This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Medco Energi Buys Back Some of its 2026s, 2027s

October 9, 2024

Medco Energi bought back $125.9mn of its dollar bonds due 2026 and 2027. It repurchased $57.1mn of its 7.375% 2026s and $68.8mn 6.375% 2027s, as per a filing. Including an early tender premium of $30 for each $1,000 in principal, it will pay $1,015 for the 2026s and $997.50 for the 2027s for each $1,000 in principal, for notes tendered before October 3. For those tendered between then and October 21, it will be $985 for the 2026s

The expected settlement date for the tender offers is October 24. Medco Energi and its senior unsecured notes were recently upgraded in June by a notch to BB- from B+ by S&P, reflecting financial flexibility for Medco Energi due to its 20.92% equity stake.

Medco Energi 7.375% 2026s and 6.375% 2027s are trading stable at 101.4 and 99.75, yielding 6.4% and 6.5% respectively.

Go back to Latest bond Market News

Related Posts:

Medco Energi Announces Tender Offer Results

June 4, 2024

Medco Energi Upgraded to BB- by S&P

June 26, 2024

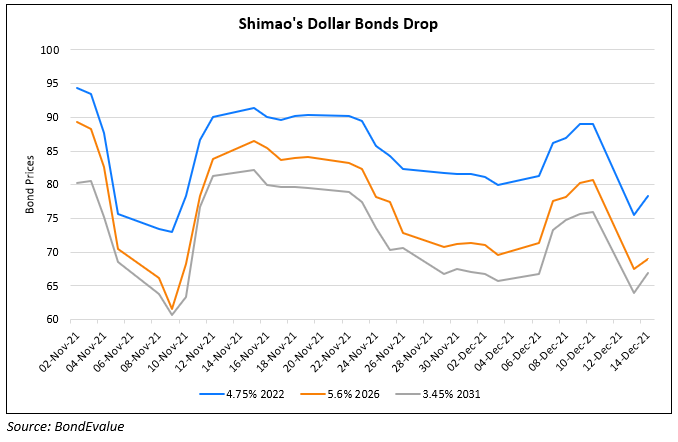

Shimao’s Dollar Bonds Tumble Over 13%

December 14, 2021