This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

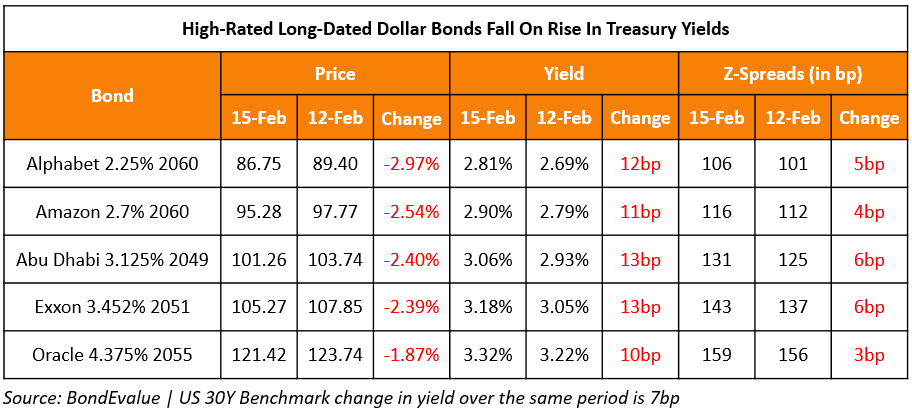

Rise in Long UST Yields Leads to Fall in Prices of High-Rated Long-Dated Bonds

February 16, 2021

Long-dated bonds of highly rated companies and sovereigns fell on Monday as benchmark 30Y US Treasury yields rose over 7bp. As can be observed in the table above, bond yields rose by double digits with the primary contributing factor being the rise in Treasury yields, although Z-spreads (measure of credit, liquidity and optionality risks) also saw widening, albeit smaller.

Go back to Latest bond Market News

Related Posts: