This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

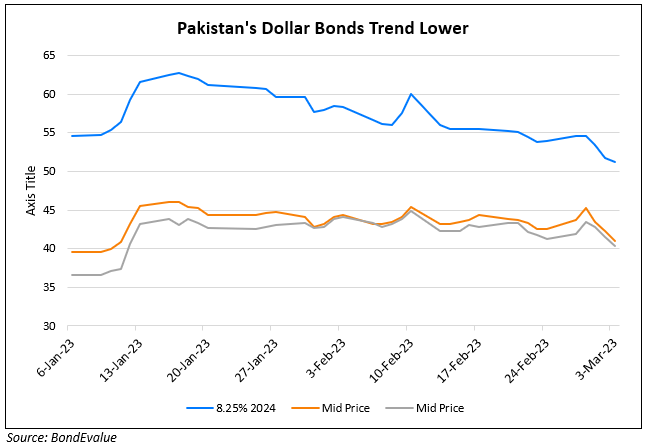

Pakistan’s Dollar Bonds Drop Over 1.5 Points

March 3, 2023

Pakistan’s dollar bonds were lower by 1.5 points across the curve to trade at 40 cents on the dollar. As per Bloomberg, its dollar bondholders are bracing for a potential default with the nation having ~$7bn in debt repayments by June, that includes a $2bn Chinese loan due in March. Earlier this week, the sovereign was downgraded to Caa3 from Caa1 by Moody’s. Pakistan is in talks with the IMF and hoping for the latter to resume its bailout loan instalment. In early February, IMF team said it held positive talks but stopped short of unlocking its $1.1bn bailout deal. IMF requires Pakistan to show a strengthening in its fiscal position with permanent revenue measures and reduction in untargeted subsidies.

Go back to Latest bond Market News

Related Posts: