This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

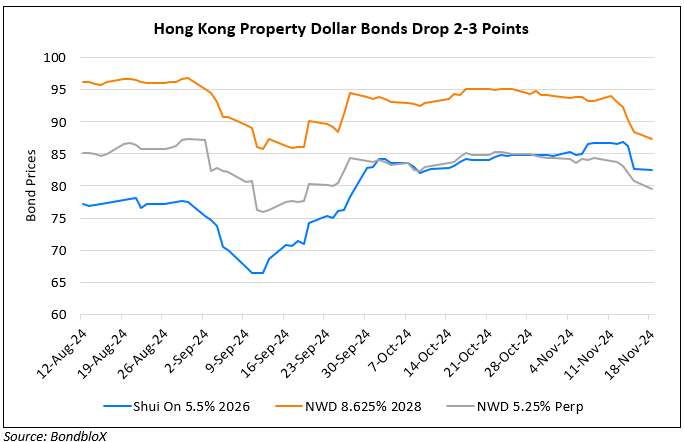

NWD’s Dollar Bonds Dip Further as Perp Approaches March Call

January 20, 2025

NWD’s dollar bonds continued to edge lower. The developer continues to search for options to liquidate some of its assets amid ongoing financial woes. JPMorgan assesses that NWD’s adjusted debt ratio stands at 85%. NWD has a 6.15% Perp that is callable in mid-March, and if not called, the coupon will reset to the 3Y UST plus 620.1bp, which at current levels would equal about 10.5%. UBS believes that NWD needs at least over $3bn annually to stay afloat. Another independent analyst added that the developer may have to resort to selling its coveted K11 MUSEA mall, noting even that might not be enough. Over the last few weeks, NWD had requested its bank lenders to waive the potential covenant breach and suspend covenant testing through end-2025, and increase its net debt-to-equity covenant to 100% from the current cap of 80%.

NWD’s 6.15% Perp fell 1.6 points to 51 cents on the dollar, yielding 20.5%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

NWD Warns of First Annual Loss in Two Decades

September 2, 2024

Dollar Bonds of NWD, Shui On Drop Sharply

November 18, 2024

NWD’s Dollar Bonds Rise; Sells Industrial Building

December 11, 2024