This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

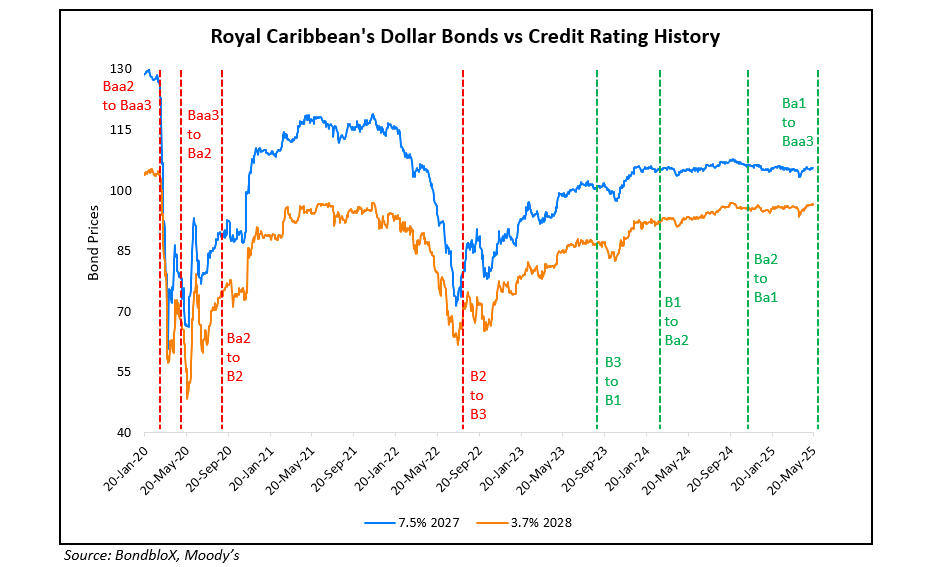

Royal Caribbean Upgraded to BBB by Fitch

September 23, 2025

Royal Caribbean Cruises was upgraded by a notch to BBB from BBB- by Fitch. The upgrade comes on the back of stronger than expected leverage metrics, ongoing debt reduction, and favorable cruise industry trends. Fitch expects the company to maintain gross leverage in the low-3x range, inline with its sub-3x net leverage target, despite the resumption of dividend payments and share repurchases. According to Fitch, Royal Caribbean benefits from its scale, strong free cash flow, ample liquidity, brand strength, and geographic diversification, though risks from economic cycles and geopolitical events remain. Bookings for 2025–26 are robust with higher pricing, while capacity and onboard spending support revenue growth. The company is the second-largest cruise ship operator in terms of berths and passengers carried. Its publicly reported EBITDA margins are considered to be significantly higher and its EBITDA leverage lower than those of its peers.

Its 5.5% 2028s traded stable at 101.95, yielding 4.48%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Royal Caribbean Sails Back to IG Rating

May 20, 2025

Sinopec Returns to the Dollar Bond Market for a Second Time in 2017

September 13, 2017