This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

October 2023: Higher-for-Longer Theme Pushes 76% of Dollar Bonds Lower

November 1, 2023

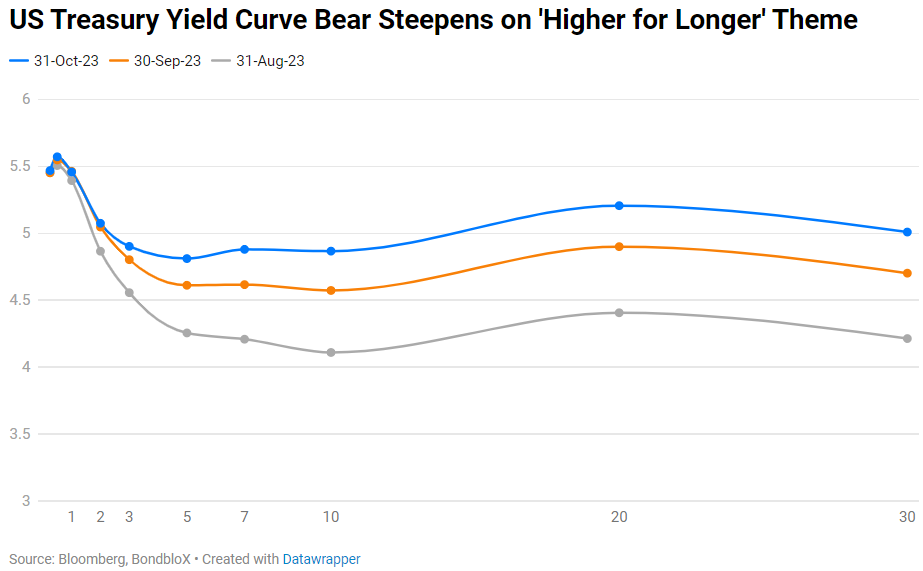

The month of October was another poor month for bond markets with 76% of dollar bonds ending lower. Both, investment grade and high yield bonds performed poorly with the latter underperforming – 82% of HY bonds ended in the red vs. 75% of IG bonds that ended lower. This marks a third consecutive month of negative returns for bonds. With mid and long-end Treasury yields rising by 20-30bp through the month (see chart below), spreads across IG and HY rose by 8bp and 45bp to 79bp and 525bp respectively. This is the widest level for US HY spreads since March. While the widening of HY spreads seen in March was driven by the Credit Suisse AT1 write-off, the recent widening was likely driven by multiple factors including heightened geopolitical risks, volatility in Treasuries and concerns over refinancing for HY issuers.

October saw a massive sell-off in Treasuries with a sharp bear steepening of the yield curve – the 2s10s curve bear steepened by 27bp during the month to -20bp currently. The resilience shown by the US economy continued to push yields higher as markets adjusted towards a possible new normal being the 'higher for longer' theme, whilst pushing out soft landing expectations to later next year. While the 2Y yield was up only 2bp through the month, the 10Y yield was up 30bp. The 10Y yield initially broke the 5% level, the first time since 2007, before edging lower. US economic data saw a pickup with Q3 GDP at 4.9%, the fastest since Q4 2021 and more than double that of the Q2 pace of 2.1%. Adding to that, US Non-Farm Payrolls came in significantly higher at 336k vs. expectations of 170k. Besides, US headline CPI came at 3.7% YoY, higher than estimates of 3.6% while Core CPI was in-line with estimates at 4.1%. Other data points including durable and capital goods orders also saw a pickup. Importantly, the ISM Manufacturing print improved from 47.6 to 49.0 in September, just below the 50-mark that indicates neither growth nor contraction. This comes after witnessing an eleventh straight month of contraction.

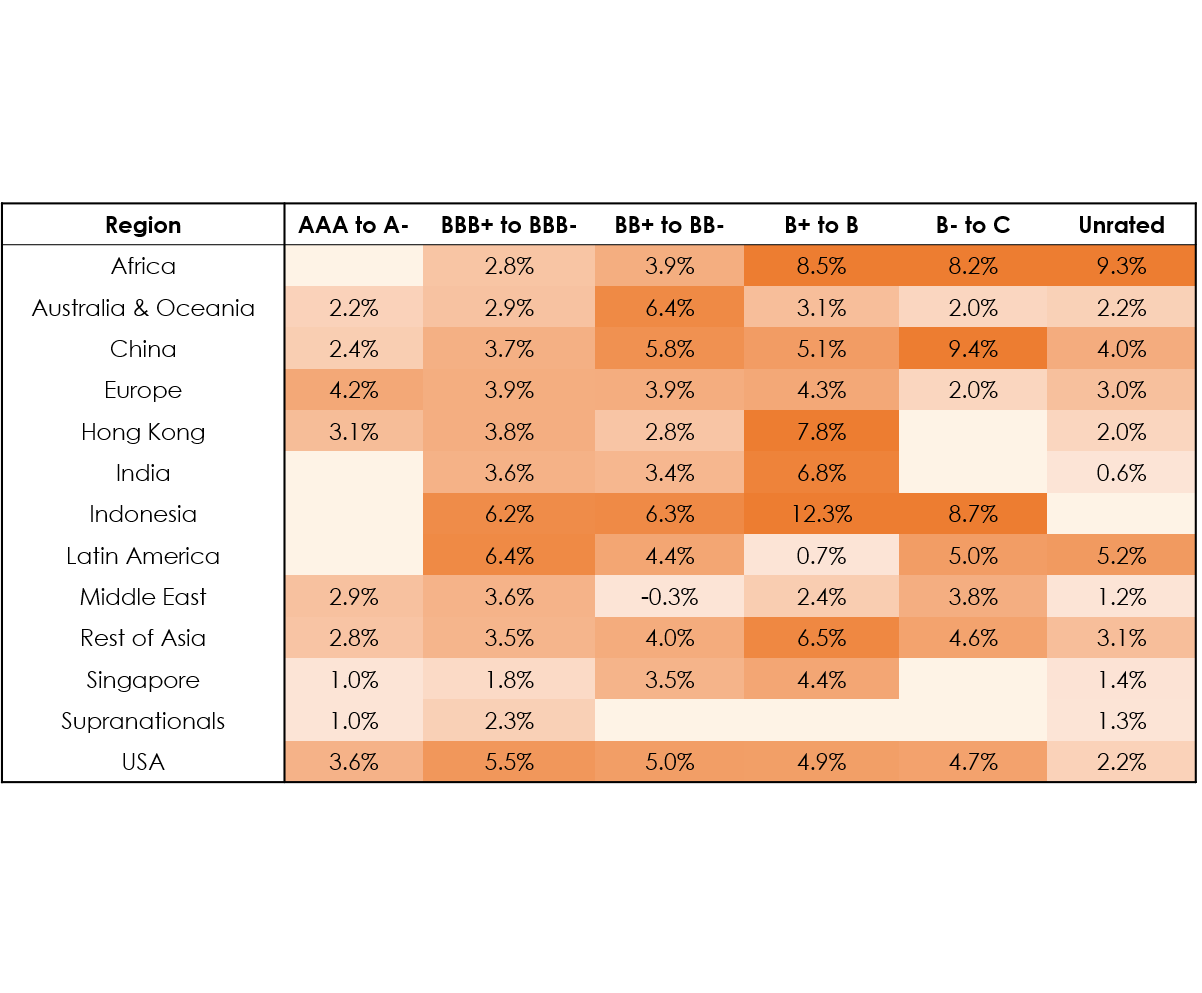

In the IG space, there were no notable gainers, considering the rise in Treasury yields. Longer-dated bonds maturing over 15-20 years from today led losses within the AAA to A- space, given their high duration. This included bonds of companies like Apple, Abu Dhabi, China, Saudi Arabia, CK Asset etc. Among this, Israel dollar bonds fell ~10% across the curve as the war with Hamas weighed on it. Among the BBB+ to BBB- space, dollar bonds of Chinese developers Vanke and Longfor dropped steeply by as much as 38% as the meltdown in the sector continued following the non-payment and subsequent default of Country Garden.

In the HY space, gainers included companies like Ping An, MHP, Qwest and others. Pakistan's dollar bonds rose by ~10% after it made a timely coupon payment on its 8.25% 2024s alongside progressive talks with the IMF. Among the biggest losers in the HY space were Chinese corporates including developers - Seazen, Yanlord, GLP China and Greentown saw their dollar bonds drop by at least 15%. Besides, Xerox's bonds fell alongside the jump in its CDS. Also, Middle Eastern sovereigns like Jordan and Bahrain saw their dollar bonds amongst the losers following the continuation of the Israel-Hamas war. Hong Kong corporates tied to the real estate sector also saw their bonds drop including Lai Sun and CK Infrastructure. However, NWD's dollar bonds were amongst the top gainers in this segment after its flagship company said that the pre-conditions to the sale of its shares to Century Acquisition were met. This would help lighten its debt load.

Issuance Volumes

Global corporate dollar bond issuances stood at $167bn in October, 29% lower than September. As compared to October 2022, issuance volumes were up 18% YoY. 90% of the issuance volumes came from IG issuers with HY and unrated issuers taking the remainder.

Asia ex-Japan & Middle East G3 issuance stood at $17.9bn, down, 32% MoM and 10% YoY. 85% of the volumes came from IG issuers with HY issuing 11% and unrated issuers taking the rest.

Largest Deals

The largest deals globally were led by led by large US banks – JPMorgan raised $7.25bn via a thee-trancher followed by Wells Fargo and Goldman Sachs that raised $6bn and $4bn respectively via a two-tranche issuances each. Besides, other large deals included Energy Transfer's and BPCE’s $4bn four-trancher, Venture Global's $2bn dual-trancher and KfW’s $4bn issuance.

In the APAC and Middle East region, deal volumes were led by the PIF’s $3.5bn dual-trancher, KDB's $2bn four-part deal and ICBC’s ~$1.82bn multi-currency three-trancher and Kookmin Bank's $1.05bn issuance. Other mid-to-large issuances included Emirates NBD's $700mn deal, Macquarie Bank’s $600mn deal, Shinhan Bank’s $500mn deal.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

Bond Investors Up $75.4 Billion in 1Q19

April 10, 2019