This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

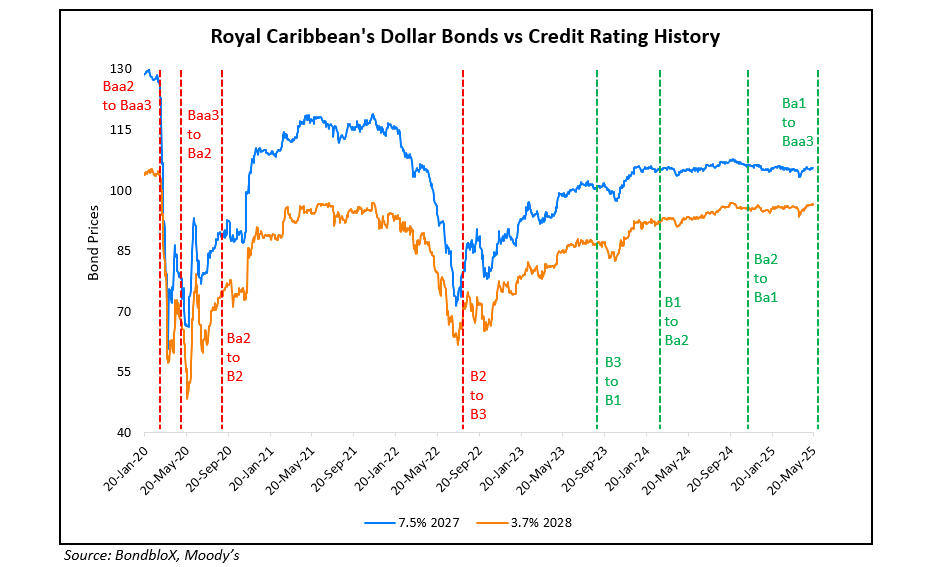

Royal Caribbean Sails Back to IG Rating

May 20, 2025

Royal Caribbean Cruises was upgraded to Baa3 from Ba1 by Moody’s, making it a rising star. It has now re-entered the investment grade bracket for the first time since early-2020, before the pandemic began. The upgrade reflects its leading financial performance in the cruise industry and strengthening of its financial leverage, with debt-to-EBITDA at 3.1x as of 31 March 2025. Moody’s expects this ratio to drop below 3x by 2026. Expanded offerings on board, the company’s increased private land destinations and growth in the average lower berth days are expected to drive revenue and earnings growth in upcoming years.

For more details, click here

Go back to Latest bond Market News

Related Posts: