This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Petrobras Offers to Take Majority Braskem Stake in Extreme Event

May 15, 2024

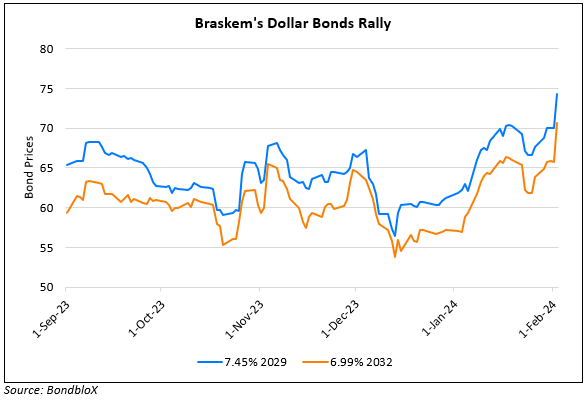

Petrobras has offered to take a majority stake in Braskem “in a case of extreme need” if the latter is at risk of deterioration. This comes after ADNOC’s talks to acquire a 38.3% stake in Braskem for $2.1bn failed last week. Post the failed deal, Braskem’s dollar bonds fell as much as 2 points across the curve. Petrobras is still waiting for other companies to make bids for a stake in Braskem after ADNOC pulled out. However, Petrobras’ willingness to save Braskem has seen the latter’s dollar bonds recover some of its losses. Novonor SA, Braskem’s controlling shareholder, has been struggling to find a buyer for its stake. Petrobras is Braskem’s second-biggest shareholder.

Braskem’s 7.45% 2029s jumped 1.7 points higher to 81.55, yielding 12.15%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Braskem Idesa Upgraded to BB- by Fitch

March 28, 2022

Braskem’s Dollar Bonds Rally on Reports of Stake Acquisition

February 2, 2024

Petrobras Reports Highest Profits on Record

February 24, 2022