This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

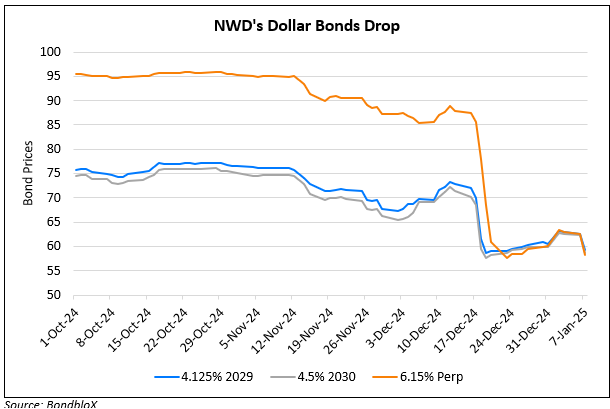

NWD’s Dollar Bonds Drop by 3-4 Points

January 7, 2025

NWD’s dollar bonds fell by 3-4 points across the curve. First, the completion of its Pavilia Farm III project in Tai Wai suggested a profit hit, with more parent-company support required to help with its rising net-debt-to-net-asset ratio, as per Bloomberg. They note that it is due to the increased risk of its assets being sold at deep discounts to book value and not achieving its noncore asset-disposal target of HKD 13bn ($1.7bn) in fiscal 2025.

Separately, it obtained majority lenders’ consent to waive a potential breach of net-gearing ratio covenants on its loans by 31 December 2024, as per sources. NWD had requested its bank lenders to waive the potential breach and suspend the testing of the covenant through end-2025, and increase its net debt-to-equity covenant to 100% from the current cap of 80%. Majority of its syndicated loan lenders agreed to increase the net gearing ratio but pushed back on suspending the covenant testing, as per sources. Some of these lenders were said to have imposed additional conditions in exchange for approving the waiver and amendments. As of June 2024, NWD’s net debt-to-equity was at 55%.

Go back to Latest bond Market News

Related Posts:

NWD Warns of First Annual Loss in Two Decades

September 2, 2024

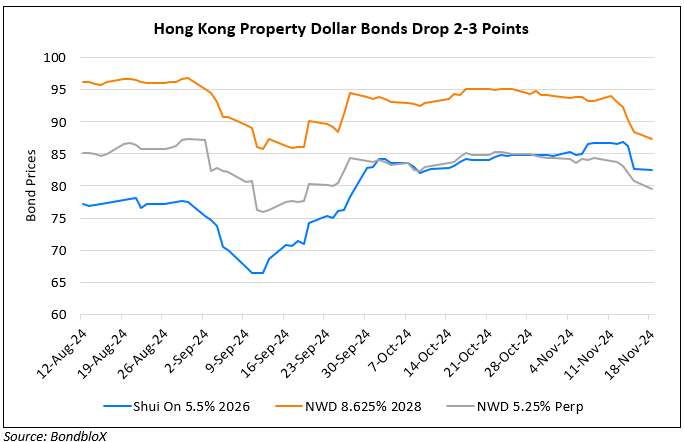

Dollar Bonds of NWD, Shui On Drop Sharply

November 18, 2024

NWD’s Dollar Bonds Rise; Sells Industrial Building

December 11, 2024