This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

R&F Properties’ Dollar Bonds Slip; Fantasia & CCRE Bonds Also Trade Weaker

September 3, 2021

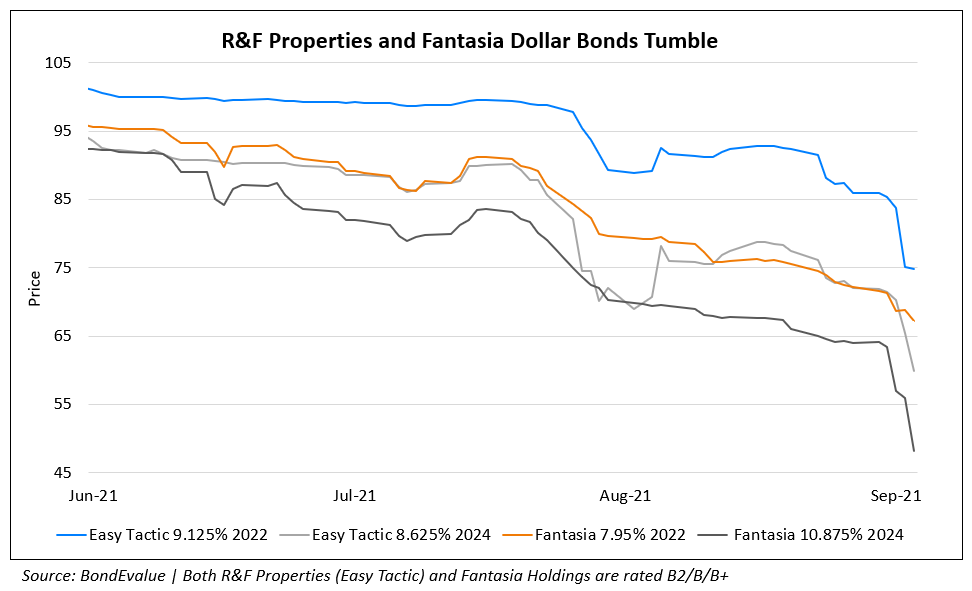

Guangzhou R&F Properties saw its dollar bonds, issued by Easy Tactic, fall sharply on Thursday as concerns over Evergrande spilled over, coupled with lower access to capital for the industry, as mentioned in Moody’s outlook revision on the overall Chinese property sector. R&F also reported 1H earnings this week with revenues rising 17.6% to RMB 39.49bn ($6.11bn). However, an increase in costs led to a 30% fall in operating profits to RMB 7.06bn ($1.09bn) and 18.8% fall in net profits to RMB 3.18bn ($492mn). The company cited a 4% decrease in overall average selling price and a concentration of properties delivered in tier-2 and tier-3 cities, which have lower prices, as reasons for the lower increase in revenue (up 17%) vs. the 22% increase in amount of saleable area sold of 4,098,000 sqm. On the balance sheet front, long-term borrowings fell 4.6% to RMB 91.45bn ($14.15bn) and the current portion of long-term borrowings fell 27.7% to RMB 38.28bn (5.92bn). However, contract liabilities and short-term borrowings rose 14.5% and 24.8% to RMB 55bn ($8.5bn) and RMB 13.63bn ($2.11bn) respectively. Its liquidity position also deteriorated with cash and cash equivalents halving to RMB 12.76bn ($1.97bn) from RMB 25.67bn ($3.97bn) at the end of last year.

Easy Tactic’s 8.625% 2024s fell over 10 points to ~60 cents on the dollar on Thursday. Spillover effects were seen in Fantasia’s and Central China Real Estate’s (CCRE) bonds too – Fantasia’s 11.875% 2023s fell 5.5 points to 61.23 while CCRE’s 7.9% 2023s fell 4 points to 80.67 currently.

Go back to Latest bond Market News

Related Posts:

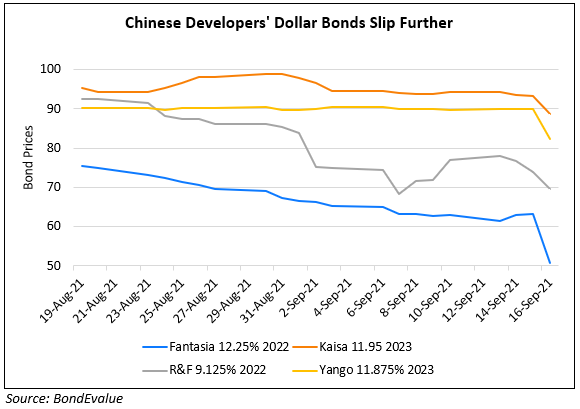

Chinese Developers’ Bonds Fall Sharply on Evergrande Spillover Risks

September 17, 2021

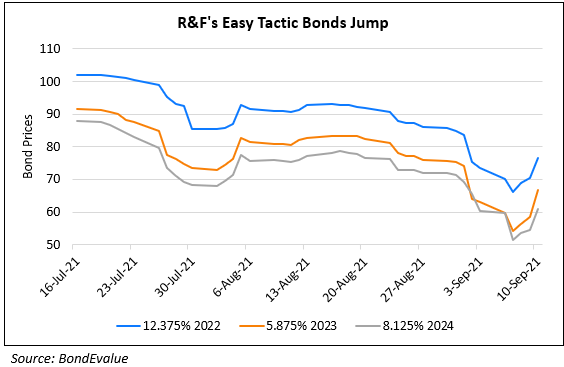

R&F Properties’ Bonds Jump Up to 8%

September 13, 2021