This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Q3 2024: 50bp Rate Cut Drives 95% of Dollar Bonds Higher

October 1, 2024

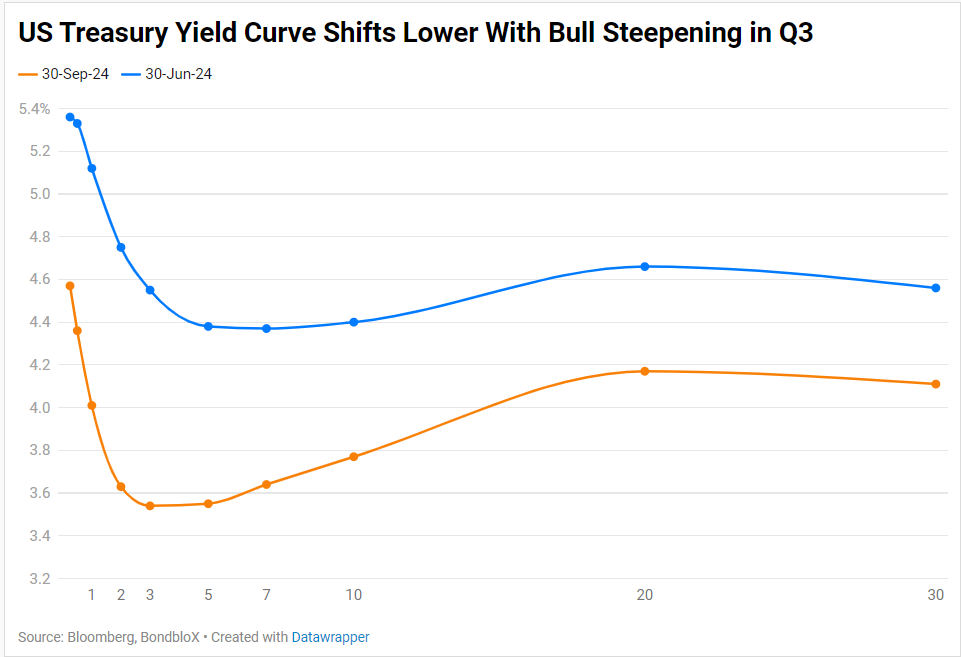

During the quarter, the US Treasury yield curve shifted lower with the 2Y and 10Y yields ending lower by 112bp and 62bp during the quarter to 3.63% and 3.77% respectively.

The US economy continued to show signs of moderation through the quarter, as evidenced by data. Looking at numbers for August, US CPI dropped to 2.5% YoY, lower than expectations of 2.6% and the prior 2.9% print. Core CPI remained flat at 3.2% YoY, in-line with estimates of 3.2% and the prior 3.2% print. ISM Manufacturing edged higher to 47.2 and the ISM Services rose to 51.5. NFP rose by 142k, lower than estimates of 160k, and the unemployment rate fell to 4.2% from 4.3%. As a result of the data, the Fed delivered their first-rate cut since 2020, lowering rates by 50bp. The dot plot indicates another 50bp of cuts by end-2024, and another 100bp in 2025.

Q3 2024 was a strong quarter for bonds, with 95% of dollar bonds in our universe delivering a positive price return (ex-coupon). 96% of investment grade (IG) bonds delivered positive returns, while 93% of high yield (HY) bonds ended in the green. The move was consistent across each of the three months, marking one of the best quarters for bondholders. The solid performance came on the back of the rally in US Treasuries as inflation cooled, and the labour market weakened, with markets anticipating a rate cut from the Fed.

No prizes for guessing, longer duration IG dollar bonds were the biggest gainers, owing to the broad move in long-dated Treasury yields through the quarter. The AAA to A- category saw bonds of issuers like Alibaba, Tencent, Apple, and Alphabet trade higher by 9-11%. Again, as expected, floating rate bonds remained relatively flat during the quarter, underperforming vs. fixed rate bonds. In the BBB+ to BBB- space, Viacom’s bonds were the top gainers after reports of the company’s merger with Paramount. Among the top losers in the BBB+ to BBB- space were bonds of Macy’s that fell ~5-9%, after buyout talks with Arkhouse Management and Brigade Capital ended and the company’s weak sales forecast.

In the HY space, Lumen’s bonds rose a solid ~65% during the quarter, on the back of the company announcing a partnership with Microsoft, reporting upbeat results and getting an upgrade to Caa1. Dish Network’s bonds also led the tables with ~20% gains as the company was reported to be closing in on a merger with DirecTV. CHS’s bonds rallied 18-20% during the quarter after the upgrade to CCC+ by S&P. El Salvador’s bonds traded higher by 17% after the nation reached a preliminary accord with the IMF.

Among the top-losers were Azul’s bonds, dropping by close to 25% after the company reported large losses, leading to its downgrade to CCC+ and rumours of the company looking to file bankruptcy. Maldives’ sukuk shed ~15% during the quarter, after the nation’s FX reserves plunged, raising concerns on liquidity and resulting in a downgrade to CC. Bonds of Sri Lanka too were under pressure during the quarter as the market remained concerned about the nation being able to reach a restructuring deal with creditors before the Presidential elections.

Issuance Volumes

In Q3 2024, global corporate dollar bond issuances stood at nearly $841bn, 20.2% higher than the prior quarter which was at $700bn. In comparison to Q3 2023, issuance volumes were 51.3% higher.

Asia ex-Japan & Middle East G3 issuances in Q3 2024 stood at $97.8bn, 13.1% higher than Q2 2024 and 94.8% higher than that of Q3 2023. 79% of the volumes in the recently concluded quarter came from IG issuers, while HY contributed to 15% of deal volumes, with the remainder taken up by unrated issuers.

Largest Deals

The largest deals globally were led by top US companies, followed closely by big US banks. Among corporates, United Health’s $12bn jumbo multi-tranche deal led the tables, followed by Kroger and Meta, both of which raised $10.5bn via five-tranche deals each. HPE’s $9bn three-part deal came in next, followed by ONEOK’s $7bn six-trancher deal. In the banking sector, JPMorgan’s $9bn and Morgan Stanley’s $8bn four-part issuance topped the tables, followed by Goldman Sachs’ $5.5bn two-rancher deal. In the HY space, some of the largest issuances included the likes of Turkey’s $3.25bn deal, followed by Royal Caribbean’s and JetBlue’s $2bn deals each.

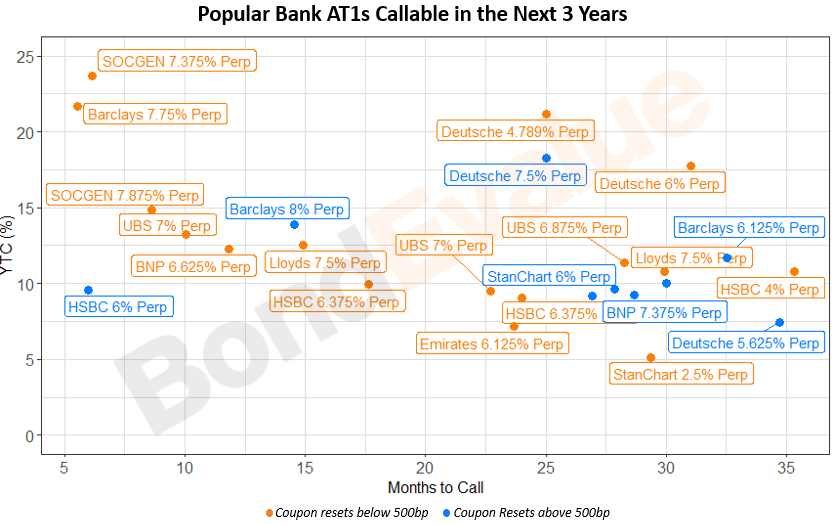

The APAC and Middle East region saw Saudi Aramco’s $6bn three-trancher deal leading the tables, followed by Adnoc’s $4bn three-part issuance and Greensaif’s $3bn issuance. This quarter also saw a flurry of AT1 issuances by European banks like HSBC, ING, UBS, Crédit Agricole, Nordea and Standard Chartered.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023