This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China, BEA & Comm Bank of Dubai Launch $ Bonds; Evergrande Raises $555mn via Shares; Sri Lanka Looking to Raise $500mn from Chinese Lenders

October 14, 2020

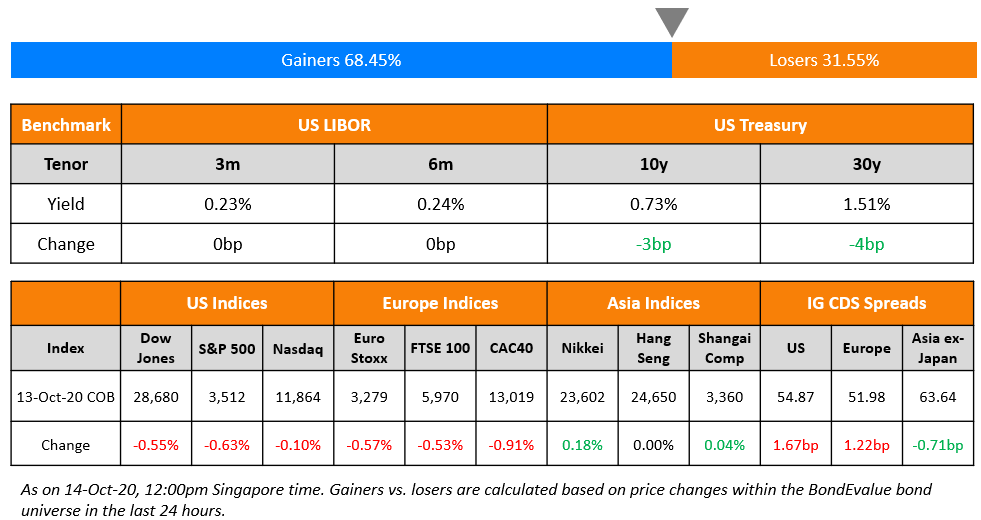

S&P took a breather, ending lower by 0.6% after four days of rally with financials and energy sectors leading the move. Apple ended 2.6% lower while falling almost 7% mid-day after the 5G iPhone event launch. Citi and JP Morgan beat estimates in their Q3 earnings results though their stocks fell 4.8% and 1.5% respectively. The US Senate will vote for replenishing the paycheck program next week according to Senate Majority Leader McConnell. Stimulus hopes before the election also dimmed with House Speaker Pelosi pushing for a revamp of Trump’s and McConnell’s plans. US 10Y Treasury yields fell 3bp to 0.73% on the weak sentiment and core inflation rate at 1.7%, lower than expectations. US IG CDS spreads widened by 1.7bp while HY spreads were flat. European IG CDS spreads widened 1.2bp while Crossover spreads were wider by 9.6bp. Asian markets are lower today by 0.3% while Asia ex-Japan CDS spreads were tighter by 0.7bp. The Asian primary markets are having a busy day with China launching its dollar sovereign bond along with AT1s from BEA and Commercial Bank of Dubai.

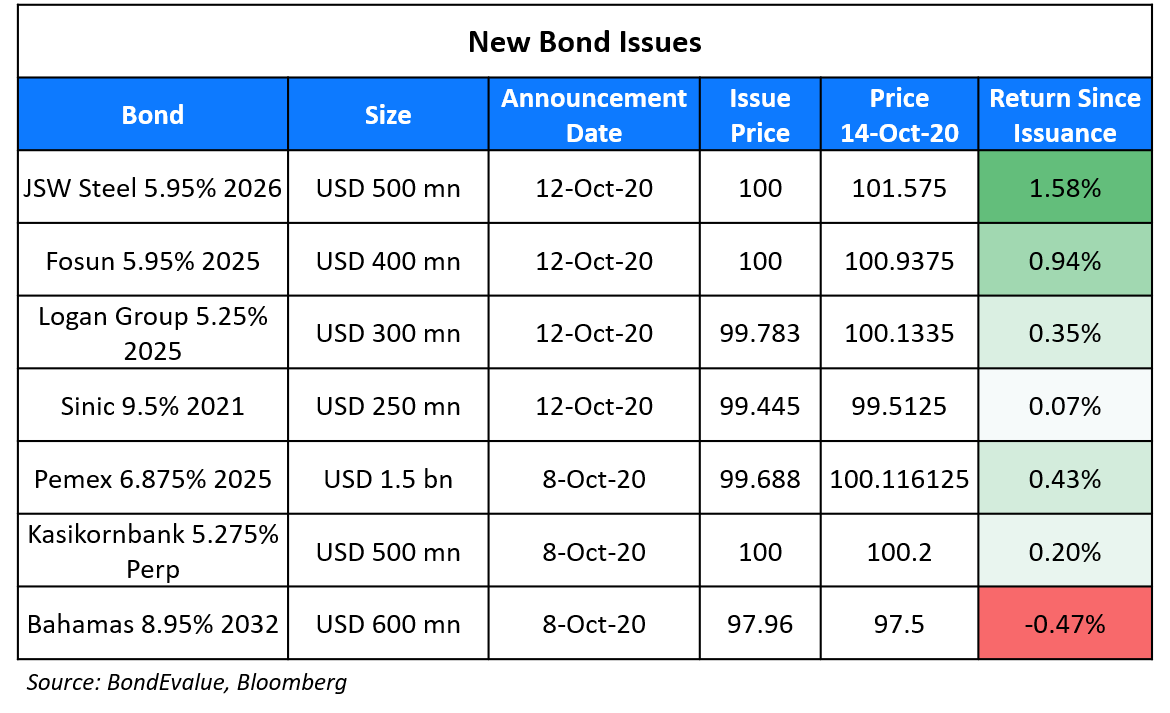

New Bond Issues

- China $ 3/5/10/30yr @ T+50/60/75/110bp area

- Bank of East Asia $ Perp NC5 AT1 @ 6.25% area

- Commercial Bank of Dubai $ Perp NC6 AT1 @ 6.375% area

- SMC Global $ Perp NC5 @ 7.3% area

- Greenland $ 1.5yr @ 7.2% area

- Fantasia $ 200 mn 3NC2 @ 10.45% area

- Shangrao City Construction $ 3yr @ 4.8% area

South Korean credit card company Shinhan Card raised $400mn via 5Y Covid-19 response social bonds to yield 1.39%, 107.5bp over Treasuries and 32.5bp inside initial guidance of T+140bp area. The bonds, with expected ratings of A2/A–, received final orders exceeding $1.5bn3.75x issue size. Shinhan intends to use the proceeds for financing low to moderate income individuals affected by the coronavirus as defined in Shinhan Financial Group’s sustainable development goals financing framework. Shinhan last visited the international bond market 13 years ago in May 2007 with a debut $400mn 5Y floater.

China Merchants Commerce Financial Leasing raised $350mn via 5Y debut dollar bond to yield 2.489%, 218bp over Treasuries and 37bp inside initial guidance of T+255bp area. The bonds, with expected ratings of BBB+, received orders exceeding $1.7bn when final guidance was announced, 4.86x issue size.

New Bonds Pipeline

Indika Energy $ Bond

Turkey $ 5Y bond

Goshawk Aviation $ Perp with letter of support from NWS Holdings

Rating Changes

Mallinckrodt PLC Downgraded To ‘D’ Following Announcement Of Voluntary Chapter 11 Proceedings

Weibo Corp. ‘BBB’ Ratings Placed On CreditWatch Negative On SINA Corp.’s Privatization Plans

Chinese Government Launches Multi-Tranche Dollar Issuance

The People’s Republic of China has launched a four-tranche dollar bond offering this morning. Moody’s assigned an A1 rating to these bonds while S&P rated them at A+ and Fitch also at A+, all of them in-line with the issuer’s long term rating. The deal size is expected to be $6bn based on sources from Bloomberg and IFR. Proceeds will be used for general government purposes. Bankers to the current deal involve BofA, Bank of China, CCB, CICC, Citi, Credit Agricole, JPMC, Goldman, Deutsche, Mizuho, CTBC, Standard Chartered and Bank of Communications. Prominent bank HSBC did not feature among the list with reasons not revealed by the bank. However, commentators infer that the an uptight relationship with China of late is a probable reason. Last month, the Global Times reported that HSBC could be put on the “unreliable list” entity.

China last issued a $6bn multi-trancher in November 2019 via $1.5bn 1.875% bonds due 2022, $2bn 1.95% bonds due 2024, $2bn 2.125% bonds due 2029 and $500mn 2.75% bonds due 2039. The issuance raked up orders of ~$20bn (more than 3x issue size).The older 3Y, 5Y, 10Y and 30Y bonds are higher by 0.11, 0.17, 0.40 and 0.60 cents to 103.1, 105.4, 108 and 106.4 respectively. In the chart below, we have plotted China’s existing dollar bonds with the new bonds based on the initial price guidance. As per IFR, the new bonds have already received orders worth $16bn.

.png?upscale=true&width=1600&upscale=true&name=China%20Sovereign%20Dollar%20Bonds%E2%80%99%20Credit%20Curve%20with%20bigger%20fonts%20(1).png)

Sri Lanka Turns to China for a $500mn Loan

Sri Lanka is seeking a $500mn loan from Chinese lenders to meet its upcoming obligations of ~$4.5bn in 2021. According to the Chinese Embassy tweet on Sunday, “a $500 million concessional loan” requested by Sri Lanka’s Ministry of Finance is under negotiation. A Sri Lankan official source revealed, “The focus now is on possible investment from China, not just loans”. The tweet comes after Beijing announced a grant of $90mn to the island nation on Sunday after a Chinese delegation led by Yang Jiechi visited Sri Lanka. The Minister for Finance Ajith Nivard Cabraal had criticised a downgrade by Moody’s late last month and had said that the country was exploring multiple options to boost foreign exchange reserves including a $1bn swap agreement with India as well as receiving a $700mn syndicated loan from China. Sri Lanka has also borrowed $500mn in “urgent financial assistance” from Beijing earlier in March. Treasury Secretary S R Attygalle was confident of repaying the sovereign’s debt even in July. At the time, Sri Lanka had lined up funding from several lenders including ADB, France, the AIIB and the World Bank and had sought a $400mn swap from the Reserve Bank of India. It had also secured part of a $1.2bn loan from China Development Bank with the balance expected in the second half of 2020.

Sri Lanka’s 6.125% 2025s and 7.55% 2030s traded at 68.3 and 66.7 cents on the dollar respectively.

For the full story, click here

Evergrande Raises $555mn via Share Placement To Repay Upcoming Bonds Due

China Evergrande Group sold shares worth HKD4.3bn ($555mn) today to shore up capital to repay debt and working capital purposes. It has sold 260.65mn shares for HKD16.5 each (the lower-end of its pricing range), a discount of 14.7% to its last closing price. As per Bloomberg, the 14.7% discount is wider than that done by other developers this year like Sunac (8.25%) and China Vanke (4.8%). Evergrande managed to raise only about half of what it had planned to sell (up to HKD8.43bn ($1.09bn)) according to Bloomberg yesterday. With balance sheet debt of over $120bn based on its recent results, Evergrande has aggregate repayments (onshore and offshore) of $4.8bn due in October and November out of its total $34bn due in onshore and offshore bonds. ~24% of its borrowings are denominated in USD and HKD. The share placement should increase cash balances by ~2% based on our calculations from the last released results. “Evergrande having difficulty placing $1 billion, which is not a very big amount relative to its size and previous fundraising, may show that its closest supporters are not willingly stepping in this time…raising $555 million at a steep discount shows signs of desperation” said Kerry Goh, CIO of Kamet Capital Partners.

Evergrande’s dollar bonds due 2021 moved lower by 0.10 with its 8.9% and 6.25% 2021s trading at 98.7 and 95.1 respectively.

For the full story, click here

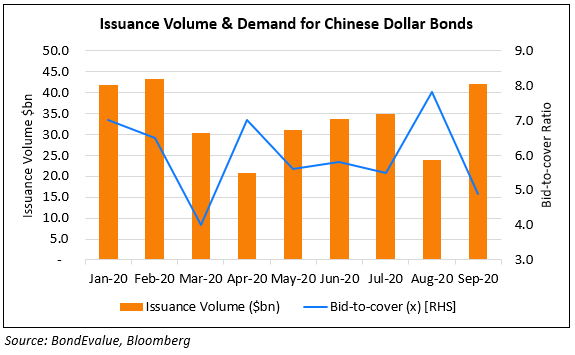

China Dollar Bond Orders Fall to Six-Month Low After Record Orders in August

Demand for dollar bonds from Chinese issuers fell to a six-month low in September. Bid-to-cover ratio (orders as a multiple of issue size) for Chinese dollar bonds fell to 4.9x in September, the lowest since April. This is in stark difference to the ratio for August, which was at a record high of 7.8x. The lower bid-to-cover ratio for September can perhaps be attributable to the massive supply of ~$42bn from Chinese issuers that month, the highest since March. In the chart below, we have plotted the monthly issuance of dollar bonds from Chinese issuers along with the bid-to-cover ratio for each month.

For the full story, click here

Aramco Looking to Sell a $10bn Stake in its Pipeline Business

Saudi Aramco has hired JPMorgan and MUFG to advise on “Project Seek”, which aims to sell a stake in its pipeline business. The deal would provide liquidity to the oil major at a time when oil prices have been negatively impacted due to lower demand and could help it finance a part of the $75bn dividend pledged during its IPO last year. The deal is expected to be on similar lines to the $10bn gas pipeline infrastructure deal by ADNOC with investors including Brookfield Asset Management. The Abu Dhabi National Oil Company (ADNOC) deal was backed by a $8bn two-year bridge loan which could be replaced with a bond issuance. BlackRock and KKR had also bought a 40% stake in ADNOC Oil Pipelines for $4bn last year. “There’s more work to be done. No buyers have been lined up, but there are talks,” said a Reuters source on the deal. Aramco’s 2.75% 2022s, 3.5% 2029s and 4.375% 2049s traded at 102.8, 111.8 and 123 respectively.

For the full story, click here

Term of the Day

Zero Coupon Bonds

As the name suggests, these are bonds that do not pay coupons. Given the lack of coupons, the price changes in the bond due to a change in interest rates (duration) can be sharper than a bond that has pays a coupon. But the lack of coupon means that there are no reinvestment risks and therefore unless a default occurs, the bondholder will get the stated yield at the time of buying. For example, if a 5Y zero coupon bond that has a yield to maturity of 3% is bought, the investor will get a 3% return if held to maturity since he/she doesn’t have to reinvest any cashflows. Whereas, in a 5Y 3% coupon paying bond that has a yield to maturity of 3%, the investor must be able to reinvest the coupons at 3% consistently over the 5Y period to get a return of 3% – if interest rates fall, he/she would end up with a lower return since the coupons are reinvested at a lower rate.

Italy yesterday issued a 0% 2023 bond, the first zero-coupon bond by the nation with a yield of -0.23%.

Talking Heads

The euro zone economy is losing momentum and the European Central Bank will react accordingly, de Guindos said late on Monday, citing December’s macro-economic projections as a key guide for future policy moves.

On the benefits of extending the G20 debt freeze – Vera Daves, Angola’s Minister of Finance

“We are very keen… to have more time regarding the DSSI, the debt suspension initiative,” Daves said. “That is very useful for us”. “We need to remain very conservative and very vigilant to make sure that we remain focused and keep our debt sustainable”.

“I think the path of least resistance is probably higher (yields) in Treasuries but it’s a slow move because we still don’t have signs of inflation or excessively strong growth,” she said.

On the risks in China’s offshore bond market highlighted by Evergrande’s situation

In a note by analysts at global investment research firm Gavekal

“Evergrande’s sheer size and extensive liabilities mean its collapse would be a systemic risk to China,” say analysts at Gavekal. “The firm’s ‘too big to fail’ status illustrates the balancing act the government faces as it tries to pressure developers to get their finances in order while avoiding defaults that would ripple through the Chinese economy.”

Owen Gallimore, ANZ Singapore

“We think Evergrande is systemically important but you can still treat (offshore) bondholders badly,” he said. “Bondholders don’t have collateral. They are in a perilous situation. China has learned with every restructuring to deal more aggressively with bondholders.”

On Mexican regulators clamping down on private investment in energy sector

Geoff Moody, vice-president of government relations at the American Fuel and Petrochemical Manufacturers

“We are very concerned with actions by the Mexican government to deny US energy companies fair market access,” said Moody.

A former energy official and close source to Onexpo, Mexico’s national association of petrol station owners

The source said 154 permit applications had been “frozen” by the CRE — the very authority supposed to ensure that the law is applied. “They’re achieving very little but the destruction in terms of investor and regulatory certainty is very big.”

On the reasons behind China’s recent purchase of Japanese government bonds

Ross Hutchison, investment director of global fixed income at Aberdeen Standard Investments

“One of the odd things about the current environment is that JGBs are no longer an obviously unattractive fixed income security, depending on the currency you are funding the purchase in,” said Hutchison.

David Nowakowski, a senior strategist of multi-asset and macro at Aviva Investors

“Many reserve managers buy JGBs and then swap or hedge the currency back into dollars, earning an additional ‘basis’ premium,” said Nowakowski. “Even with a zero yield — in fact JGB yields are slightly below 0% — Japan’s bond market is more attractive than many other countries’ bonds, with Sweden, Switzerland, and core Eurozone countries all having deeply negative yields,” he said.

“The severe economic downturn gives rise to fears that the number of corporate insolvencies will rise significantly in the coming quarters,” the Bundesbank said. “An increase in unemployment and the number of household insolvencies could result in rising defaults on housing loans, while a rise in corporate insolvencies and a change in demand for office space could have a negative impact on the commercial real estate market,” the Bundesbank said.

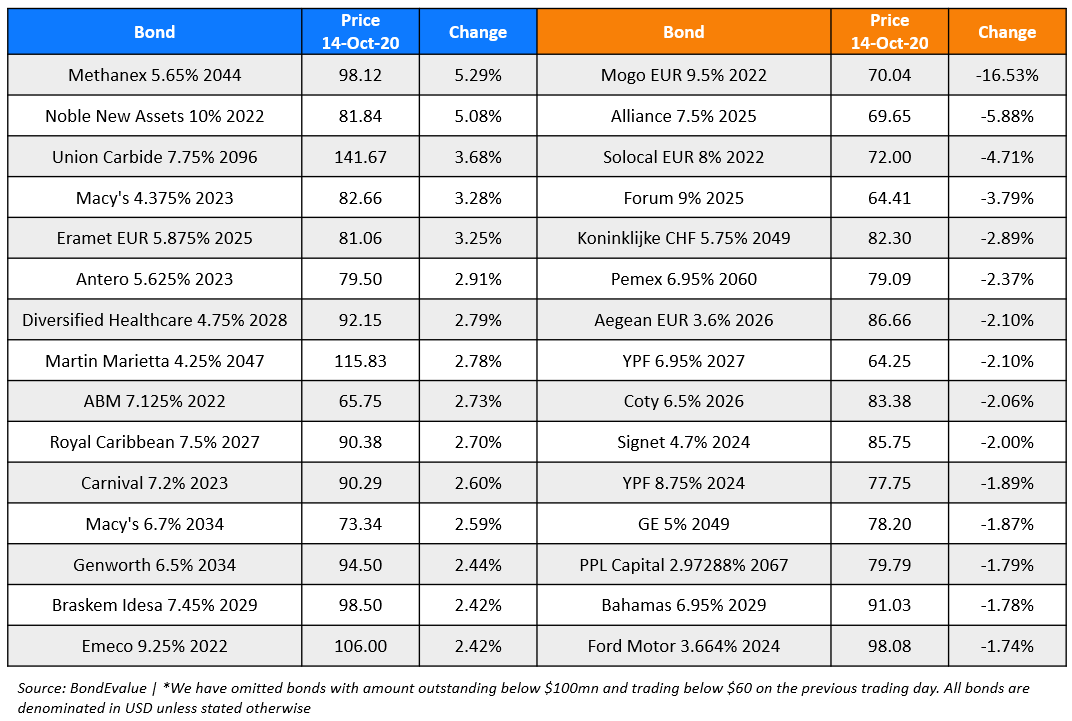

Top Gainers & Losers – 14-Oct-20*

Go back to Latest bond Market News

Related Posts: