This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

October 2024: Dollar Bonds End Three Month Winning Streak as Treasury Curve Jumps Higher

November 1, 2024

October 2024 was a poor month for bond investors with 85% of dollar bonds ending lower (price returns ex-coupons). Both, Investment Grade (IG) bonds and High Yield dollar bonds performed poorly as markets repriced rate cut expectations by the Fed amid the consistently solid data out of the US. 90% of IG bonds and 71% of HY bonds closed in the red during the month.

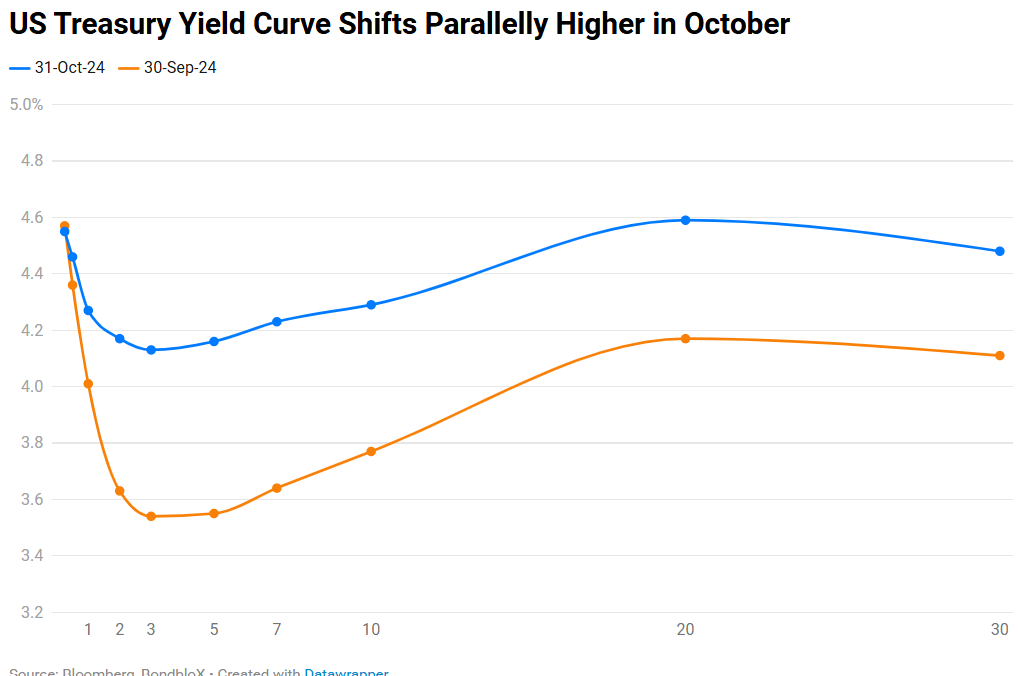

October saw the Treasury yield curve shift even almost parallelly higher, rising over 55bp on average across tenors. The US economy continued to show resilience and growth, starting with the Non-Farm Payrolls (NFP) showing a strong pick-up of 254k, much higher than the surveyed 147K. AHE YoY rose by 4.0%, higher than the surveyed 3.8%. and the Unemployment Rate stood at 4.1%, lower than surveyed 4.2%. Looking at inflation, US CPI rose as expected, by 2.5% YoY in August vs. 2.9% in July. Core CPI held steady and was in-line with expectations at 3.2%. Meanwhile, even as manufacturing activity continued to indicate signs of slowing down, with the ISM Manufacturing Index coming at 47.2, the Services PMI stayed upbeat by inching higher to 54.9. Following this, most FOMC speakers came out speaking in favor of moving gradually regarding the pace of rate cuts. Markets thus repriced their expectations of Fed rate cuts in 2024 to settling on 40bp of rate cuts by year end, from over 50bp at the beginning of October.

In the top-rated AAA to A- bucket, longer dated bonds of most issuers, which included the likes of Apple, Microsoft, Amazon and Abu Dhabi, were the top losers dropping by 5-8% led by the rise in benchmark rates with the 10Y and 30Y Treasury yield rising by 45 and 35bp each. The BBB+ to BBB- bucket saw a similar trend with Mexico's longer dated bonds being the worst performers in the category dropping by 4-7%.

Under the HY segment, in the BB+ to B- bucket, bonds of China Property issuers like Longfor and China Jinmao topped the charts gaining by 4-6%, continuing their rally from previous month on the back of aggressive stimulus package announced by China to pull the economy out of deflation and boost its economic growth. Panama's bonds were the top losers in the category after the nation issued an executive decree to strip maritime vessels of their domestic licenses and registrations if they face global sanctions. In the B+ to B category, Pemex bonds were the top gainers after Mexico approved Energy Reform Bill to reclassify Pemex as Public Company. Among the top losers, GLP's Perps dropped 9-11% after the company scrapped the new bond deal and cancelled its tender offer for its 2025s. With a gain of 8-15%, bonds of Argentina were the top performers in the B- to C category after it was promised to get $8.8bn in financing from the World Bank and Inter-American Development Bank (IDB). Dollar bonds of Sri Lanka followed closely, with gains of 9-11% after its newly elected President held his first meetings with the IMF and initiated steps to move forward with the nation’s debt restructuring. Lumen's bonds also continued their rally from previous month gaining by 6-10% in the month. CHS' bonds were the top losers, down 8-9% on weak Q3 numbers and a cut in its guidance. Ecuador's bonds also fell by 3-6% during the month.

Issuance Volumes

Global corporate dollar bond issuances stood at $261bn in October, 34% lower than September. As compared to October 2023, issuance volumes were up 51% YoY. 88% of the issuance volumes came from IG issuers with HY comprising 23% and unrated issuers taking the remaining 3%.

Asia ex-Japan & Middle East G3 issuance stood at $26bn, down 44% MoM, while being up 47% YoY. 67% of the issuance volumes came from IG issuers with HY comprising 27% and unrated issuers taking the remaining 6%.

Largest Deals

The largest deals globally were led by JPMorgan’s $8bn four-trancher and LBBW's €6.5bn multi-tranche issuance. This was followed by Morgan Stanley’s $5.75bn three-part deal and Elevance Health's $5.2bn six-tranche deal. In the HY space, some of the largest issuances included the likes of Cleveland-Cliffs $1.8bn two-part deal, Ecopetrol's $1.75bn deal and LATAM Airlines $1.4bn issuance.

In the APAC and Middle East, Abu Dhabi National Energy’s $1.75bn two-trancher deal led the tables followed by KDB’s $1bn and CSI Ltd’s $1bn two-trancher. This was followed by $800mn deal each by Dukhan Bank and Biocon Biologics.

Top Gainers & Losers

>

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

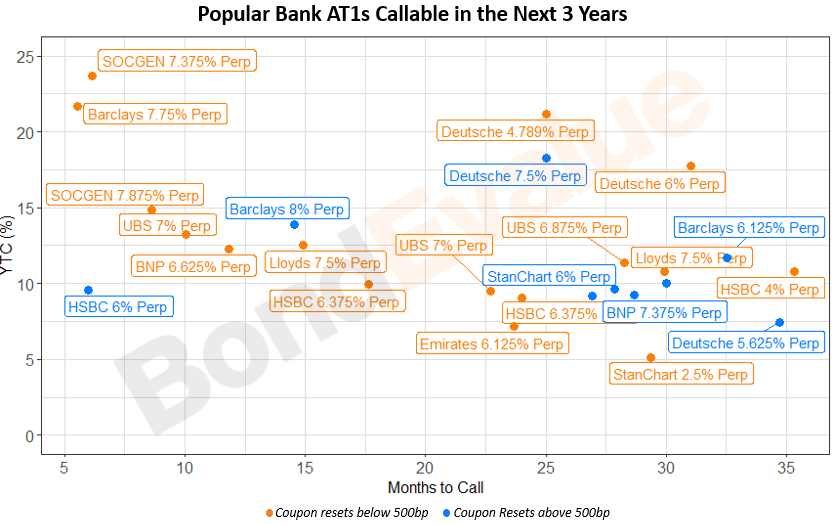

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023