This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

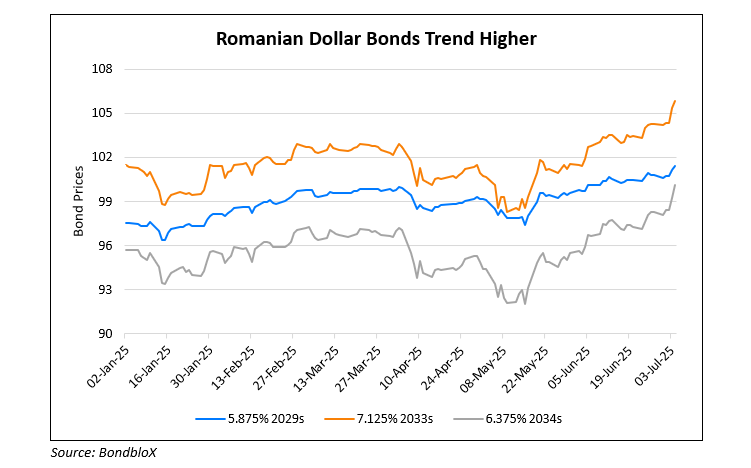

Romania Bonds Rally After Deficit Measure Announcement

July 4, 2025

Romania’s sovereign bonds extended their rally after the government unveiled a package of spending cuts and tax increases, aimed at narrowing the widest fiscal gap for any EU nation. These measures include raising the value-added tax and cutting public sector wages and would be presented at next week’s meeting of EU finance ministers. Investor sentiment improved as the government’s plan targets a reduction of the deficit by about 1.2% of GDP this year, with further cuts planned through 2026, as per Bloomberg.

Following the improved market sentiment, Romanian finance ministry issued a total of 3bn lei ($700mn) in domestic bonds maturing in 2027 and 2034, three times the initial offer size. Romania’s bonds have historically traded at a higher risk premium compared to other European peers, due to concerns about the country’s fiscal trajectory and the potential for a credit rating downgrade.

Romanian dollar bonds have trended higher across maturities, as can be seen in the chart above.

For more details, click here.

Go back to Latest bond Market News

Related Posts: