This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

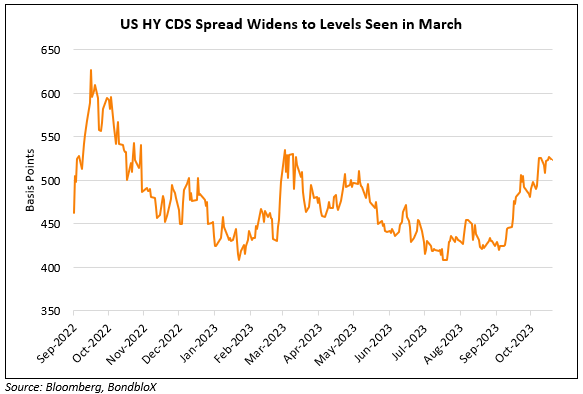

US HY CDS Spreads at 523bp, Widest Levels Since March

October 31, 2023

US Treasury yields were marginally higher on Monday. Markets await the US Treasury’s quarterly refunding announcement where analysts expect a boost in the size of auctions for bills, notes and bonds in Q4. This comes after the US budget deficit widened to $1.7tn in fiscal 2023, the largest since the pandemic induced $2.78tn deficit seen in 2021. The deficit-to-GDP was at 5.4% of in 2022 and stands at 6.3% in fiscal 2023. US credit markets saw IG CDS spreads tighten 0.6bp and HY spreads tighten by 4.8bp. US HY CDS spreads have widened by over 100bp since mid-September to 523bp, approaching levels seen in March after the collapse of Credit Suisse. US IG CDS spreads however, are still more than 10bp lower than levels seen in March, currently at 81bp. US equity markets rallied, with the S&P and the Nasdaq up 1.2% each.

European equity markets closed higher too. In credit markets, European main CDS spreads were tighter by 1bp and crossover spreads tightened by 3.4bp. Asian equity markets have broadly opened lower today. Asia ex-Japan IG CDS spreads tightened 0.7bp.

New Bond Issues

- Xiamen ITG $ 364-Day at 7% area

Morgan Stanley raised $6bn via a four-part deal. The details of the issuance can be found below.

If the 6NC5s and 11NC10s are uncalled, the coupons will reset at the overnight SOFR plus 183bps and 205bps respectively, and be paid quarterly thereafter. While all the bonds are senior bank notes, the 3Y fixed rate and floating notes are both issued at the Opco level, by its North American branch while the other longer tenure notes are issued by the Holdco. This explains the difference in issue rating between the notes. Proceeds will be used for general corporate purposes. Both the 3Y notes have selling restrictions that allow it to only be offered and sold to accredited investors (as per Rule 501 of the Securities Act), where each beneficial owner will be required to hold a minimum principal amount of $250k. The new 3Y fixed rate notes offer a new issue premium of 4.2bps over its existing 4.754% 2026s that yield 5.84%. The new 6NC5s are priced 1.3bps tighter than its existing 5.164% 2029s (callable in 2028) that yield 6.42%, while the new 11NC10s are priced roughly in line with its existing 5.424% 2034s (callable in 2033) that yield 6.62%.

Santander raised $3.75bn via a three-tranche senior preferred offering. It raised

- $1bn via a 4NC3 bond at a yield of 6.527%, 20bp inside initial guidance of T+185bp area. If uncalled, the coupon will reset at the US 1Y Treasury rate plus a spread of 165bps.

- $1.25bn via a 5Y bond at a yield of 6.607%, 20bp inside initial guidance of T+200bp area. The new bonds offer a new issue premium of 14.7bp over its existing 5.588% 2028s that yield 6.46%.

- $1.5bn via a 10Y bond at a yield of 6.938%, 20bp inside initial guidance of T+225bp area.

The bonds have expected ratings of A2/A+/A.

Altria raised $1bn via a two-tranche issuance. It raised $500mn via a 5Y bond at a yield of 6.247%, 25bp inside initial guidance of T+170bp area. It also raised $500mn via a 10Y bond at a yield of 6.912%, 25bp inside initial guidance of T+230bp area. The senior unsecured bonds are rated A3/BBB/BBB. Proceeds will be used for general corporate purposes, which may include the repayment of its 4% 2024s and 3.8% 2024s.

Hyundai Capital raised $1.5bn via a three-part deal. It raised:

- $500mn via a 2Y bond at a yield of 6.289%, 20bp inside initial guidance of T+145bp area. The new bonds offer a new issue premium of 11.9bp over its existing 2.65% 2025s that yield 6.17%.

- $300mn via a 2Y FRN at a yield of 6.665%. The coupons will reset at the overnight SOFR plus a spread of 132bps and will be paid quarterly. .

- $700mn via a long 5Y bond at a yield of 6.587%, 27bp inside initial guidance of T+205bp area.

The senior unsecured bonds have expected ratings of Baa1/BBB+. Proceeds will be used for general corporate purposes.

Korea Investment & Securities raised $400mn via a 3Y bond at a yield of 7.25%, 25bp inside initial guidance of T+260bp area. The senior unsecured bonds have expected ratings of Baa2/BBB, and received orders over $2.6bn, 6.5x issue size. Asset and fund managers were allocated 68%, banks took 16%, and the remainder went to other entities including sovereigns, supranationals, pension funds and private banks. APAC investors made up 85% and the rest were from EMEA. Proceeds will be used for general corporate purposes.

New Bond Pipeline

- Ziraat Katilim hires for $ 3Y sukuk bond

- Oman Telecom hires for $ 7Y sukuk

- KHFC hires for $ 3Y Fixed/FRN bond

Rating Changes

- Ford Motor Co. And Subsidiary Upgraded To ‘BBB-‘ On Improving Margins And Financial Flexibility; Outlook Stable

- Fitch Downgrades Beijing Capital Group to ‘BBB-‘; Outlook Stable

- Moody’s withdraws Casino Guichard-Perrachon SA’s ratings

Term of the Day

Rising Star

Rising stars are companies that have recently seen credit rating upgrades that pull its rating to investment grade category from its previous junk or high yield category. They are termed as rising stars as their financial and/or operational metrics show an improving trend. The opposite of rising stars are fallen angels, which are issuers that have been recently downgraded to junk category from its previous investment grade rating category.

Ford was upgraded to BBB- from BB+ by S&P, making it a rising star.

Talking Heads

On Time to Short European Banks After Rally – JPMorgan

“Banks could suffer if economies enter contraction, and if some of the very benign credit backdrop changes next year, with spreads widening and delinquencies rising… Any drop in yields, or interest-rate cuts by the European Central Bank next year, will reduce banks’ profitability”

On The Bond Market Event Due on Wednesday at the Treasury\

Subadra Rajappa, head of US rates strategy at SocGen

“Looking at the refunding, the composition of Treasury issuance might be very consequential and relevant”

Ian Lyngen, head of interest-rate strategy at BMO Capital Markets

“It’s an open question whether or not we actually see them in February. If the Treasury Department gives us any guidance in that regard, I think that would trigger a more significant selloff and that’s when all of a sudden 5.05% or 5.10% in 10-year yield starts to make sense.”

On Wall Street Cutting S&P Expectations as Geopolitical Risk Rises

Ed Yardeni, founder of Yardeni Research

“We still think that a Santa Claus rally is possible. But between now and Thanksgiving, it’s easier to see downside than upside for the stock market”

Morgan Stanley’s Mike Wilson

“Narrowing breadth, cautious factor leadership, falling earnings revisions and fading consumer and business confidence tell a different story than the consensus”

Oppenheimer’s John Stoltzfus

“This is a tantrum. Wait until you see our target for next year”

Top Gainers & Losers- 31-October-23*

Go back to Latest bond Market News

Related Posts: