This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Over $30bn Eroded From Chinese Developers’ Dollar Bonds Since Mid-August

October 15, 2021

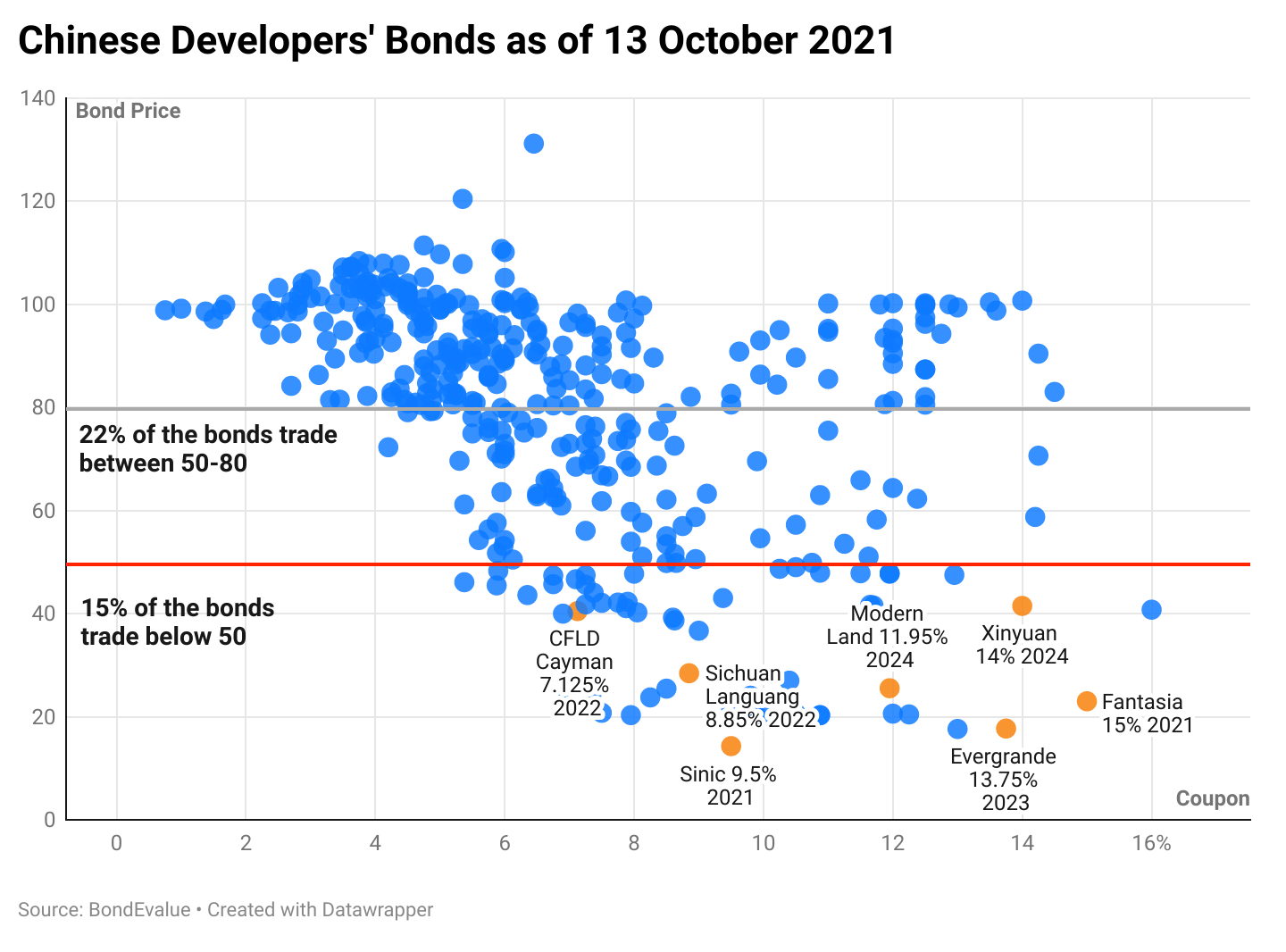

As the turmoil unfolds in the Chinese real estate sector, developers’ dollar bonds have seen an erosion of over $30bn in notional value since mid-August. In the animated chart below, we have plotted prices of Chinese developers’ bonds in our universe on August 16, September 15 and October 13 to highlight the trajectory. The chart below clearly shows the transition in the number of bonds trading above 80 cents to below 50 cents on the dollar in the last three months. You can click on each of the three dates below the chart title to see the scatter plot for that date.

While 90% of the dollar bonds traded above 80 cents on the dollar in mid-August, only 63% of them trade above those levels currently. On August 16, 2021, only 3% of dollar bonds traded at distressed levels below 50 cents on the dollar. That number has now grown 5x to 15% of the dollar bonds trading below 50.

In terms of the notional value eroded from Chinese developers' dollar bonds since mid-August, about $19.7bn or 65% of the $30.5bn eroded came from ten developers' bonds alone. These included the likes of Fantasia, Kaisa, Evergrande and Greenland as shown in the animated chart below. The chart shows the MTM losses on the ten developers' dollar bonds between mid-August to mid-October.

What began as an Evergrande's crisis has spilled over to pretty much the entire sector, with major updates over the last couple of weeks being:

- Greenland Downgraded to B+ by S&P on Impaired Funding and Weak Operating Conditions

- Modern Land Downgraded to Caa2 by Moody’s

- R&F Properties Downgraded To B- On Refinancing Uncertainty

- Xinyuan Real Estate Downgraded to C by Fitch on Distressed Debt Exchange

- Modern Land’s Bonds Collapse; Seeks to extend 12.85% 2021s, Major Shareholder Loan on Track

- Chinese Developers’ September Sales Plummet 36%

- Fantasia Downgraded to Ca/SD/RD Across the Three Rating Agencies

- Meltdown Seen Across Chinese Property Dollar Bonds after Evergrande and Fantasia Incidents

- Sunac’s Dollar Bonds Drop on Liquidity Concerns after a Leaked Letter

Go back to Latest bond Market News

Related Posts:

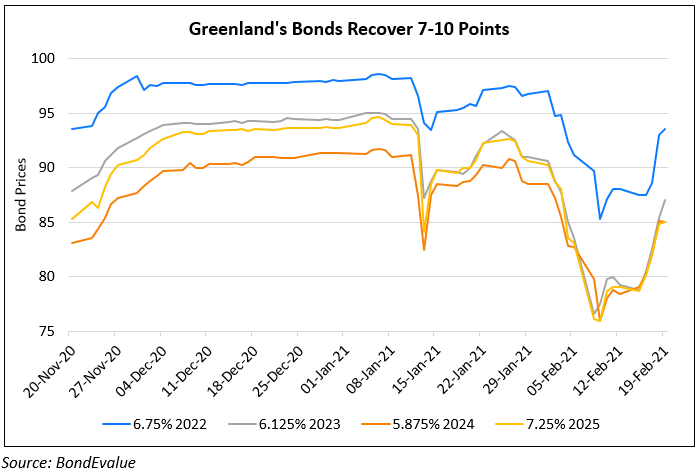

Greenland’s Dollar Bonds Recover 7-10 Points from Lows

February 19, 2021