This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

R&F Properties’ Bonds Continue Fall to Fresh Lows

September 8, 2021

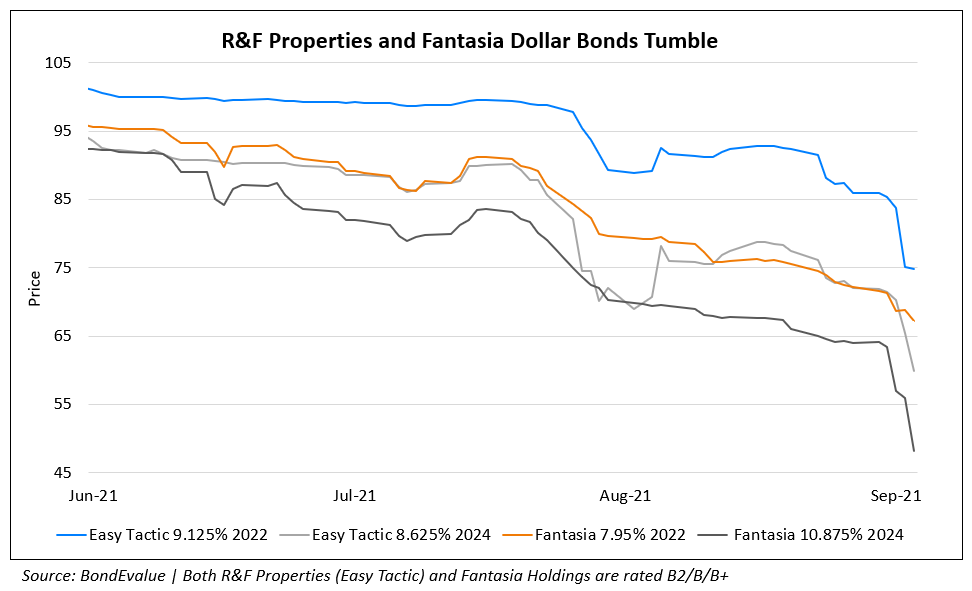

Guangzhou R&F Properties’ dollar bonds extended losses on Tuesday over liquidity concerns. The latest selloff comes after R&F was downgraded deeper into junk to B2 by Moody’s on Monday while being placed on rating watch for further downgrade amid refinancing risks. The fall in its bond prices was so massive that trading on its local currency 6.58% 2022s had to be stopped on Monday after it plunged more than 20% to fresh all-time lows. The sell-off indicates investors’ concerns over the adequacy of the property developer’s cash flows to service its debt and comes at a time when Chinese regulators have imposed restrictions on developers not meeting the ‘Three Red Lines’ metrics, limiting their ability to generate fresh debt. R&F is among the developers that does not meet any of the ‘Three Red Lines’ criteria set by Chinese government. The recent fall in Evergrande’s bonds has only added to investor worries. In fact, thinner margins from property sales and restricted cash flows in China had prompted Moody’s to lower the outlook of the entire property sector in the country to negative.

Guangzhou R&F reported that its total borrowings fell by RMB 16.4bn ($2.54bn) 1H2021 and that it had already secured RMB 25.7bn ($3.98bn) to refinance its debt. However, the developer’s cash, cash equivalents and restricted cash fell 28% to RMB 28.8bn ($4.45bn) as of June 30 from the end of 2020. The company also pledged shares worth RMB 355mn ($54.9mn) to a state-backed firm in Guangzhou. Easy Tactic, the issuer of its notes has a total of $5.3bn in offshore bonds along with its onshore debt.

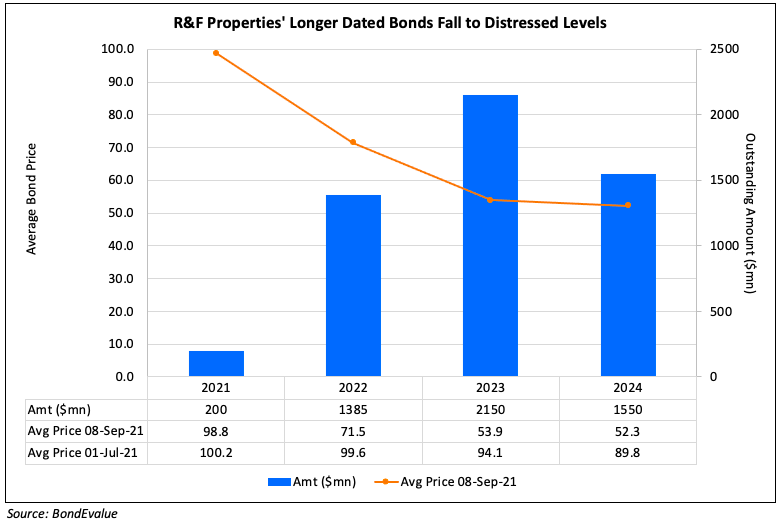

In the chart below, we have plotted R&F’s upcoming offshore bond maturities against the average prices of its dollar bonds due in 2021, 2022, 2023 and 2024. The developer has:

- $200mn bonds maturing in 2021 whose prices of have fallen 1% QTD to 98.8 currently

- $1.385bn due in 2022 with average prices of its 2022s down 28% QTD to ~71 cents on the dollar

- $2.15bn due in 2023 and $1.55bn in 2024. The prices of these bonds have fallen ~42% QTD to trade in the 50s. Its 9.125% 2022s were down to 68.28, 8.125% 2023s were down to 54 and its 8.125% 2024s dropped to 51.5 cents on the dollar.

Go back to Latest bond Market News

Related Posts: