This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Powell, Mester Comment on Fed Policy

March 8, 2024

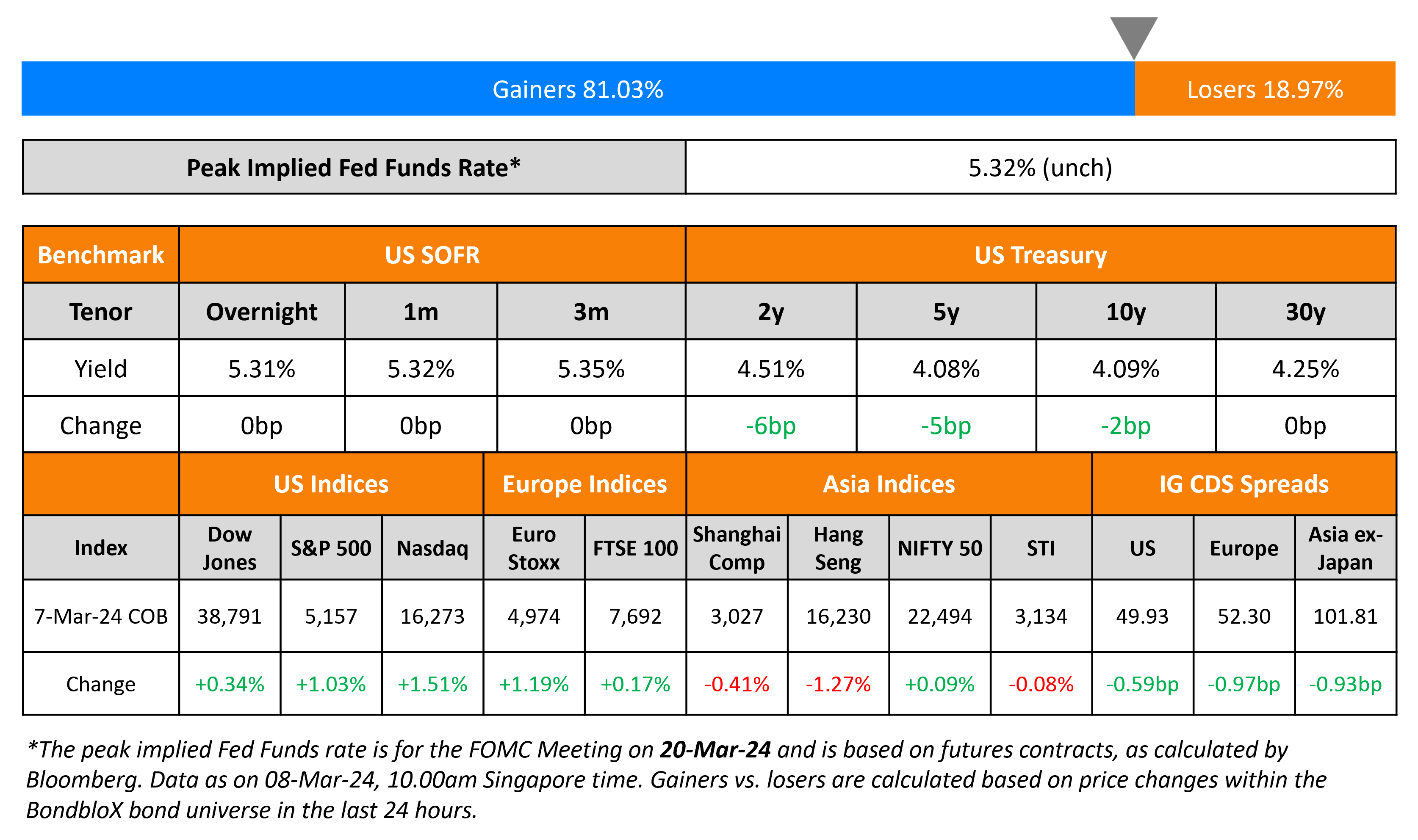

US Treasury yields moved slightly lower across the curve with the 10Y yield down 4bp. Federal Reserve Chairman Jerome Powell in his hearing before the Senate Banking Committee, said that the Fed was “not far” from gaining confidence to begin loosening policy. Separately, Cleveland Fed President Loretta Mester said that policy was in a “good place”. Looking at credit markets, US IG CDS spreads tightened 0.6bp and HY CDS spreads were 2.2bp tighter. Equity markets closed higher with the S&P and Nasdaq up 1-1.5%.

European equity markets ended higher. Credit markets in the region saw the European main CDS spreads tighten 1bp and crossover spreads tighten by 3.8bp. The ECB kept their policy rates unchanged. However, with their latest forecasts pointing to lower inflation and growth, market participants noted that ECB policymakers indicated they were preparing for a probable first cut in interest rates in June. Asian equity markets have opened lower slightly higher today. Asia ex-Japan IG CDS spreads were 0.9bp tighter.

New Bond Issues

BNY Mellon raised $2.5bn via a three-part deal. It raised:

- $500mn via a 2NC1 FRN at a yield of SOFR+45bp, 15bp inside initial guidance of SOFR+60bp area,

- $1bn via a 6NC5 bond at a yield of 4.975%, 25bp inside initial guidance of T+115bp area, and offer a new issue premium of 14.5bp over its existing 4.543% 2029s (callable in February 2028) that currently yield 4.83%.

- $1bn via a 11NC10 bond at a yield of 5.188%, 25bp inside initial guidance of T+135bp area

The FRN is rated Aa2/AA-/AA, while the fixed notes are rated A1/A/AA-. Proceeds will be used for general corporate purposes.

CaixiaBank raised $2bn via a two-part deal. It raised $1bn via a 6NC5 bond at a yield of 5.673%, 27.5bp inside initial guidance of T+187.5bp area. It also raised $1bn via a 11.25NC10.25 bond at a yield of 6.037%, 25bp inside initial guidance of T+220bp area. The notes are rated Baa3/BBB/BBB+. Proceeds will be used for general corporate purposes.

New Bond Pipeline

- Aston Martin hires for $ 5Y/7Y bond

Rating Changes

- Moody’s changes outlook on Egypt to positive, affirms Caa1 ratings

- Moody’s changes Modernland’s outlook to negative; affirms CFR at Ca

- Fitch Revises Teva’s Outlook to Positive; Affirms LT IDR at ‘BB-‘

- Mirae Asset Securities Outlook Revised To Negative On Sector’s High Property Risks; ‘BBB/A-2’ Ratings Affirmed

- Nabors Industries Ltd. Outlook Revised To Stable From Positive On Weaker Than Expected Cashflow; Ratings Affirmed

Term of the Day

State-Contingent Debt Instruments (SCDIs)

State-Contingent Debt Instruments (SCDIs) are sovereign debt instruments which have pay-outs based on certain economic variables which can indicate the economic state of the sovereign. The IMF states that SCDIs are debt instruments that have pay-outs that are higher in good states of the world than bad states, based on the value of a state variable, such as GDP or commodity prices, which is linked to the sovereign’s capacity to service debt. By tying the payments of restructured debt contracts to future outcomes, SCDIs may reduce conflicts over current valuations and facilitate more sustainable agreements between creditors and debtors. The IMF has priorly said that wider and more standardized use of SCDIs, which allow for increased pay-outs based on improved economic outcomes, could play an important role in sovereign debt restructurings.

Talking Heads

On Skepticism of Inflationary Impact of Surge Pricing – Fed Chair, Jerome Powell

“I think we need to give companies the freedom to do that as long as they’re not fixing prices or failing to disclose the nature of the price changes to the public

Marc Goldwein, senior vice president for the Committee for a Responsible Federal Budget

“I think it’s a coin flip whether the 10-year is higher or lower in 10 years than it is today. I think there are pressures both ways”

On Governments ‘Can’t Keep Us Aloft Forever’ – Oaktree’s Howard Marks

“Governments don’t make money, they’re not expected to make money, and they pay their debt by running a printing press… don’t think governments can keep us aloft forever”… corporate balance sheets as “generally less levered”

Top Gainers & Losers- 08-March-24*

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Sunac Raises $552 Million via Tap of 2024s & 2025s at Tighter Levels

February 26, 2021

Aramco Weighs Natgas Pipelines Stake Sale

April 27, 2021