This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ping An, Manappuram Launch $ Bonds; NatWest, Muthoot, Philippines Price $ Bonds

May 8, 2024

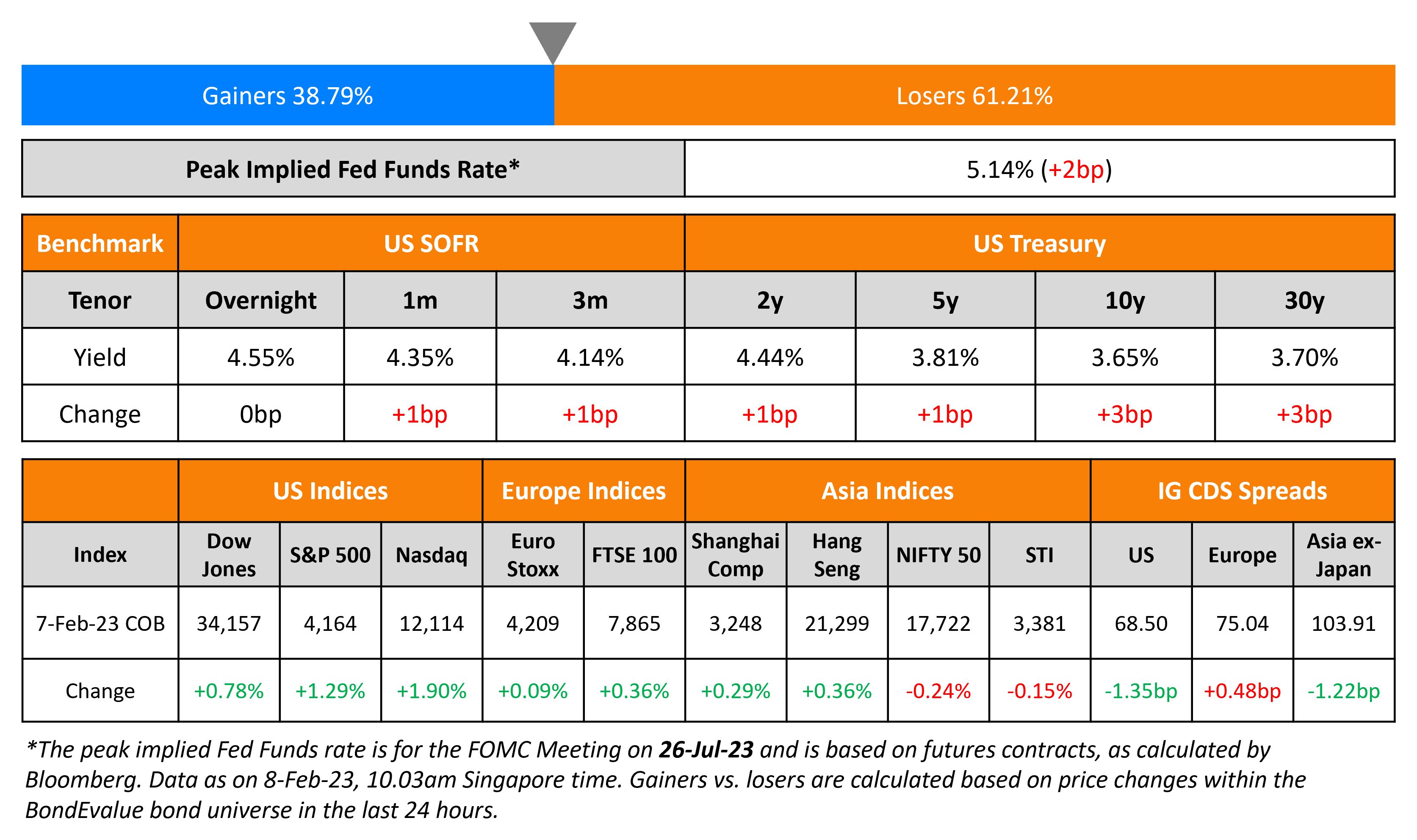

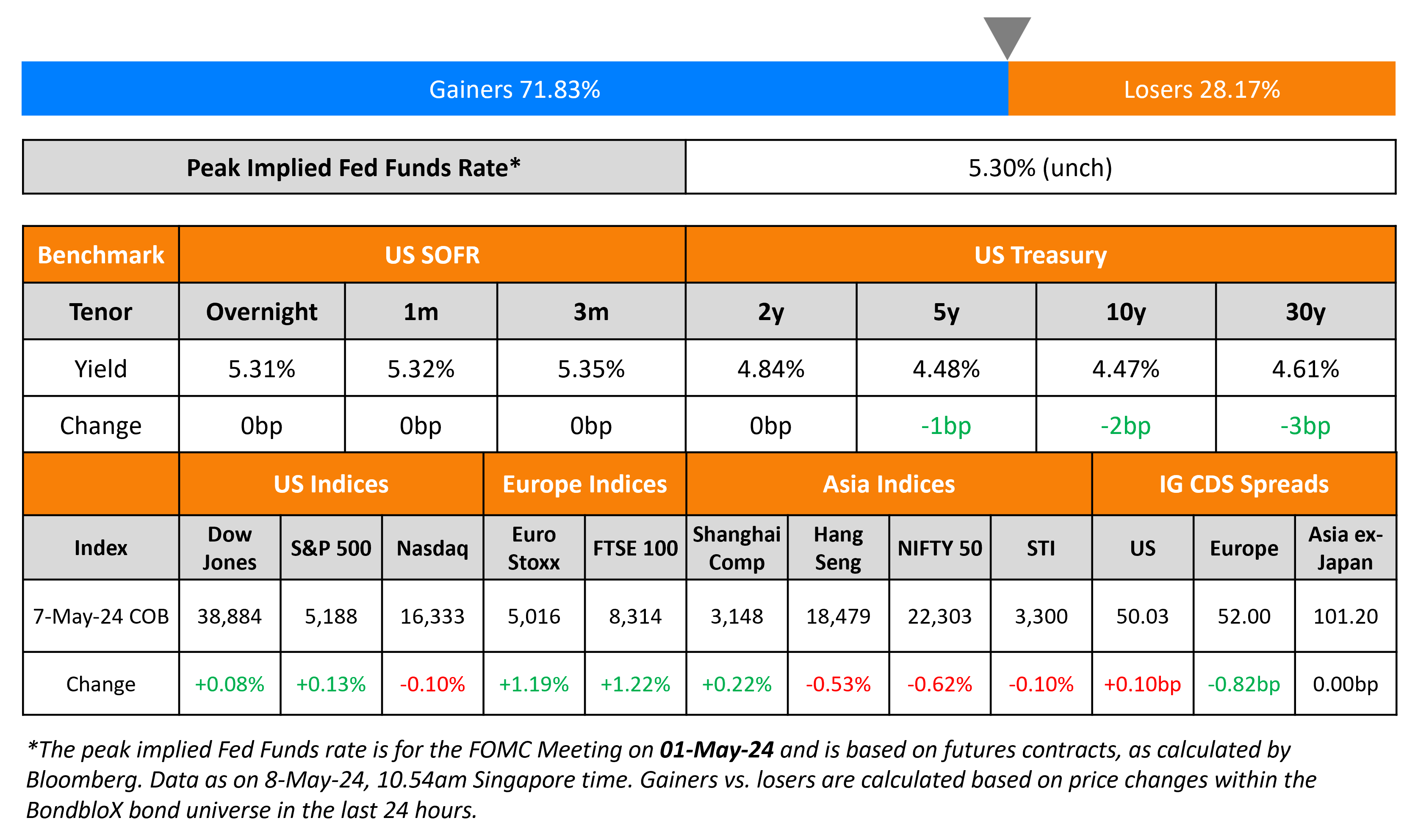

US Treasuries were stable on Tuesday with no economic data releases. Minneapolis Fed President Neel Kashkari said that the Fed will likely keep interest rates restrictive for “an extended period of time”. He added that there may be a reduction in rates if inflation decreases or if they see a “marked weakening in the labor market”. He further said, “if we get convinced eventually that inflation is embedded or entrenched now at 3% and that we need to go higher, we would do that if we needed to”. S&P and Nasdaq were nearly unchanged. US IG CDS spreads widened 0.1bp and HY spreads were 1bp tighter.

European equity markets were higher. Europe’s iTraxx main CDS spreads tightened 0.8bp and crossover spreads tightened 5.9bp. Asian equity indices have opened weaker this morning. Asia ex-Japan CDS spreads were flat. Asian primary dollar bond markets have been busy with five deals priced yesterday and another four being launched today.

New Bond Issues

- Export Import Bank of Thailand $ 5Y at T+120bp area

- China Ping An Insurance $ 10Y at T+210bp area

- Manappuram $ 4Y at 7.75% area

- Security Bank $ 5Y at T+140bp area

- Westpac $ 2Y/5Y at T+60/85bp area

NatWest raised $1bn via a PerpNC10 AT1 bond at a yield of 8.125%, 62.5bp inside initial guidance of 8.75% area. The subordinated notes are rated Baa3/BB-/BBB-. If not called by 10 May 2034, the coupon resets then and every 5Y thereafter to the 5Y UST + 375.2bp. Proceeds will be used for general corporate purposes. The bonds offer a yield pick-up of 56.5bp over the UBS 9.25% Perp callable in November 2033 that currently yield 7.56% to call and rated Baa3/BB/BBB-.

Muthoot Finance raised $650mn via a 3.75Y bond at a yield of 7.125%, 25bp inside initial guidance of 7.375% area. The senior secured bonds are rated BB/BB (S&P/Fitch). The door-to-door tenor is 3.75Y with a weighted average life (WAL) of 3.25Y. The bonds amortize 20% each in months 33, 36, 39, 42 and 45. A change of control will occur when the promoter group collectively no longer holds control of issuer or if the promoter group collectively, directly/indirectly, no longer holds at least 50% of voting rights. A “Change of Control Triggering Event” implies both a change of control and a rating decline. Proceeds will be used for onward lending and other activities, in accordance with approvals granted by the RBI. Maintenance covenants include but are not limited to a capital adequacy ratio complying with the RBI requirements in effect from time to time. It also involves having a security coverage ratio >= 1x (reviewed on a quarterly and annual basis).

Las Vegas Sands raised $1.75bn via a three-trancher. It raised:

- $750mn via a 3Y bond at a yield of 5.946%, 30bp inside initial guidance of T+160bp area.

- $500mn via a 5Y bond at a yield of 6.026%, 30bp inside initial guidance of T+185bp area.

- $500mn via a 10Y bond at a yield of 6.213%, 35bp inside initial guidance of T+210bp area.

The senior unsecured notes are rated Baa3/BB+/BBB-. Proceeds, together with cash on hand, will be used to (a) redeem in full the outstanding senior notes due 2024 (b) pay transaction-related fees and expenses. Any excess net proceeds will be used for general corporate purposes.

StanChart raised $3bn via a three-trancher. It raised:

- $1bn via a 4NC3 bond at a yield of 5.688%, 30bp inside initial guidance of T+135bp area.

- $500mn via a 11NC10 bond at SOFR+117bp vs. inside initial guidance of SOFR equivalent area.

- $1.5bn via a 11NC10 bond at a yield of 5.905%, bp inside initial guidance of T+175bp area.

The senior unsecured notes are rated A3/BBB+/A. Proceeds will be used for general corporate purposes.

Korea Expressway raised $500mn via a 3Y bond at a yield of 5.22%, 30bp inside initial guidance of T+90bp area. The senior unsecured notes are rated Aa2/AA. Proceeds will be used for general corporate purposes.

BOC Aviation raised $500mn via a long 5Y bond at a yield of 5.323%, 37.5bp inside initial guidance of T+125bp area. The senior unsecured notes are rated A-/A-. Proceeds will be used for new capex and/or refinancing of existing borrowings and general corporate purposes.

Philippines raised $2bn via a two-tranche deal. It raised $1bn via a 10Y bond at a yield of 5.263%, 40bp inside initial guidance of T+120bp area. It also raised $1bn via a 25Y sustainability bond at a yield of 5.6%, 45bp inside initial guidance of 6.05% area. The notes are rated Baa2/BBB+/BBB. Proceeds from the 10Y note will be used for general budget financing. Proceeds from the 25Y note will be used for general budget financing and to finance/refinance assets in line with the Republic’s sustainable finance framework.

ING Groep raised €1.25bn via a 10.25NC5.25 Tier 2 bond at a yield of 4.449%, 35bp inside initial guidance of MS+200bp area. The subordinated notes are rated Baa2/BBB/A- and received orders of over €4bn, 3.2x issue size. Proceeds will be used for general corporate purposes.

Deutsche Bank NY raised $1bn via a 5Y senior preferred bond at a yield of 5.414%, 30bp inside initial guidance of T+125bp area. The senior preferred notes are rated A1/A/A. Proceeds will be used for general corporate purposes.

Rating Changes

-

Delhi International Airport Upgraded To ‘BB-‘ On Likely Increase In Cash Flow; Outlook Positive

- GMR Hyderabad International Airport Upgraded To ‘BB’ On Higher Tariffs And Robust Traffic; Outlook Stable

- Turk Telekom Ratings Raised To ‘B+’ On Similar Sovereign Action, Placed On Watch Positive On Proposed Debt Issuance

- Fitch Upgrades Indonesia’s Bank Mandiri to ‘BBB’/’AAA(idn)’; Outlook Stable

-

Fitch Downgrades Hertz to ‘B-‘; Maintains Negative Outlook

Term of the Day

Weighted Average Life (WAL)

Weighted average life (WAL) is a feature of amortizing bonds, which are different from straight bonds in that they payback principal through the life of the bond rather than a one-time payment of the full principal at maturity. WAL refers to the average time, stated in years, in which the bond’s unpaid principal remains outstanding.

WAL is calculated as follows with an example of a 3Y bond with a $100 face value where P1 refers to principal repayment in year one, P2 in year two and P3 in year three:

WAL = [(P1 x 1) + (P2 x 2) + (P3 x 3)] / $100

Talking Heads

On Why US Default Rate Is Less a Worry for Investors – JPMorgan

Nelson Jantzen, head of US high yield and leveraged loan strategy

“A lot of the confusion is around the absolute numbers being reported because people aren’t necessarily feeling it to that effect in their portfolio”

Julia Chursin, VP at Moody’s

“Our default rate will be a little more elevated”

David Einhorn,

“Passive investors have no opinion about value.

Bloomberg Intelligence

“Despite the strong and steady growth of passive funds, their impact on market moves remains small”

Rich Weiss, CIO American Century Investment Management

“The growth of passive investing has been going on since I joined the business… So why all of a sudden it’s now achieved some level where value doesn’t work?”

Top Gainers & Losers- 08-May-24*

Go back to Latest bond Market News

Related Posts: