This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

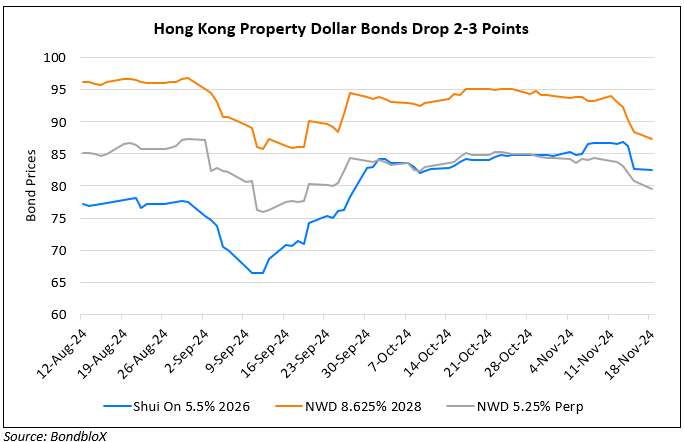

NWD’s Dollar Perps Continue to Move Lower

December 4, 2024

NWD’s dollar perps continued to move lower by over a point, with its 6.15% Perp at 86.8 cents on the dollar. The developer recently appointed Echo Huang Shaomei as CEO amid its ongoing debt and financial issues, alongside family succession issues. The company recently reported its first full-year loss in two decades. Bloomberg Intelligence adds that NWD’s removal from the Hang Seng Index, amidst other problems may have increased non-call risks regarding its 6.15% Perp. The bonds are callable from March 2025 and if not called, the coupon will reset along with a step-up in June, by 620.1bp over the US 3Y Treasury yield. If current levels persist till then, this would imply a potential new coupon of 10.33%. Earlier in June, the management of NWD said that they will try to call back the notes.

Go back to Latest bond Market News

Related Posts:

NWD Warns of First Annual Loss in Two Decades

September 2, 2024

Dollar Bonds of NWD, Shui On Drop Sharply

November 18, 2024