This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Santander’s Perps Rally on Call Announcement; Prices EUR AT1

May 8, 2024

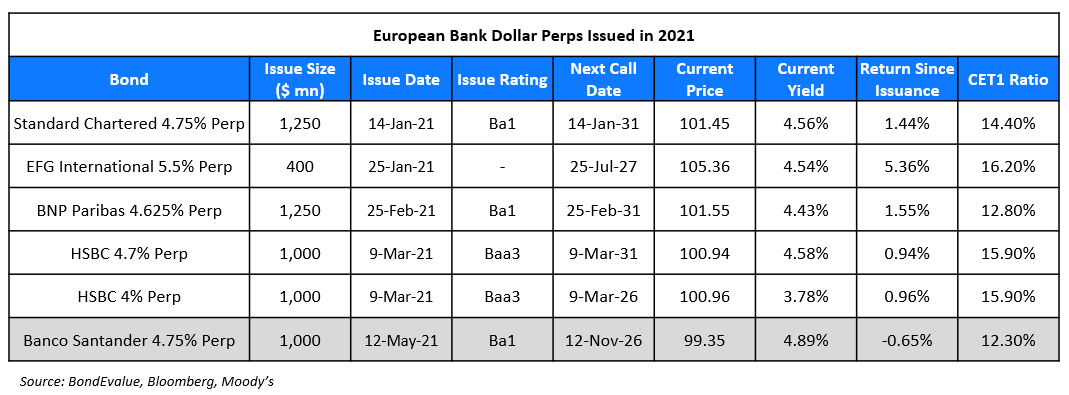

Banco Santander’s dollar and euro denominated AT1s rallied yesterday as the lender offered to buyback its €1.5bn Perps. Santander’s offer is particularly notable as the bank has skipped call options in the past. In 2023, Santander opted not to redeem a €1bn note given a costly refinancing market. Similarly, in 2019 it skipped the option to call a €1.5bn AT1 citing “obligation to assess the economics and balance the interests of all investors”. The latest update comes as a positive surprise given the historical decisions.

Its USD 4.75% Perp jumped 2.5 points to 89.5 cents on the dollar, yielding 8.76%.

The lender also raised €1.5bn via a PerpNC6 AT1 bond at a yield of 7%, 37.5bp inside initial guidance of 7.375% area. The junior subordinated notes are rated Ba1/BBB-. Proceeds will be used for general corporate purposes and for managing potential refinancing of existing capital securities. If not called by 20 May 2030, the coupon resets then and every 5Y thereafter to the 5Y MS + 443.2bp. A trigger event would occur if the CET1 ratio of the bank or the Group falls below 5.125%.

Go back to Latest bond Market News

Related Posts: