This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Q3 2025: 92% of Dollar Bonds Rally, Led by Weak Jobs Data, Rate Cut Expectations

October 1, 2025

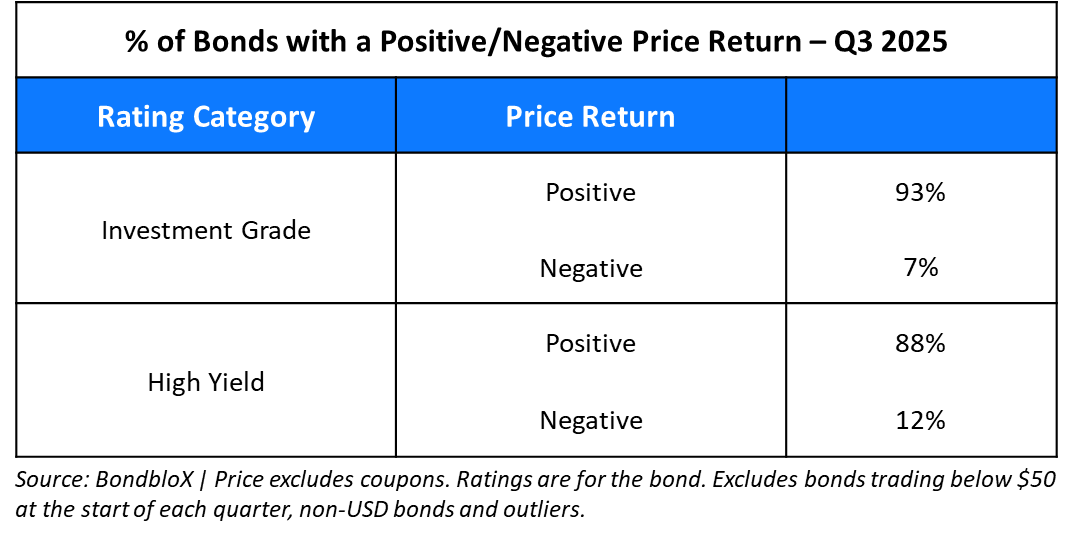

Bond investors enjoyed a great third quarter with 92% of dollar bonds in our universe delivering a positive price return (ex-coupon). Both, investment grade (IG) and high yield (HY) bonds delivered strong returns. 93% of IG bonds and 88% of HY bonds ended in the green respectively. Looking at the month of September, 74% and 78% of dollar bonds rallied, witnessing a third consecutive month of a positive trend in dollar bonds. The rally in bonds came on the back of increased expectations of Fed rate cuts, following weak employment data, with signs of more rate cuts to come.

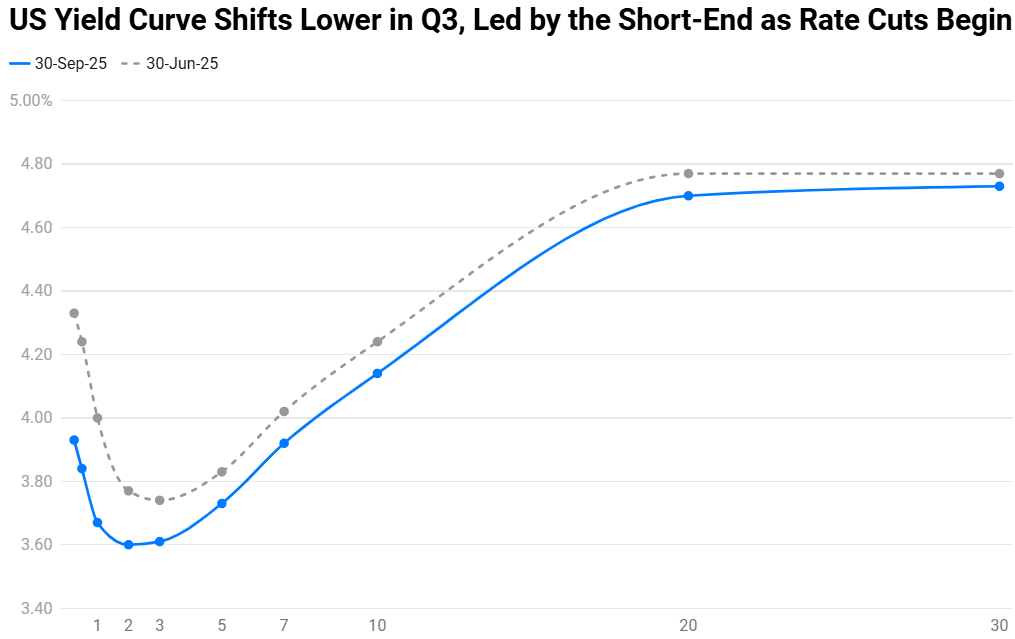

The US Treasury yield curve shifted lower in Q3 and continued to steepen. Q3 2025 presented a broadly weaker US economic scenario, particularly on the employment front. Average Non-Farm Payroll (NFP) figures indicated a sharp drop in job growth to only about 30k vs ~145k in Q2. The unemployment rate rose from 4.1% to 4.3% during this period. While average CPI and Core CPI readings during this period rose to 2.7% and 3.1% (from 2.7% and 2.9%), it was broadly inline with expectations and the seasonality. The average ISM Manufacturing PMI reading continued to show a contraction (50-mark), while the Services reading stayed muted albeit slightly above the 50-mark. Consumer sentiment dipped for two consecutive months to 55.1, as measured by the Michigan Consumer Sentiment Index. Looking at the data, particularly the labor market, Fed policymakers cut interest rates by 25bp as expected with a potential for more rate cuts to come. Markets are currently pricing-in another 50bp in cuts by the end of the year.

Looking at the performance of bonds across bond indices/regions, all regional markets performed well. Among these, the top performers were the Asian High Yield and GCC corporate bond indices that rallied by 3.9% and 3.7% respectively. Most other indices were up by over 2-2.5% while the EU Aggregate Index underperformed, up by only 0.2%.

The IG-space saw most long-dated dollar bonds of corporates and sovereigns move higher thanks to their longer duration being benefitted by the move lower in US Treasury yields. For instance, Alibaba, Aramco, Tencent, UAE, Hong Kong Airport, Panama, PTT, Thaioil and others rallied by ~7-10%. .

Among the gainers in the high yield space, US retailers like Michaels’ and Kohls’ bonds were among the top gainers rallying by ~34% and 24% respectively. The move in Kohls’ bonds came after the company asked its vendors for more time to settle invoices as part of its efforts to manage cash flows during its turnaround. Dollar bonds of NWD rallied by over 21% after a media report on a potential refinancing and take-private deal. Besides, there were also reports that NWD was in talks with potential investors including Blackstone and CapitaLand Group to buy some of its assets. Pemex’s longer end of the curve rallied by over 14% after the Mexican government raised up to $12bn via a P-Caps sale to support the company. Besides, Pemex also reported its first quarterly profit in over a year. Following this, it received a rating upgrade from Fitch. The Mexican government further pledged support by funding the Pemex’s debt tender offer resulting in an upgrade by Moody’s. DISH’s unsecured bonds rallied by over 19% after AT&T agreed to buy spectrum licenses from EchoStar in a $23bn deal. Transocean’s dollar bonds rallied by 11-20% after the company made amendments regarding a revolving credit facility enhancing financial flexibility and freeing-up additional cash.

Ambipar’s dollar bonds were the top losers in the category, plunging by ~80%, after concerns emerged over the company’s potential business and debt restructuring. Braskem’s dollar bonds lost almost half of their value during the quarter, after downgrades by multiple rating agencies on the back of weak financials and restructuring concerns. Argentina’s bonds fell by 17-20% after President Milei’s party lost the provincial elections of Buenos Aires and weak economic data. Xerox’s bonds fell by ~12-20% after reporting weak 2Q25 results and a downgrade by S&P.

Issuance Volumes

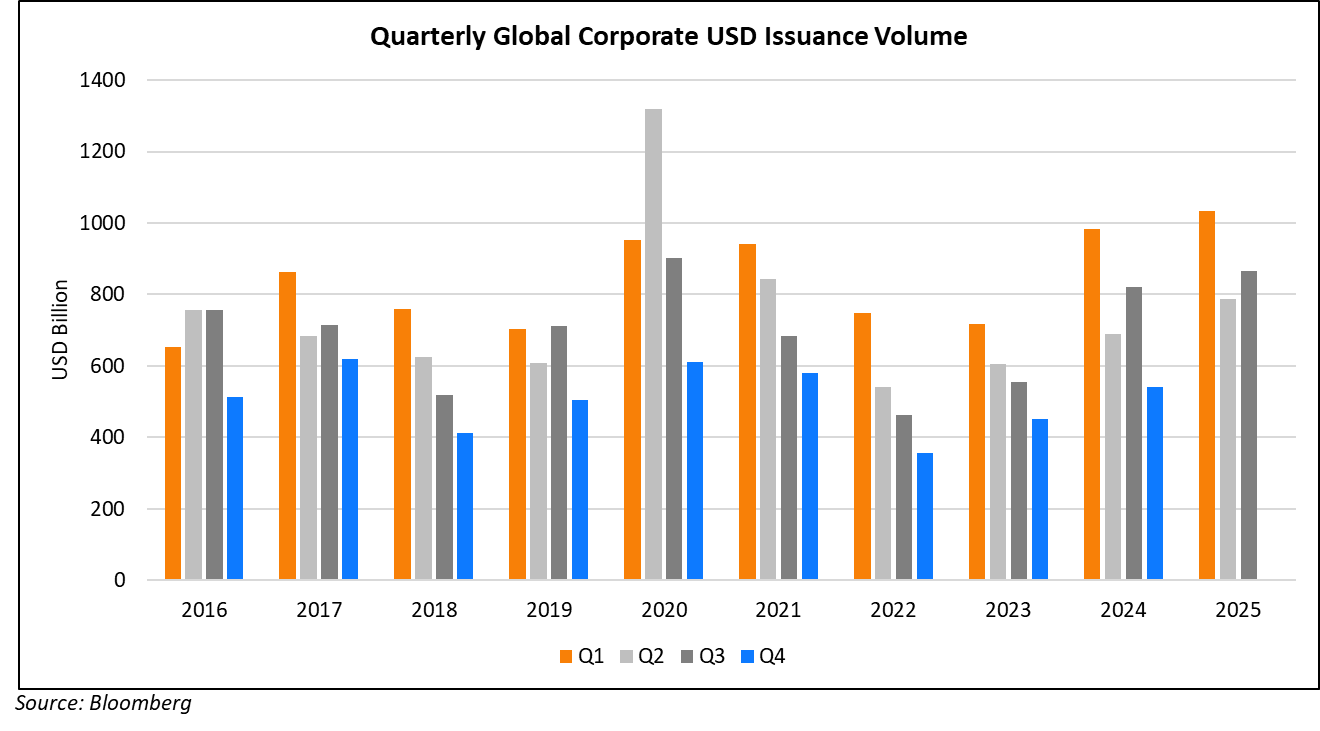

In Q3 2025, global corporate dollar bond issuances stood at nearly $880bn, over 7% higher than the same quarter last year which was at $820bn. In comparison to Q2 2025, issuance volumes were 10% higher. Q3’s issuances were also the highest during the second quarter of a year in a decade, led by a deluge of new deals in September, one of the busiest months on record.

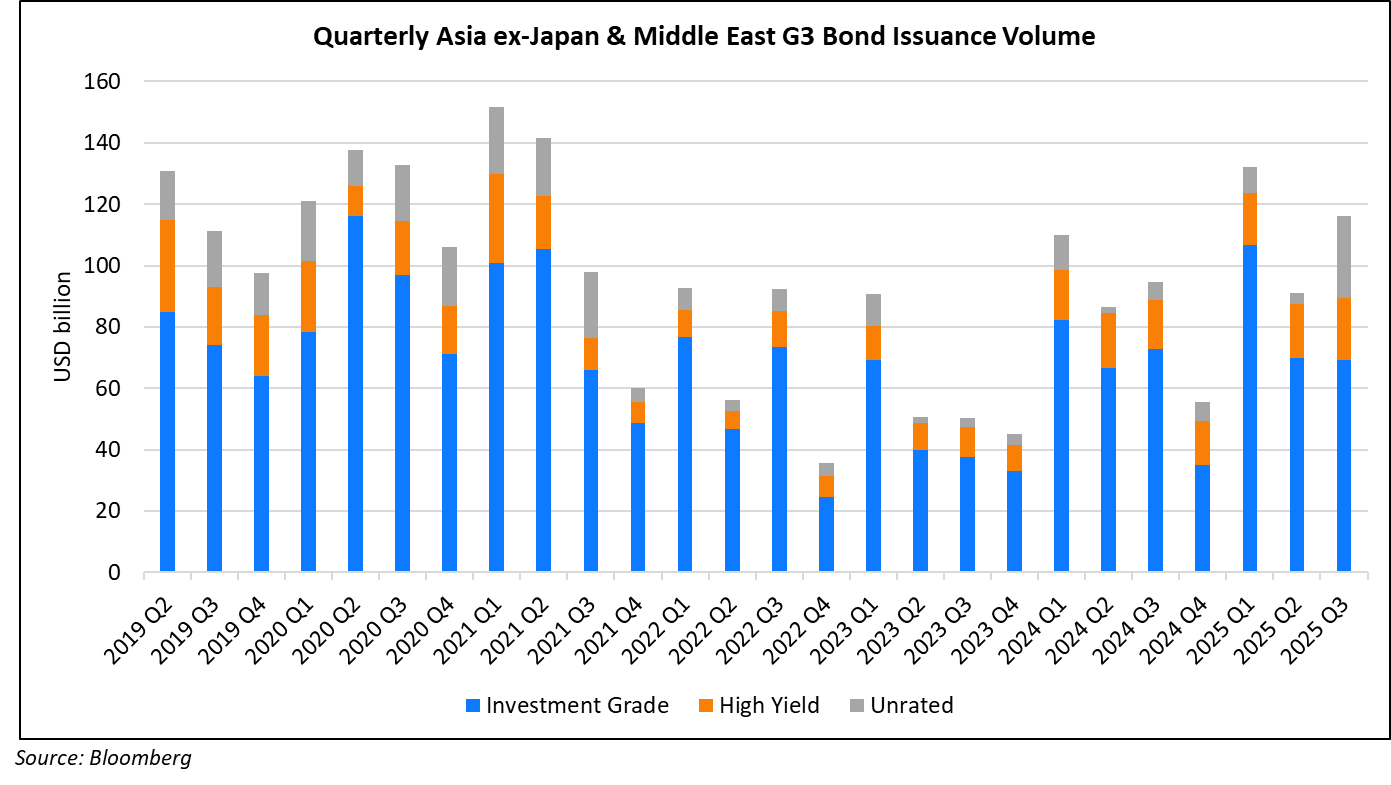

Asia ex-Japan & Middle East G3 issuances in Q3 2025 stood at $130bn, 25% higher YoY, and 30% higher QoQ. 60% of the volumes in the recently concluded quarter came from IG issuers while HY contributed to about 20% of deal volumes, with the remainder taken up by unrated issuers.

Largest Deals

The largest deal globally was led by Oracle’s $18bn eight-trancher (the second largest deal this year), followed by Mexico’s $12bn issuance via a 5Y P-Cap bond to support Pemex. This was followed by Citi’s $6.8bn four-tranche issuance, Eli Lilly’s $6.75bn seven-trancher and $6bn multi-tranche deals each by Merck, Morgan Stanley and Broadcom.

In the APAC and Middle East region, Kuwait’s $11.5bn three-trancher led the tables, followed by Abu Dhabi and Aramco’s $3bn two-tranchers each. Other large deals included Saudi Real Estate Refinance Company’s (SRC) $2.5bn deal, Indonesia’s $2.2bn two-tranche deal, DBS Group’s $2bn issuance, Al Rajhi and Saudi Arabia’s $2bn deals each.

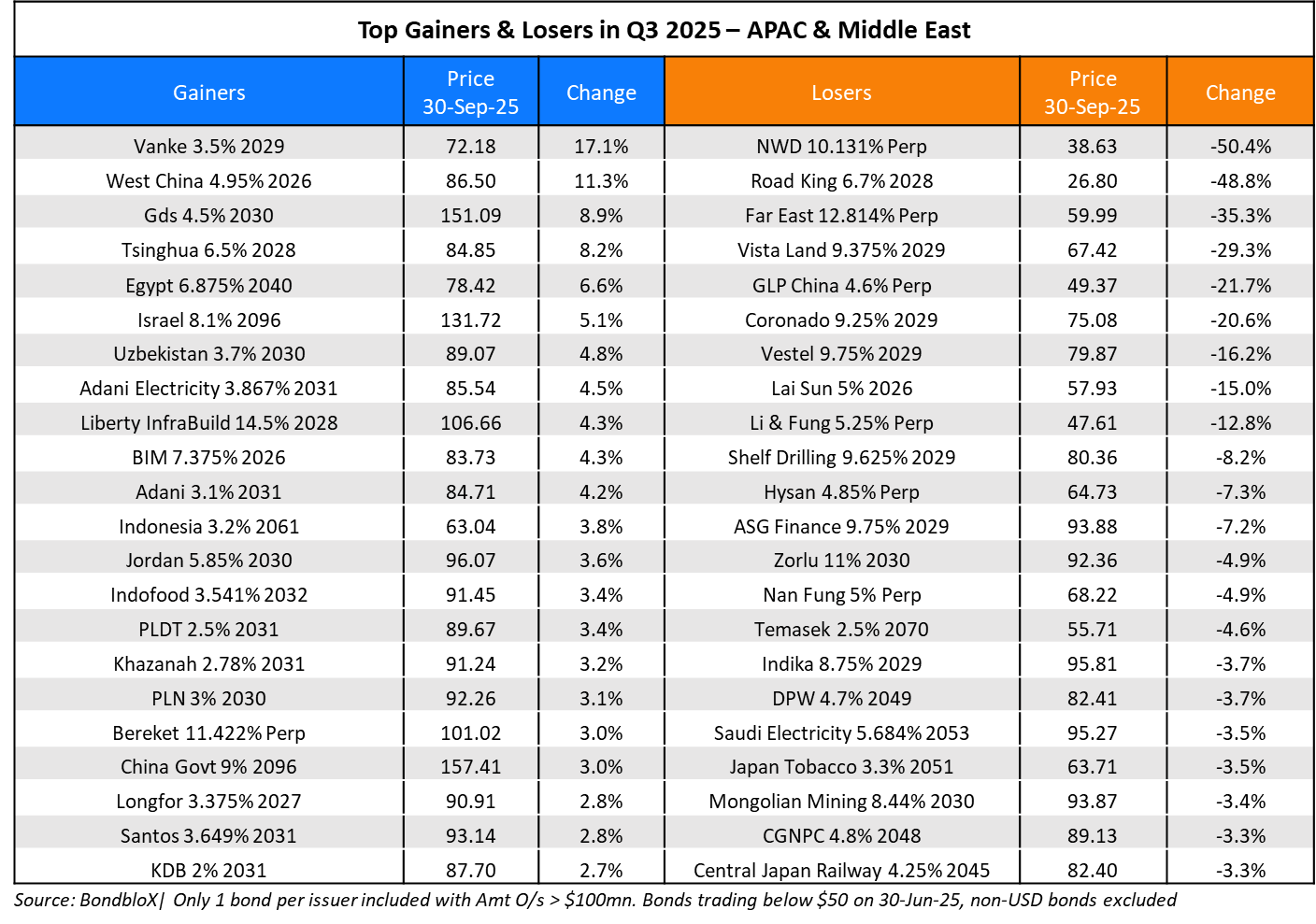

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

High-Yield Bonds Lead The July Recovery

August 6, 2018

Bond Yields – Explained

December 26, 2024

What to Look for When Buying Bonds

December 4, 2024