This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Braskem’s Dollar Bonds Drop as ADNOC Talks Fall Through

May 7, 2024

Braskem’s dollar bonds were lower by 1.3-2 points across the curve after talks with Abu Dhabi National Oil Co (ADNOC) failed. The exact reason for the stall in talks is not known. In November 2023, ADNOC offered $2.1bn to acquire a 38.3% stake in Braskem in November 2023 in order to to develop a global chemicals business and diversify beyond oil. Now, Brazil’s Petrobras (a minority shareholder in Braskem) is waiting for other companies to make bids for a stake in Braskem after ADNOC pulled out. In February, it was reported that PIC from Kuwait and Saudi’s Aramco showed interest in acquiring a stake in Braskem. However, no details have emerged since then regarding their interest.

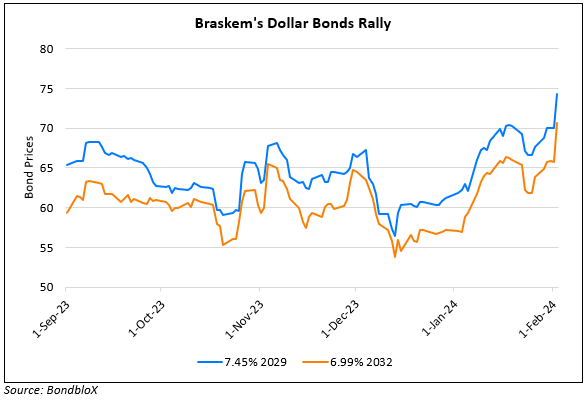

Braskem Idesa’s 7.45% 2029s fell 2.3 points to 77.16, yielding 13.44%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

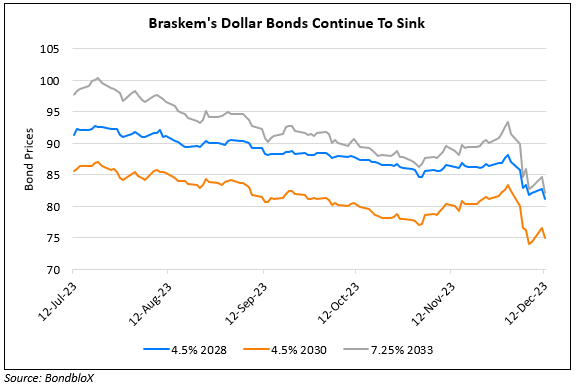

Braskem’s Dollar Bonds Drop Further on Mine Rupture

December 12, 2023

Braskem Downgraded to Ba2 by Moody’s

December 13, 2023

Braskem’s Dollar Bonds Rally on Reports of Stake Acquisition

February 2, 2024