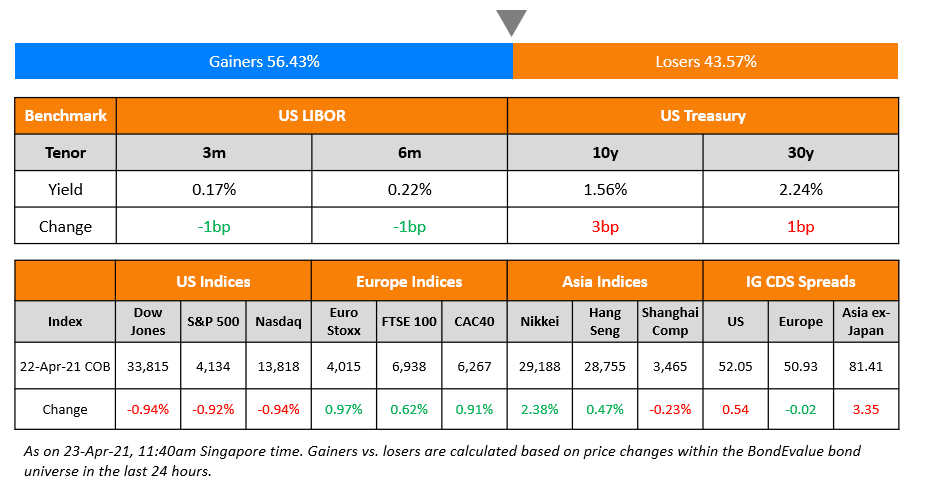

US Treasury yields were up by about 4-5 bp across the curve. Yesterday saw a solid 5Y auction, with a bid-to-cover ratio of 2.38x and an indirect acceptance rate of 70.3%. Aside from this, Federal Reserve Governor Adriana Kugler gave her remarks on the half-percentage point cut last week. She claimed that she strongly supported the decision and that additional cuts are warranted to avoid unnecessary weakening of the economy as disinflation continues in the right direction. US IG and HY CDS widened by 0.5bp and 1.5bp, respectively. Looking at US equity indices, the S&P closed 0.2% lower, while the NASDAQ ended almost flat.

European equity markets also ended lower. Looking at Europe’s CDS spreads, the iTraxx Main spreads were almost flat, while the Crossover spreads widened by 0.3bp. Asian equity indices opened higher this morning. Asia ex-Japan CDS spreads tightened by 0.2bp.

New Bond Issues

Saudi Arabian Oil Co. raised $3bn via a 2-part offering. It raised $1.5bn via a 5Y bond at a yield of 4.37%, 35bp inside initial guidance of T+120bp area. It was priced in-line with the existing 3.5% 2029s that currently yield 4.37%. It also raised $1.5bn via a 10Y bond at a yield of 4.781%, 35bp inside initial guidance of T+135bp area. The new bonds are priced in-line with the existing 5.25% 2034s that currently yield 4.81%. The senior unsecured notes are expected to be rated A1/A+. Proceeds will be used for general corporate purposes.

Republic of Turkiye raised $3.5bn via a 10Y bond at a yield of 6.75%, 37.5bp inside initial guidance of 7.125%. The senior unsecured notes are rated B1/BB-. The new bonds are priced in-line with the existing 7.625% 2034s that currently yield 6.69%. Proceeds will be used in part for liability management transactions and/or general budgetary purposes.

Oracle raised $6.25bn via a four-part offering. It raised:

The senior unsecured bonds are expected to be rated Baa2/BBB/BBB. Proceeds will be used to repay all or a portion of its 2.95% 2024s, 2.50% 2025s, and 2.95% 2025s, which total $8bn in notional outstanding, as well as to repay commercial paper borrowings. Any remaining net proceeds are intended to be used for general corporate purposes, which may include stock repurchases, payment of cash dividends on common stock, repayment of other indebtedness, and future acquisitions.

Danske Bank raised $1bn via a 6NC5 bond at a yield of 4.61%, 25bps inside initial guidance of T+135bp area. The senior non-preferred bond is expected to be rated Baa1/A-/A+. Proceeds will be used for general corporate purposes.

Rating Changes

- Moody’s Ratings downgrades Thames Water’s CFR to Caa1, negative outlook

- Moody’s Ratings downgrades Sumitomo Electric to A3; changes outlook to stable from negative

- Belgian Crane Rental Provider Sarens Bestuur Outlook Revised To Positive On Steady Deleveraging; ‘B’ Rating Affirmed

Term of the Day

Bailout

Bailout refers to the financial support provided to a sovereign or a corporation, which is on the verge of bankruptcy. A bailout may take the form of liquidity injection through cash, loans, bonds, stocks or even subsidies. It may also sometimes help in avoiding an insolvency process. The aim of a bailout is to prevent the bailed out entity from becoming insolvent.

Talking Heads

On Treasury Yields Marching Higher

Jack McIntyre, portfolio manager at Brandywine Global Investment Management.

“We have a little less conviction on Treasuries given the strong rally we have seen, and are better sellers than buyers at the moment. I don’t think the economy needs another 50-basis-point rate cut unless we get a weak payroll number.”

On Bumper Rate Cuts Reviving Reflation

Cayla Seder, macro multi-asset strategist at State Street Global Market

“I think there are questions around how quickly inflation will be able to get to the Fed’s target if we’re in a cutting environment, and if we’re in an environment where the Fed is saying we want to support the labor market before the labor market gets weak.”

Brendan Murphy, Head of fixed income, North America, at Insight Investment

“We think inflation is going to remain relatively benign… but the more aggressive the Fed cuts, the more you have to question that.”

On Tide Turning In Favor of Emerging Markets

Jitania Kandhari, Deputy CIO & Head of macroeconomic research for EM at Morgan Stanley IM

“Growth and interest rates that were favoring the dollar are now peaking and moving in favor of the ex-US universe. The overall macro fundamentals look good for emerging markets. I continue to be constructive, my view was this is an asset class for this decade.”

Top Gainers & Losers 26-September-24*

Go back to Latest bond Market News

Related Posts:

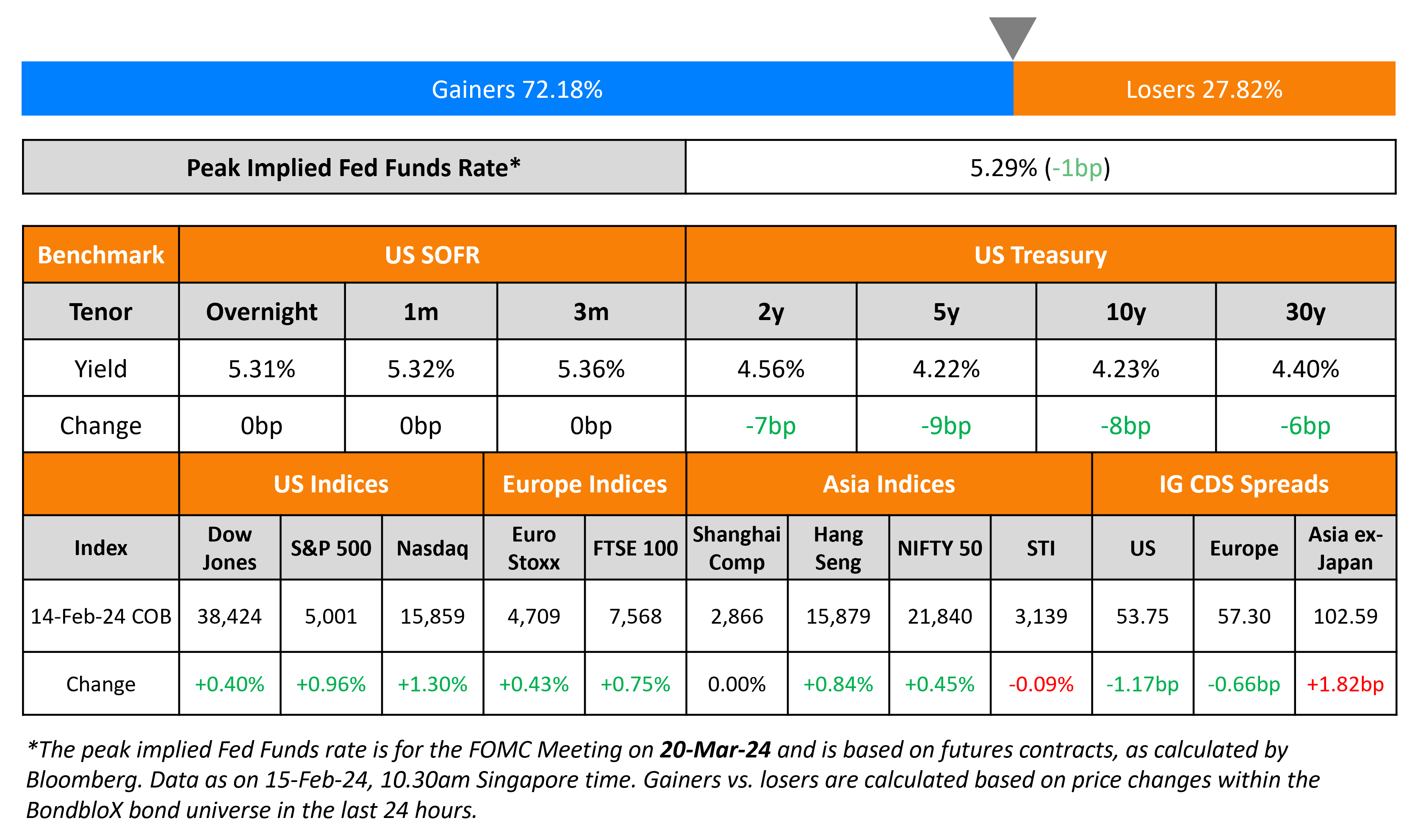

UBS Launches S$ Perp

February 15, 2024