This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Mapletree, Akbank, GM Price Bonds

June 14, 2024

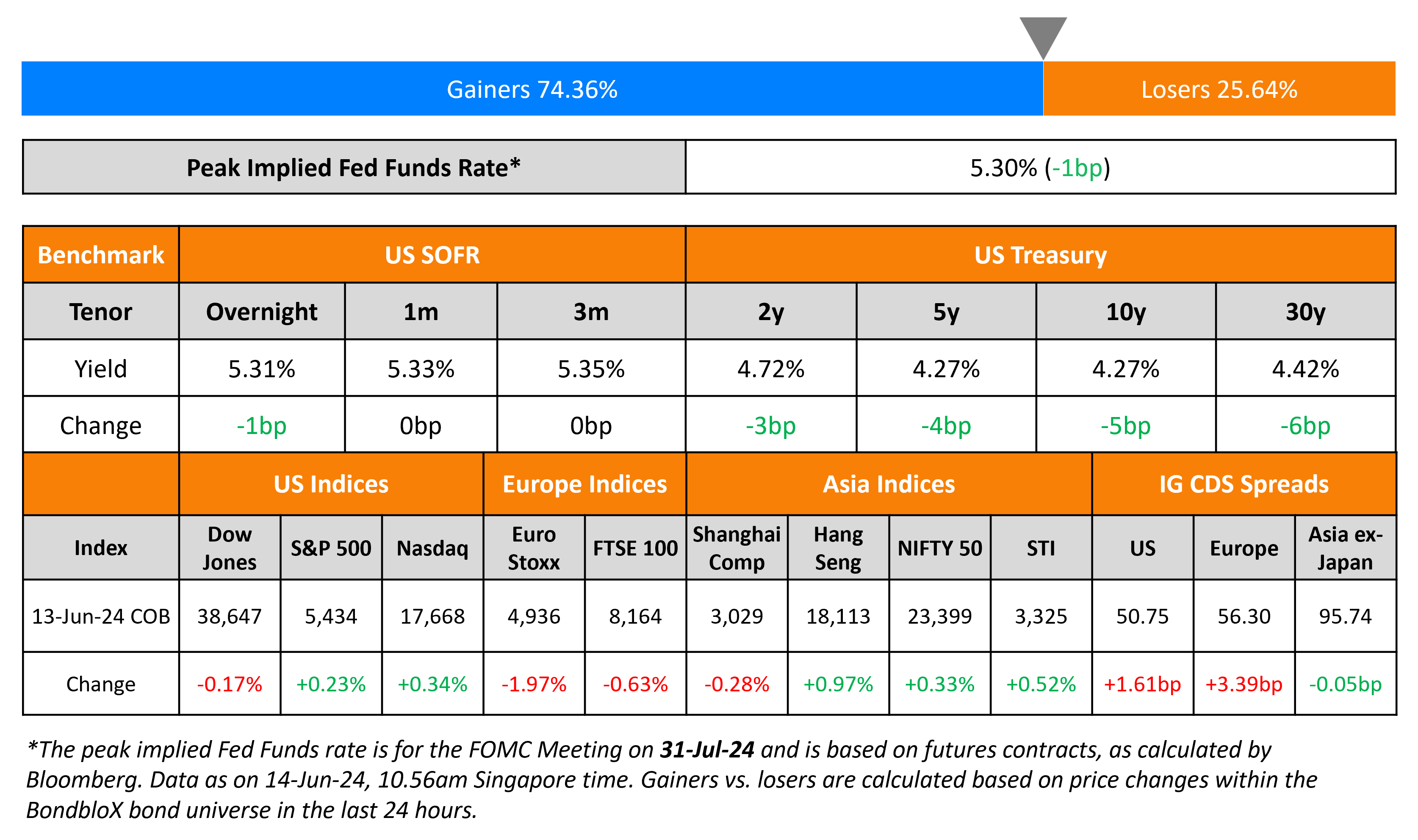

US Treasuries continued to rally, by 4-5bp across the board, following softer-than-expected economic data. US PPI saw a 2.2% YoY growth vs. expectations of a 2.5% rise. Initial jobless claims for the previous week rose to a 10-month high of 242k, worse than expectations of a 225k print. As per CME probabilities, markets continue to expect 50bp in rate cuts by end-2024 as compared to the Fed’s latest dot plots that indicated only a 25bp cut. US equity markets inched higher, with the S&P and Nasdaq up by 0.2% and 0.3% respectively. US IG and HY CDS spreads widened by 1.6bp and 8bp respectively.

European equity markets sold-off sharply, with credit spreads also widening across the board on the back of increased political risks emerging from France. Europe’s iTraxx Main CDS spreads were 3.4bp wider and crossover spreads were wider by 12.1bp. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads were flat.

New Bond Issues

Mapletree Investments raised S$200mn via a 12Y bond at a yield of 3.688%, 16.2bp inside initial guidance of 3.85% area. The notes are unrated and the issuer is Mapletree Treasury Services Ltd. Proceeds will be used for general corporate purposes which may include refinancing existing debt.

GM Financial raised $2.5bn via a three-trancher. It raised:

- $1.1bn via a 3Y bond at a yield of 5.353%, 25bp inside initial guidance of T+90bp area

- $400mn via a 3Y FRN at SOFR+105bp vs. inside initial guidance of SOFR equivalent area

- $1bn via a 7Y bond at a yield of 5.625%, 25bp inside initial guidance of T+165bp area

The senior unsecured notes are rated Baa2/BBB/BBB. Proceeds will be used for general corporate purposes.

Akbank raised $500mn via a long 5Y sustainability bond at a yield of 7.5%, ~43.75bp inside initial guidance of 7.875-8% area. The senior unsecured notes are rated B3/B (Moody’s/Fitch). Net proceeds will be used to finance and/or refinance certain sustainable projects aligned to the issuer’s sustainable finance framework.

New Bonds Pipeline

- REC Limited hires for $ Long 5Y Green bond

- Korea Gas hires for $ 3Y or 5Y bond

Rating Changes

- Fitch Downgrades China Great Wall to ‘BBB-‘; Removes from Rating Watch Negative; Outlook Stable

- Fitch Downgrades China Orient to ‘BBB+’; Removes RWN; Outlook Stable

- Fitch Downgrades Lippo Karawaci to ‘C’ on DDE; Removes Rating Watch Negative

- Fitch Affirms Akbank’s LTFC IDR at ‘B’/Positive; Upgrades VR to ‘b+’

- Fitch Affirms Garanti BBVA’s LTFC IDR at ‘ B’/Positive; Upgrades VR to ‘b+’

Term of the Day

Panda Bonds

Panda bonds are renminbi denominated notes sold by a non-Chinese issuer in onshore China. The first of its kind was issued by the IFC and ADB in 2005. While these bonds attract Chinese investors, they have also gained traction among international investors. It also helps issuers diversify investor bases and reduce currency risk.

Talking Heads

On Fed’s Favored Inflation Gauge Set to Rise By Least in Six Months

Ian Shepherdson, the chief economist at Pantheon Macroeconomics

“Our mapping of the PPI and CPI data suggests that the core PCE deflator increased by only 0.11% in May, well below the 0.32% average increase in the first four months… Our estimate points to a material downside surprise”

On Inflation Could Temporarily Accelerate Again – ECB GC Member, Madis Muller

“As we saw in the initial euro area inflation estimate in May, the pace of inflation may temporarily accelerate again… In order to achieve our goal, interest rates presumably still need to stay above average for some time”

On Expecting Corporate Bond Spreads Widening Slightly Into Year-End – UBS

“These are equity-like returns, and that is a strong statement in support of credit as an asset class… not seeing an acceleration of stress, if anything we are seeing a bit of relief”

On Liking China Junk Debt But Is Skeptical on India – Shamaila Khan, UBS Asset Management

“In India, the market underestimates the risk, while in China high yield, Sri Lanka and certain other corners of EM, the market overestimates the risk… For Indian government debt, “The upgrade is almost priced in”… For China’s debt, “A lot of risk premium” has been priced-in.

Top Gainers & Losers- 14-June-24*

Go back to Latest bond Market News

Related Posts: