This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NWD Dollar Bonds Rise

May 20, 2024

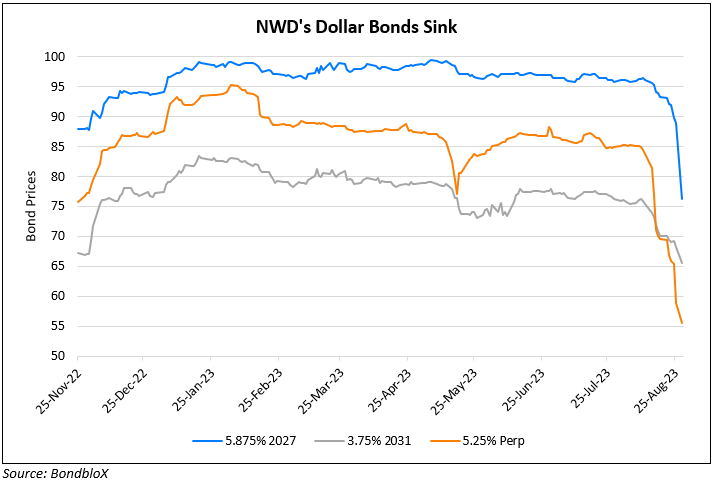

NWD’s dollar bonds were up over 1.5 points across the curve. Despite the property downcycle in Hong Kong, NWD is expected to survive it as per Bloomberg Intelligence. They noted that NWD has no bond maturities due this year and that the company’s cashflows appear sufficient. They believe that NWD can get a greater buffer from asset coverage with its investment properties, land bank and farmland in Hong Kong. However, they also said that NWD would need to catch up on property sales after lagging peers Henderson Land and CK Asset. NWD’s next major dollar bond due comes in the form of its 6.15% Perp callable from March 2025. Separately, NWD and state-owned enterprise Shum Yip Group agreed to jointly develop an innovation and technology zone in Hong Kong.

NWD’s 5.25% Perp was up 2 points to 75.1, yielding 20.5% to its call date in March 2026.

Go back to Latest bond Market News

Related Posts: