This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Pakistan Expects Roll Over of $11.3bn of Maturing Debt

August 2, 2023

Pakistan’s central bank Governor Jameel Ahmad has announced that Pakistan expects $11.3bn of its debt maturing this fiscal year to be rolled over. This amounts to about half of its overall $24.5bn of debt due. Ahmad added that officials believe the remaining amount will be sufficiently covered by inflows. Pakistan’s financial position has significantly improved since two months ago, when the country’s forex reserves were barely enough to cover one month’s worth of imports. Since then, it secured a $3bn bailout from the IMF, received financial support from countries like Saudi Arabia and the UAE, and had its debt payments to China rolled over. Pakistan’s foreign exchange reserves currently stand at $8.19bn, roughly double the amount before it received the IMF funds, with this figure projected by the central bank to surpass $10bn by June 2024. Moreover, the country is currently in talks for a possible commercial borrowing and also expects to issue dollar bonds and/or sukuk at the end of this fiscal year.

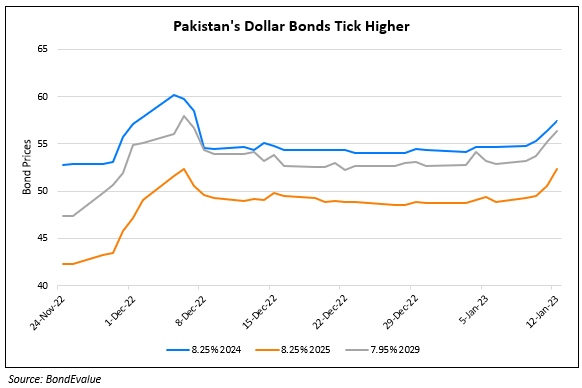

Pakistan’s 8.25% 2025s inched higher by 0.5 points and are currently trading at 62 cents on the dollar.

For more information, click here

Go back to Latest bond Market News

Related Posts: