This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

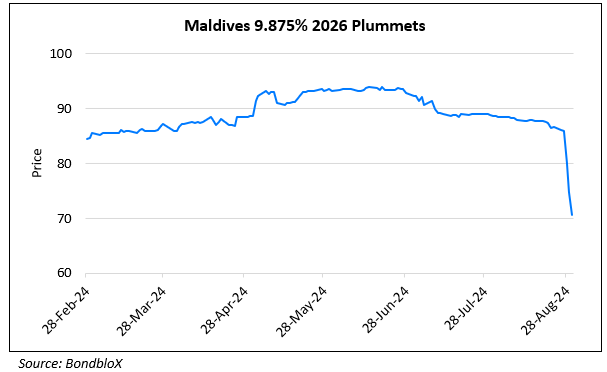

Maldives Receives Funds for Sukuk Coupon Payment

September 23, 2024

Maldives has received sufficient funds from India for the coupon payment of $24.6mn on its 9.875% 2026 sukuk due on 8 October. This has eased the default risk for the island nation in the near term. State Bank of India (SBI), subscribed to $50mn of T-bills issued by Maldives, following the special request by the Government of Maldives, to provide emergency financial assistance. India had given similar aid with SBI subscribing to $50mn of T-bills under the same mechanism, earlier in May 2024. India added that the loan has been offered to the island nation interest-free and that Maldives remains its key maritime neighbor and an important partner. Earlier there were concerns of Maldives defaulting on its first-ever sukuk after its foreign reserves declined leading to downgrades by Moody’s and Fitch, over the past weeks.

Its 9.875% 2026s traded slightly negative at 78.9 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: