This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

November 2024: Election-Led Selloff in Treasuries Fades as 60% of Dollar Bonds End Higher

December 2, 2024

November 2024 was a positive month for bond investors with 60% of dollar bonds ending higher (price returns ex-coupons). Investment Grade (IG) bonds outperformed High Yield dollar bonds, with 62% of IG bonds ending in the green while about 53% of HY bonds closed higher. The outperformance of IG bonds came on the back of a rally in Treasuries since mid-month, as the election-led move faded with markets also pricing back a December Fed rate cut.

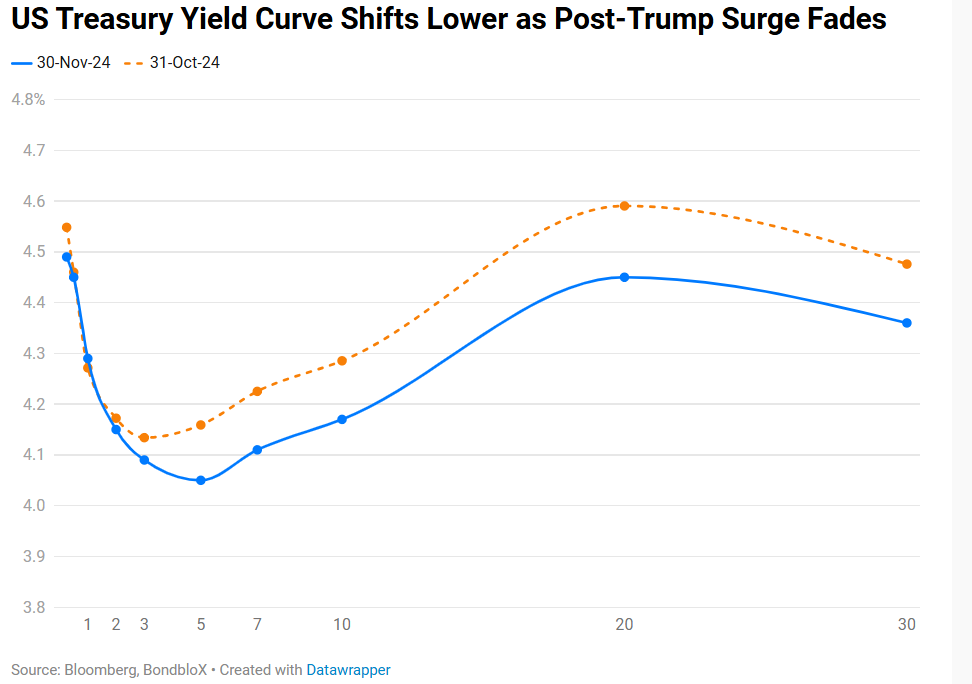

November saw the Treasury yield curve shift lower, falling by ~10bp across the mid and long-end while short-end yields were stable. Treasury yields surged higher following Donald Trump's election victory, but eased later through the month. Economic data was mixed, US Non Farm Payrolls (NFP) for October saw only 12k job additions as compared to expectations of 100k, mainly due to one-off factors such as the hurricanes that occurred and the major Boeing labor strike that took place. AHE YoY rose by 4.0%, and the Unemployment Rate stood at 4.1%, both inline with expectations. Looking at inflation, US Headline and Core CPI rose as expected, by 2.6% and 3.3% YoY respectively. Meanwhile, manufacturing activity continued to contract, with the ISM Manufacturing Index coming at 46.5, while the Services PMI stayed upbeat at 56.0. Fed's Jerome Powell and Adriana Kugler remarked that the Fed must proceed with caution with respect to rate cuts and not rush them. Following this, markets priced-in only a 51% chance of a 25bp December Fed rate cut. However, other Fed speakers including Neel Kashkari and Austan Goolsbee later voiced their justification for a potential rate cut in December, for which markets are now pricing-in a 67% possibility and Treasury yields moving lower since then.

In the top-rated AAA to A- bucket, longer dated bonds of most issuers like Halliburton, Israel, Three Gorges, IBM and Pepsico, were the top gainers, higher by over 5% led by the fall across the long-end of the Treasury curve. Similarly, the gainers in the BBB+ to BBB- bucket saw a similar trend of longer dated bonds being the best performers in the category. However, dollar bonds of Adani Group dominated the losers list after its issuance was scrapped following the announcement of an indictment against a number of senior executives by the US Attorney’s Office, Eastern District of New York.

Under the HY segment, the biggest gainers were dollar bonds of Argentina that rallied over 10%. The move comes after it was upgraded by a notch to CCC by Fitch due to improvements in the its ability to meet foreign-currency bond payments without seeking debt relief, alongside easing in its monthly inflation. Sri Lanka's defaulted bonds also rallied over 10% after it held talks with bondholders following which it began its offshore debt swap restructuring. Lumen's bonds also continued their rally from previous month gaining another 8% during the month after it announced a tender offer for its notes. Property developers like Road King, Vanke, NWD led the losers, falling over 10-15% amid continued weakness in the property sector across China and Hong Kong.

Issuance Volumes

Global corporate dollar bond issuances stood at $182bn in November, 30% lower than October. As compared to November 2023, issuance volumes were down 8% YoY. 81% of the issuance volumes came from IG issuers with HY comprising 16% and unrated issuers taking the remaining 4%.

Asia ex-Japan & Middle East G3 issuance stood at $22bn, down 16% MoM, while being up 7% YoY. 62% of the issuance volumes came from IG issuers with HY comprising 28% and unrated issuers taking the remaining 10%.

Largest Deals

The largest deals globally were led by Marsh & McLennan’s $7.25bn seven-trancher, followed by Colombia’s $3.64bn two-part and AppLovin’s $3.55bn four-part deals respectively. This was followed by big banks like BNP Paribas’ $3.3bn two-part deal, Morgan Stanley, Goldman Sachs, Citibank and Lloyds Group’s $3bn issuances each.

In the APAC and Middle East, Westpac’s $3bn three-trancher led the tables, followed by Indonesia’s $2.75bn three-part sukuk deal, Alibaba’s $2.65bn three-trancher, CBA’s $2bn two-part deal and China’s $2bn two-trancher.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023