This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

EM Corporate Bonds Maintain Yields Despite Compressing Spreads

May 21, 2024

Emerging market (EM) corporate dollar bond spreads over the US Treasury and American peers have compressed to its tightest level in years. However, absolute EM yields are still at attractive levels not seen in years, several fund managers remarked. This might be even more attractive when the Fed starts easing and global borrowing costs fall they added, as market participants would look for higher-yielding notes like those from EM. Among the factors that have caused spreads to compress has been limited supply, besides a stronger credit profile with limited sovereign-driven EM corporate rating downgrades, a fund manager noted. Investors added that default risks across the most vulnerable countries have also subsided due to bailouts from the IMF and other lenders.

As seen in the chart below, absolute yields of EM IG dollar bonds are above 6.8% on average. This is higher than pre-pandemic levels and is also sustaining over levels seen in mid-2021.

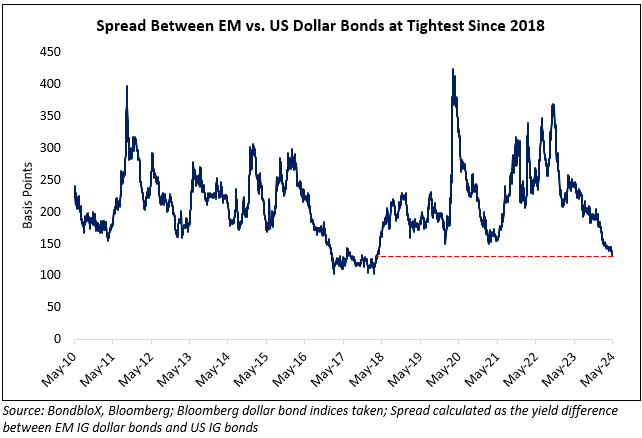

However, while yields continue to stay above 6.8%, the spread between EM and US IG dollar bonds are at its tightest levels since 2018. This yield premium is currently at 130bp.

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

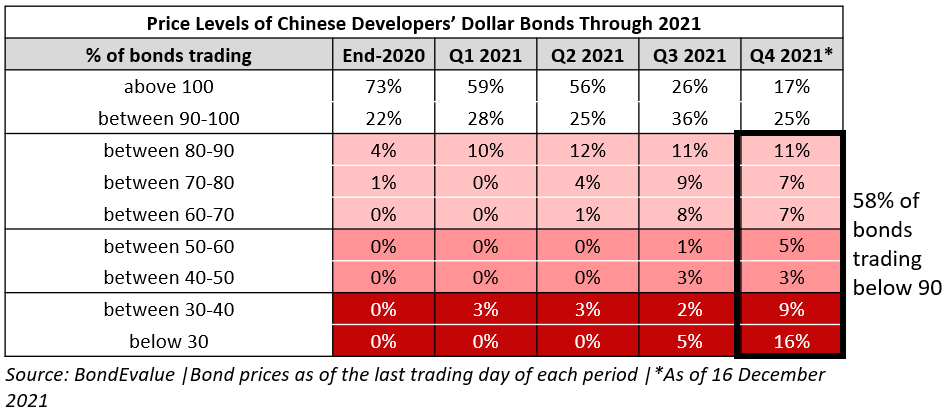

2021 Recap: China Real Estate – When Hope Went Up In Smoke

December 20, 2021

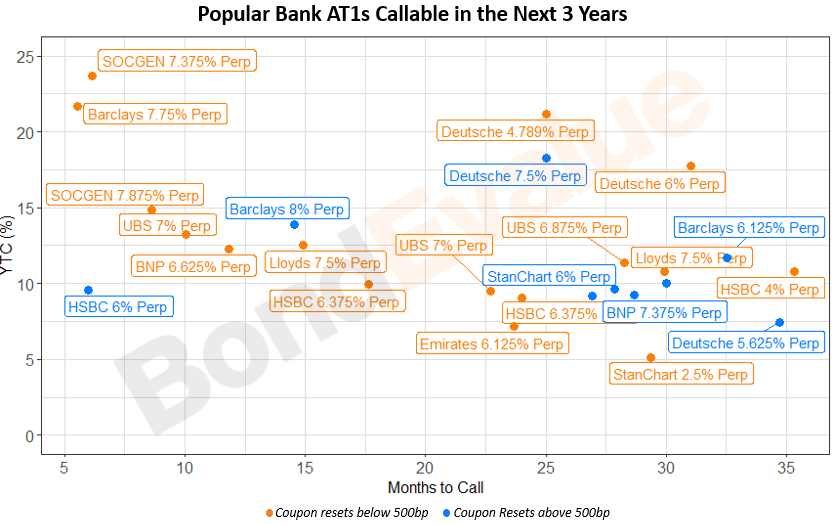

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023