This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Await PPI and CPI Data; NatWest, ESR-Logos, BofA Price Bonds

August 13, 2024

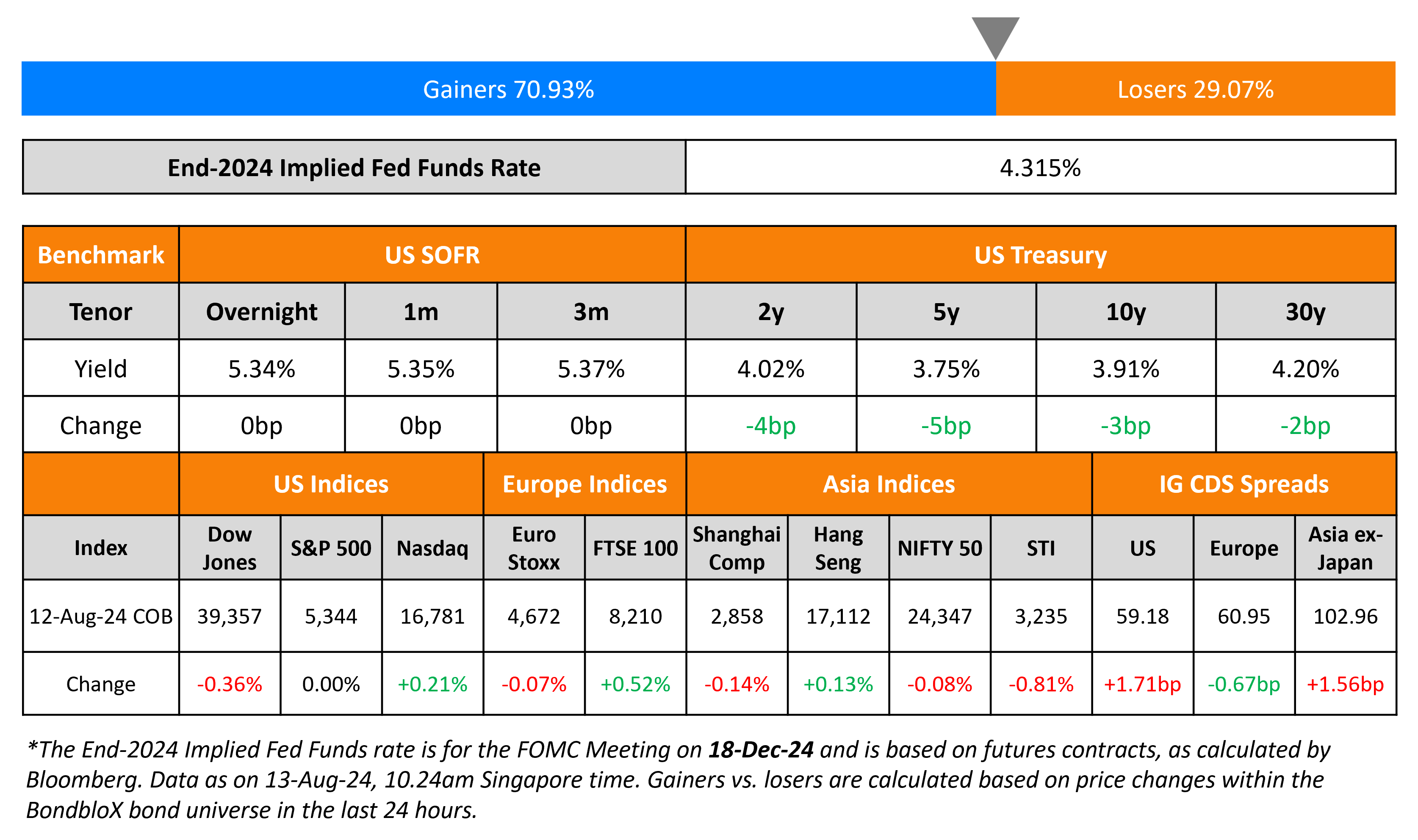

US Treasury yields fell by 3-5bp across the curve with the 2Y currently at 4.02% and 10Y at 3.91%. There were no major economic data points released yesterday and markets continue to await the release of PPI data later today and CPI data tomorrow. Looking at US equities, S&P was unchanged while Nasdaq was up by over 0.2%. US IG CDS spreads widened by 1.7bp while HY CDS spreads widened by 8.5bp.

European equity markets also ended mixed. Looking at Europe’s CDS spreads, the iTraxx Main spreads tightened by 0.7bp while Crossover spreads were tighter by 3.25bp. Asian equity indices have opened mixed today morning. Asia ex-Japan CDS spreads were wider by 1.6bp.

New Bond Issues

NatWest raised $1.75bn via a two-tranche deal. It raised $500mn via a 4.25NC3.25 FRN at SOFR+130bp, 20bp inside initial guidance of SOFR+50bp area. It also raised $1.25bn via a 6NC5 bond at a yield of 4.964%, 28bp inside initial guidance of T+150bp area. The senior unsecured bonds are rated A3/BBB+/A. Proceeds will be used for general corporate purposes.

ESR-Logos Reit raised S$100mn via a PerpNC5 bond at a yield of 6%, 20bp inside initial guidance of 6.2% area. The bonds are unrated. If not called by 20 August 2029, the coupons reset then and each reset date thereafter based on the prevailing SGD 5Y SORA-OIS plus the initial spread of 354.8bp. The bonds have a dividend stopper, but do not have a dividend pusher. Private banks received a 25 cent concession. Proceeds will be used for: (a) refinancing/repayment of existing borrowing (b) financing/refinancing acquisitions and/or investments of the issuer and any development and asset enhancement works initiated by them (c) financing general working capital and capex needs of the group.

BofA raised $2.5bn via a 11NC10 subordinated bond at a yield of 5.425%, 33bp inside initial guidance of T+185bp area. The subordinated notes are rated A3/BBB+/A.

New Bonds Pipeline

- Zhuji State-owned Assets Management hires for $ bond

Rating Changes

- Fitch Downgrades NFE’s IDR to ‘B+’; Places Rating on Negative Watch

- Continental Outlook Revised To Developing On Potential Automotive Division Spin-off; ‘BBB’ Ratings Affirmed

Term of the Day

Qualified Institutional Placement (QIP)

A qualified institutional placement (QIP) refers to an fund raising mechanism wherein listed companies can issue equity shares to qualified institutional buyers without elaborate regulatory paperwork. In essence, it is a private placement to institutional buyers with lower legal fees, funding costs and is faster than a follow-on public offer (FPO). QIPs are more commonly observed in India and in some parts of southern Asia.

Talking Heads

On Hedge Funds Smelling Blood as Lenders Turn on Each Other

Michael Haynes, Beach Point hedge fund

“Creditor violence is rife, and taking advantage of loose documentation is not the exception but becoming standard practice”

Dan Zwirn, Arena Investors

“This type of lending is a blood sport. We’ll start to see that play out in the next year after a decade of loose lending and mis-marking pushes things to the brink.”

On Chinese Bonds Extending Losses as PBOC Warns About Potential Risks

Lynn Song, ING Bank

“The PBOC hopes to limit risks from what they deem to be excessive capital flows into the bond market. The threat of intervention is likely the main factor driving yields higher today”

Trinh Nguyen, Natixis

“Whether bond yields bottom depend on how serious the government is in fighting deflationary impulses”

On US consumers could become discouraged without rate cuts – BofA CEO, Brian Moynihan

“They’ve told people rates probably aren’t going to go up, but if they don’t start taking them down relatively soon, you could dispirit the American consumer… Once the American consumer really starts going very negative, then it’s hard to get them back”

Top Gainers & Losers-13-August-24*

Go back to Latest bond Market News

Related Posts: